Visa Merchant Screening Service

Identifies potentially high-risk Merchants and their Third Party Agents in Acquisition due diligence.

available for use by

Acquirer Banks

Regional Availability

View Details- N. America

- Asia-Pacific

- Europe

- CEMEA

- LAC

Pricing

Reduce Acquirers and Visa exposure to fraud and chargeback

Visa Merchant Screening Service (VMSS) allows Acquirers to identify potentially high-risk, unreliable or fraudulent Merchants and Third Party Agents prior to making an onboarding decision and therefore helps reduce risk exposure to fraudulent and illegal transactions, and helps protect against brand damage and non-compliance assessments.

Key Features

Add Terminated Merchants/Agents

Add Terminated Merchants/Agents on the Terminated Listing Database if VMSS listing criteria are met.

Screen Merchants/Agents

Screen Merchants/Agents prior to onboarding to identify whether they are on the Terminated Listing Database.

Alert Acquirers

Alert Acquirers for retroactive match of terminated listings against their inquiries within 180 days.

Key Benefits

Reduce risk exposure

Allow Acquirers to identify potentially high-risk, unreliable or fraudulent Merchants and Third Party Agents prior to making an onboarding decision.

Make informed onboarding decisions

Help Acquirers facilitate the Merchant and Third Party Agent due diligence.

Protect against brand damage and non-compliance assessments

Assist Acquirers in preventing frauds and illegal transactions.

Why Use It?

Mandated by Visa Rules for Acquirer participation, unless prohibited by applicable laws or regulations.

Given the rise of transaction laundering, identity theft, and unfunded chargebacks, Acquirers are increasingly vulnerable to the financial damage, legal actions, and regulatory penalties. To help reduce harm and loss and maintain integrity of the Visa Payment System, the Visa Rules mandates Acquirer participation in the Visa Merchant Screening Service (VMSS) which provides members with an online, multi-functional database designed to facilitate the Merchant and Third Party Agent due diligence and acceptance.

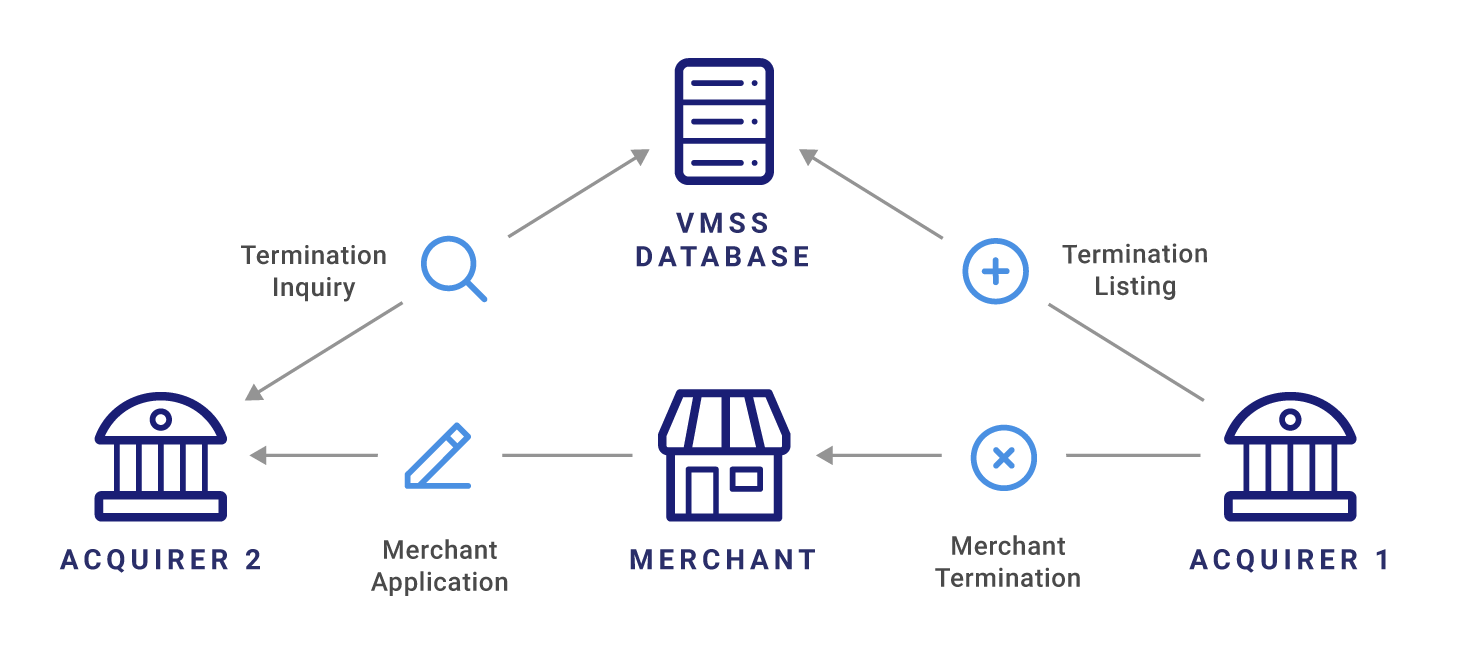

How Does It Work?

Termination Management

Acquirers must ensure that a terminated Merchant, Sponsored Merchant, or Third Party Agent (including, but not limited to, a Payment Facilitator, Marketplace, Staged Digital Wallet Operator, or Independent Sales Organization) is added to the Visa Merchant Screening Service (VMSS) one business day after termination if VMSS listing criteria are met.

Termination Inquiry

Acquirers must query the Terminated Listing Database before onboarding a prospective Merchant, Sponsored Merchant, or Third Party Agent (including, but not limited to, a Payment Facilitator, Marketplace, Staged Digital Wallet Operator, or Independent Sales Organization). If a member receives a response indicating a “possible match” against a merchant/agent listed on theTerminated Listing Database, the member must:

- Verify the merchant/agent identified in the response is the same merchant/agent for whom the inquiry was generated.

- Contact the listing member directly to determine why the merchant/agent was added to the Terminated Listing Database.

- Make its acceptance decision based on further investigation, and use Terminated Listing data only as an informational tool in the decision-making process.

APIs Included

Termination Inquiry API

Termination Inquiry API allows Acquirers to identify Merchants and Agents terminated by other Acquirers and pull the termination details directly from the Terminated Listing Database.

Termination Management API

Termination Management API allows Acquirers to manage complete info of their terminated Merchants and Third Party Agents in one central Terminated Listing Database compiled by Visa.