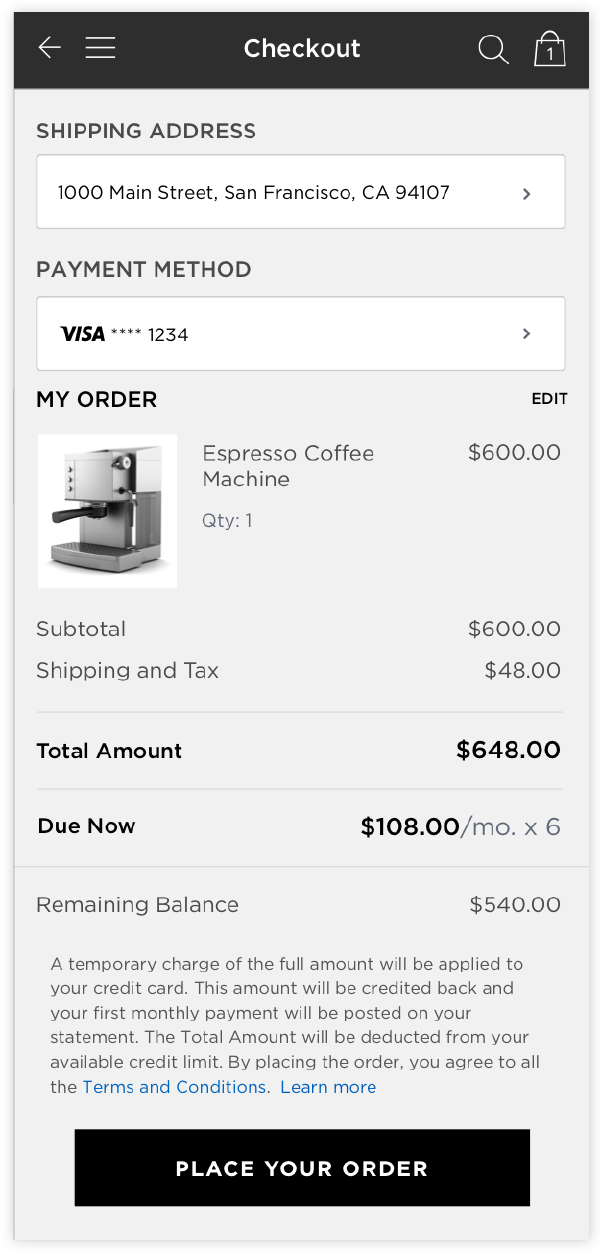

Installment payments (installments) refers to the option of paying for purchases over time, where the purchase amount is divided into smaller equal payments over a defined time period.

The following example shows how installment payments work for a big ticket purchase of $900 paid over 6 months with 0% APR.

There are three primary models in the global installments payments landscape: Pre-Purchase, During Purchase, and Post-Purchase. These models differ by when the cardholder is offered the ability to pay in installments.

At this stage, Visa is primarily focused on the During-Purchase use case where the installments plans are surfaced for cardholders at the point-of-sale (but is also supporting Pre- and Post-Purchase).

The Installment Management Service offers issuers the ability to enable installment offers as applicable in their market, thereby providing more flexible payment options to their cardholders at different points in the purchase journey.

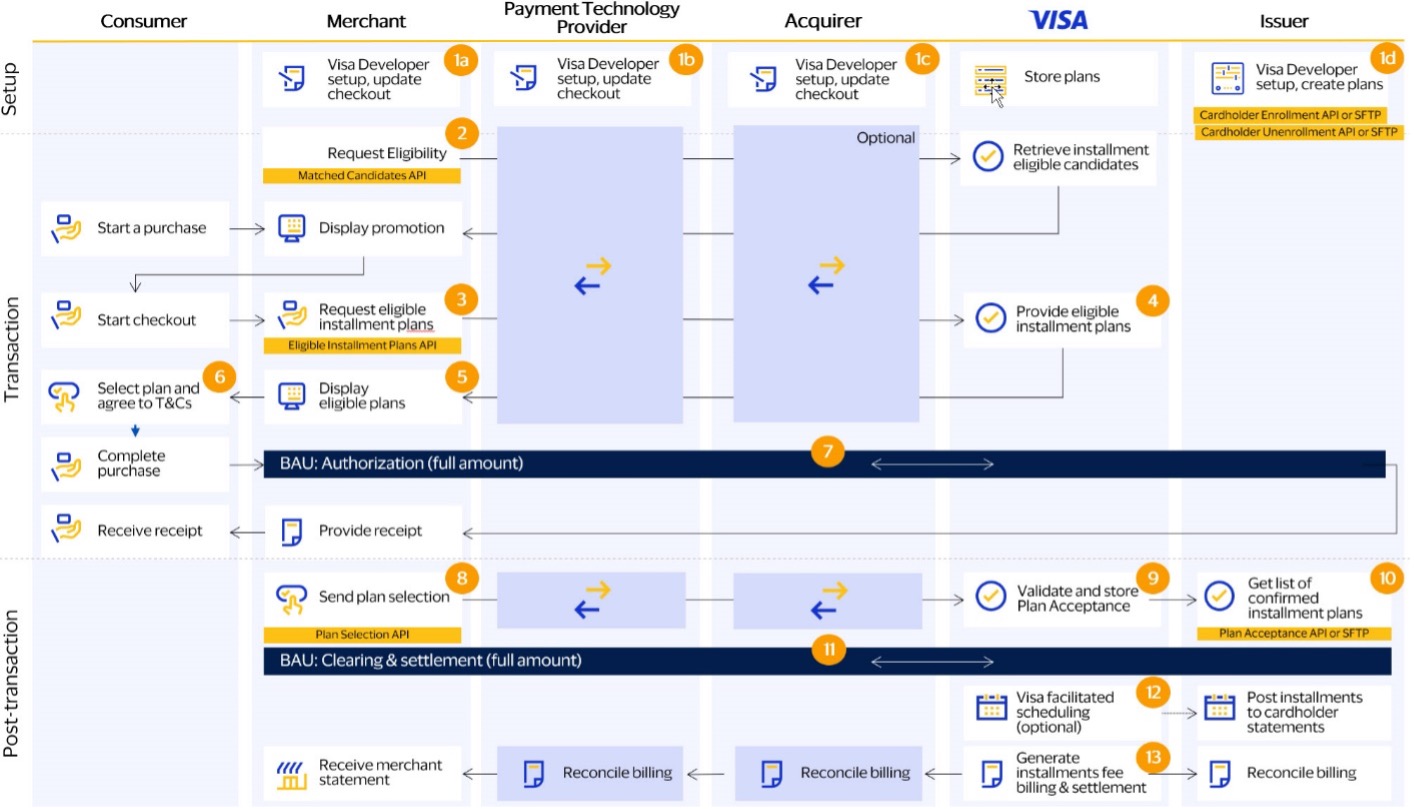

Sample Transaction Flow During-Purchase (Credit)

This diagram shows the Installment transaction flow for a credit card purchase.

The transaction flow is as follows:

- Issuers (1d) sign up for Visa Installment Solutions (VIS). Visa representative provides Issuers the access to Visa Developer Center (VDC), where they can log in, access the Installment Management Service, manage their profile and credentials, and create users. Issuers create installment plans, enrolling their cardholders with PANs and qualification criteria for installments eligibility using the Cardholder Enrollment API.

- For Card-On-File use case, batch eligibility check can be performed before the shopping journey. Merchant checks if an individual cardholder is (or a set of cardholders are) enabled for Installments using the Matched Candidates API (Batch)

- Consumer starts the checkout process at the point of sale. Merchant retrieves Installment Plans available to the Eligible Cardholder using the Eligible Installment Plans API.

- Visa looks through eligible installment plans in the repository.

- Eligible plans are returned to the merchant and displayed to the cardholder.

- Cardholder selects an installment plan and agrees to the Terms & Conditions.

- Business As Usual: Authorization of purchase, for full amount of transaction, using ISO.

- Merchant uses the Plan Selection API to send the selected installment plan to Visa.

- Visa validates and stores the selected installment plan.

- Issuer gets a list of confirmed installment plans from Visa and finds the matching transaction in clearing file based on different filters like date/time, PAN, and Transaction ID.

- Business As Usual: Clearing & Settlement process, for the full amount of the transaction, using ISO.

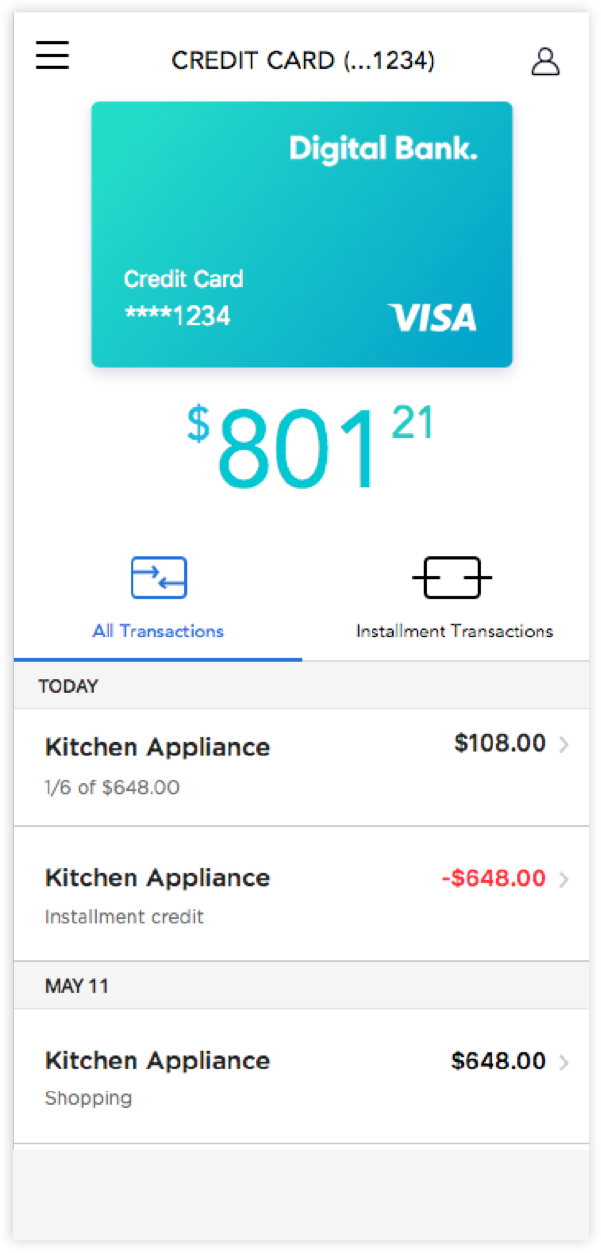

- Visa-facilitated scheduling (optional) – Visa credits the original transaction and posts the installment amount monthly through scheduling service.

- Client-to-client fee settlement (mandatory) – Visa facilitates fee settlement between the Issuer and the Acquirer (on behalf of the Seller).