Manage Overseas Spend

Visa Transaction Controls allows cardholders the option to block international transactions when they are not traveling and / or allow purchases in select countries.

Today’s cardholders demand visibility and control over their payments and finances. They want to manage their lives wherever they go and they’re using mobile phones to do just that. Visa Transaction Controls can help issuers deliver convenient mobile banking experiences and drive card engagement and cardholder preference.

Available for use by

Regional Availability

Global

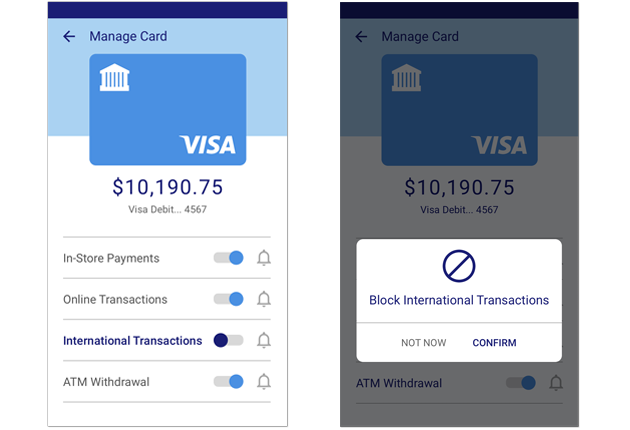

Enable your cardholders to set cross-border controls and alerts

The cross-border control can be used as a block and/or an alert. When a cardholder blocks cross-border transactions, VTC will prohibit any transactions outside of the cardholder's home country. If the cardholder chooses to receive alerts about cross-border transactions, they will be notified when an international transaction is attempted. Cardholders can also set the filterByCountry attribute to include or exclude specific countries from being blocked by the cross-border control.

Refer to Visa Transaction Controls Docs for more details.

Overseas spend scenario

Jack lives in the United Kingdom and often travels for work, sometimes visiting multiple countries within a month. Due to his constant travel, Jack sets up transaction alerts for monitoring while on the go and decides to block all international transactions when at home.

When Jack learns he needs to go to Rio de Janeiro for work, he updates his cross border settings to only allow transactions in Brazil. In Rio, Jack receives alerts for all of his purchases, providing him the oversight and confidence he wants.

Enable Blocks for International Transactions

Jack enables blocks for all international transactions when he is at home in the U.K.

Allow Transactions in Brazil

Jack is notified that he will be traveling to Brazil for work. Jack goes into his mobile banking app and turns on a cross border control, allowing him to make purchases in Brazil.

Travel Confidently

Jack travels confidently to Brazil.

Card Accepted

Jack lands in Brazil and uses his card and the transaction is approved.

Example of cross-border alerts/blocks mobile banking interface

Key Benefits

Give cardholders control and visibility

At the tap of a finger, cardholders can disable or enable their card's use.

Reduce risk and fraud

Allows cardholders to block all cross-border transaction activity when they are not traveling.

Give cardholders more confidence when they travel

Cardholders can receive notifications for all cross-border transactions providing them insight and greater control over their card's use.

APIs Used

Customer Rules API

The Customer Rules API is used to enroll, configure and retrieve an account’s card control settings. The consumer facing application used to perform these functions can be an issuer’s mobile banking application, online banking website, or a 3rd party application. For simplicity, we’ll refer only to an issuer’s application unless there are unique considerations for 3rd party providers.

Notification Callback API

The Notification Delivery API is used to send purchase notifications to the issuer who will then create the cardholder-facing message and deliver it via email, SMS or push. The issuer is responsible for creating and delivering the notification based on the data provided. Note: future product enhancements can result in new data elements being available in the Notification Delivery Callback API payload. The client should be flexible enough to revive these new data elements without adversely impacting their existing notification process.