Visa Direct request to pay

Designed as a scalable, scheme agnostic solution to enhance the user experience of requesting and receiving funds

available for use by

Issuer Banks

Acquirer Banks

Merchants

Independent Developers

Issuer Banks for Small Business

Regional Availability

View Details- N. America

- Asia-Pacific

- Europe

- CEMEA

- LAC

Send and receive payment requests with Visa Direct request to pay

Innovate and simplify services for you and your clients with our secure, fast and convenient messaging framework.

- Rail Agnostic: Designed to be rail agnostic, the Visa Direct request to pay API is extendable to support additional settlement mechanisms.

- New Flows: Allow clients to enable new payment flows across various use cases and markets.

- Differentiate and Innovate: Help your clients to go to market with convenient and innovative solutions that are simple to build.

The Visa Direct request to pay framework supports the requests with a simple set of steps:

The payee submits a request for payment to Visa Direct request to pay via their service provider

The Visa Direct request to pay processes the request and forwards it to the payer's service provider

The payer receives the request to pay from their service provider

The payer can accept the request to pay and pay using agreed payment methods or reject it

The payer's service provider confirms the acceptance or rejection of request by the payer back to the Visa Direct request to pay

The Visa Direct request to pay confirms the acceptance or rejection of the request to pay to the payee via their service provider

Key Features

Simple to build

The API set is easy to use, facilitating quick development

Request to pay Life cycle management

Simplified APIs for request to pay life cycle management

Payment rail agnostic

Supports requests that are settled outside the Visa eco-system

Block control management

Consumer protections designed to help prevent spam and harassment

Security and resilience

Secure and trusted channels for payment request messaging

Risk management controls

Configurable risk management controls applied during request to pay processing

What is Visa Direct request to pay?

Visa Direct request to pay is a secure messaging solution which gives the ability for payees to request a payment from payers via a secure digital message. Once the request is received by the payer, they are able to make a payment or reject the request.

Request to pay is a scalable, interoperable, and scheme agnostic solution designed to enable an enhanced user experience for sending and receiving funds.

Benefits

Control of payment

Provide payees with control over active payment requests, including the ability to modify or cancel active payment requests.

Enable payers to dictate when and how payments are made.

Cashflow management

Address the pain point of 'lost' invoices sent through insecure email/post, streamline communication, and include enriched data feature facilitates to support easy payment reconciliation.

Better customer experience & greater flexibility

Enable experiences where end users do not need to see or use account or card numbers.

Payers and payees can see and track updates on their request to pay.

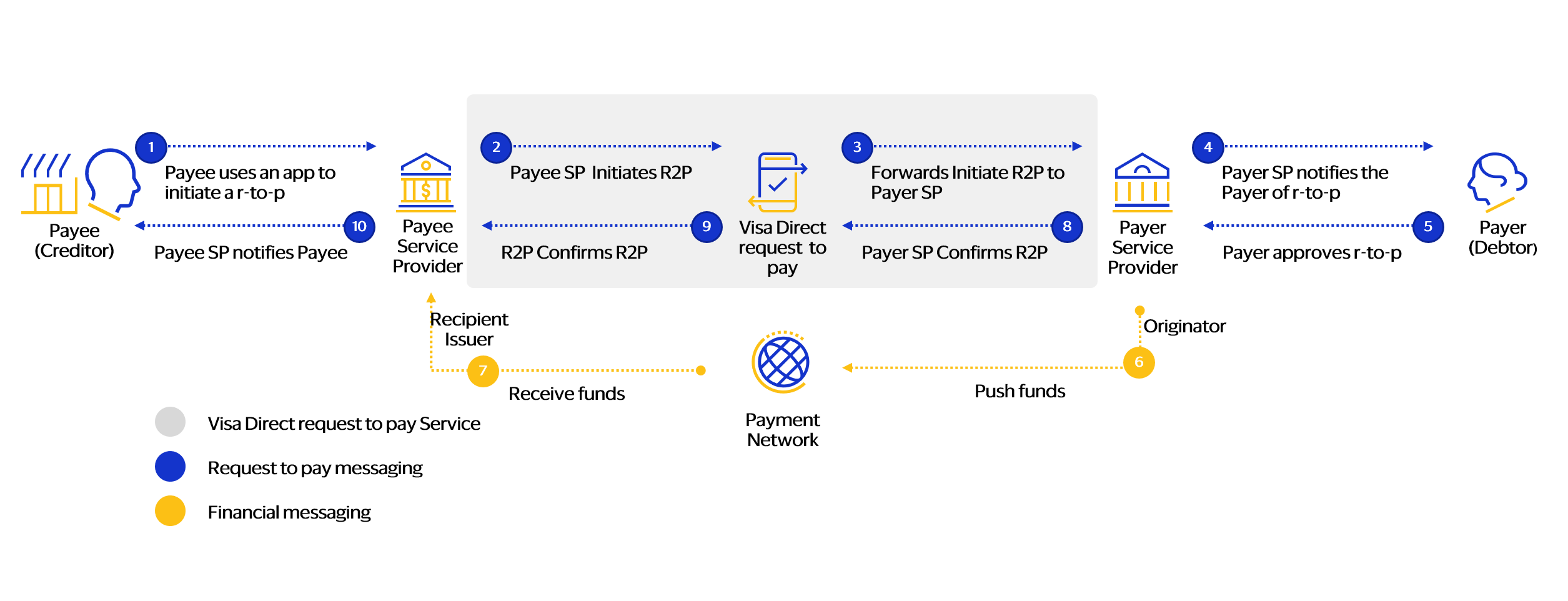

How Does It Work?

Visa Direct request to pay can be tailored to support use cases according to clients demand and enable new flows.

Step 1: Payee uses an app to initiate a request to pay

Step 2: Payee's service provider submits an Initiate R2P to Visa

Step 3: The Visa Direct request to pay forwards the request to the payer's service provider

Step 4: The payer's service provider notifies the payer of the request to pay

Step 5: Payer receives and approve request to pay

Step 6 and Step 7: The payer service provider sends funds to the payee service provider via the agreed Payment Network

Step 8: The payer service provider sends a Confirm R2P to Visa Direct request to pay

Step 9: The Visa Direct request to pay sends Confirm R2P request to the payee service provider

Step 10: The payee service provider notifies payee

Use Cases - Visa Direct request to pay

Visa Direct request to pay can be tailored depending on the type of client and client's needs. The following use cases represent the subset currently supported by our API:

P2P (Person to Person)

Individual users requesting payments from other individual users.

Example use cases:

- Splitting bills

- Funds collection

B2C (Business to Consumer)*

Business users requesting payments from their customers.

* The B2C use case is in the process of development, and should be understood as a representation of the potential feature of the fully-developed product. The final version of this product (if any) may not contain all of the features described in this document.

Availability

Visa Direct request to pay enables a set of capabilities for clients that can plug in to their existing payment processes, with simple integration and development.

| North America | Asia-Pacific | Europe | CEMEA | LAC | Notes |

|---|---|---|---|---|---|

-

KEY

- Available in entire region

- Not available

- See notes for available countries

Please contact your regional Visa account manager or representative for more details on the availability of Visa Direct request to pay in your market.