Installment payments (installments) refers to the option of paying for purchases over time, where the purchase amount is divided into smaller equal payments over a defined time period.

The following example shows how installment payments work for a big ticket purchase of $900 paid over 6 months with 0% APR.

Visa Installment Solutions integrates with REST APIs or SFTP batch files via Visa Developer Center (“VDC”). On VDC, Merchants and Acquirers can access Visa Installment Solutions’ APIs and features via "Installment Transaction Service."

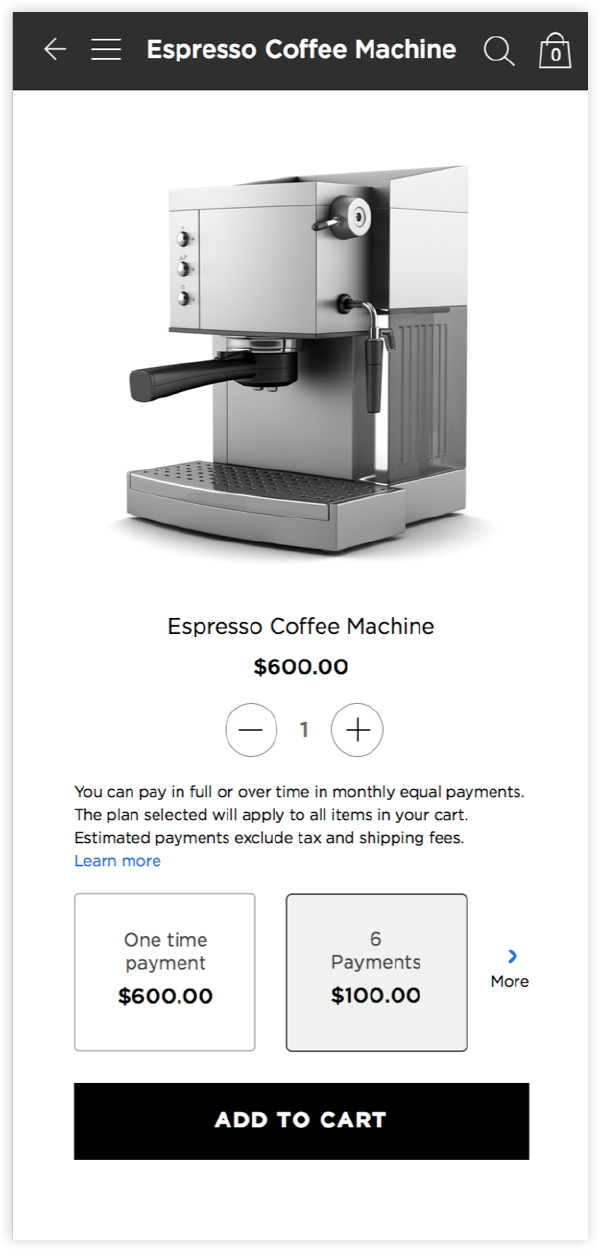

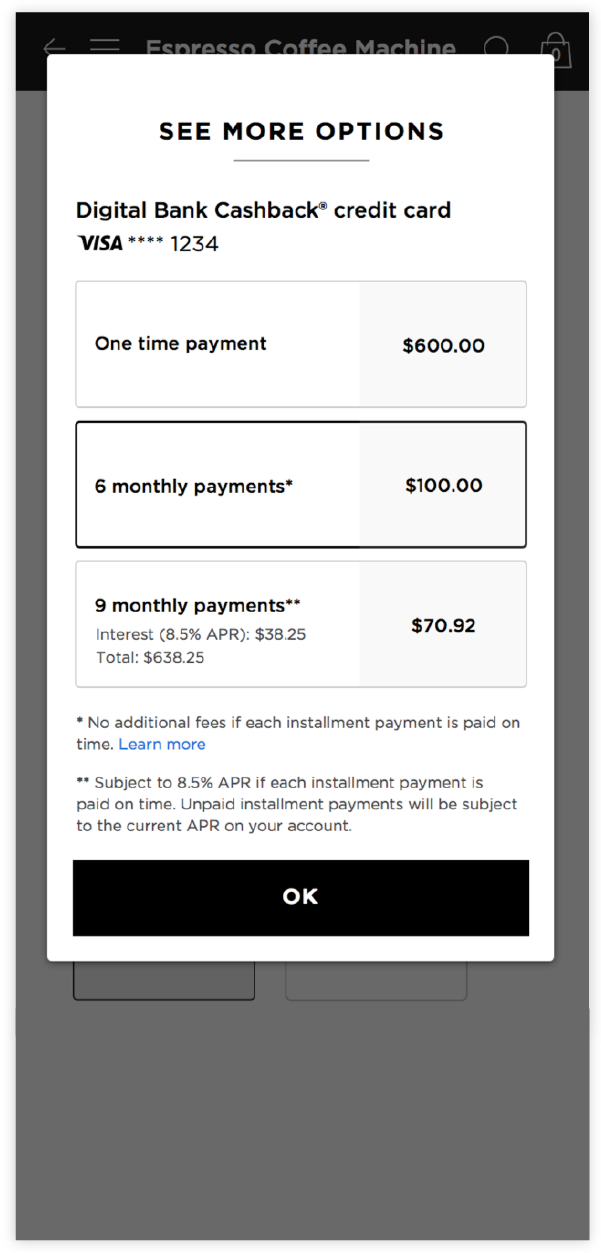

Installment Transaction Services enable merchants to offer installment plans (issuer-defined) to consumers at the point of sale, online or in-store, helping drive a potential increase in sales and volume. Installment Transaction Services offer consumers the flexibility to pay for the things they want now, or over time, driving customer acquisition, loyalty, and retention. These plans are for eligible Visa cardholders and require the participation of Issuers, Acquirers and Merchants.

| North America | Asia-Pacific | Europe | CEMEA | LAC | Notes |

|---|

This diagram shows a sample installment transaction flow during-purchase for a credit card purchase.

The transaction flow is as follows:

Shop at participating merchant

Select an installment plan

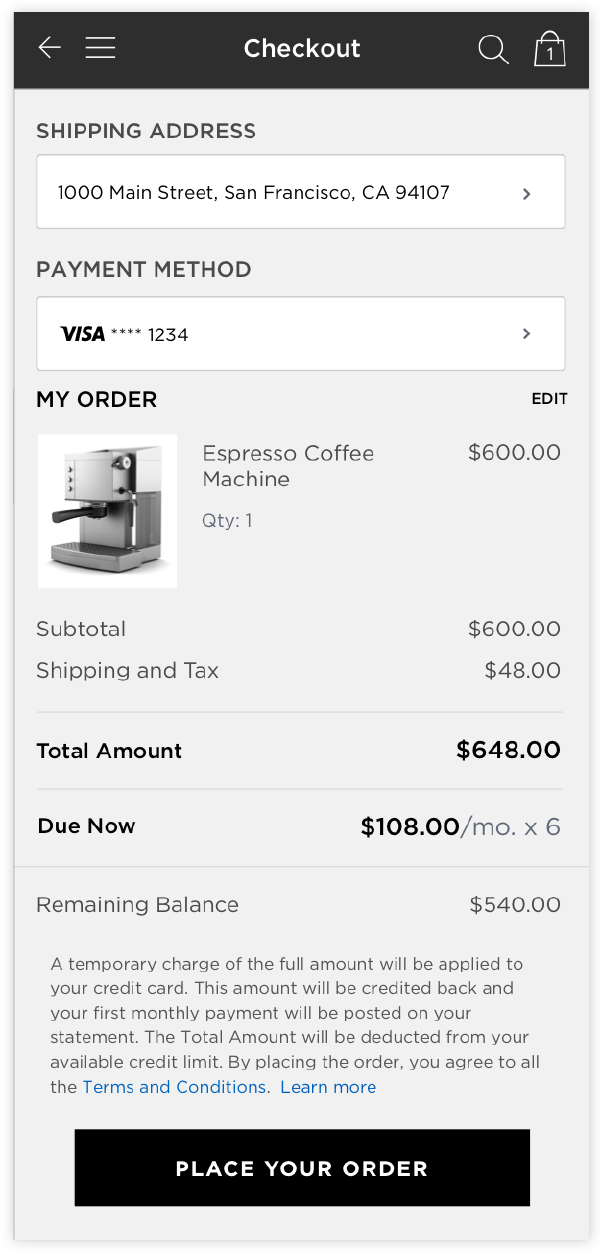

Review payment schedule and accept terms & conditions

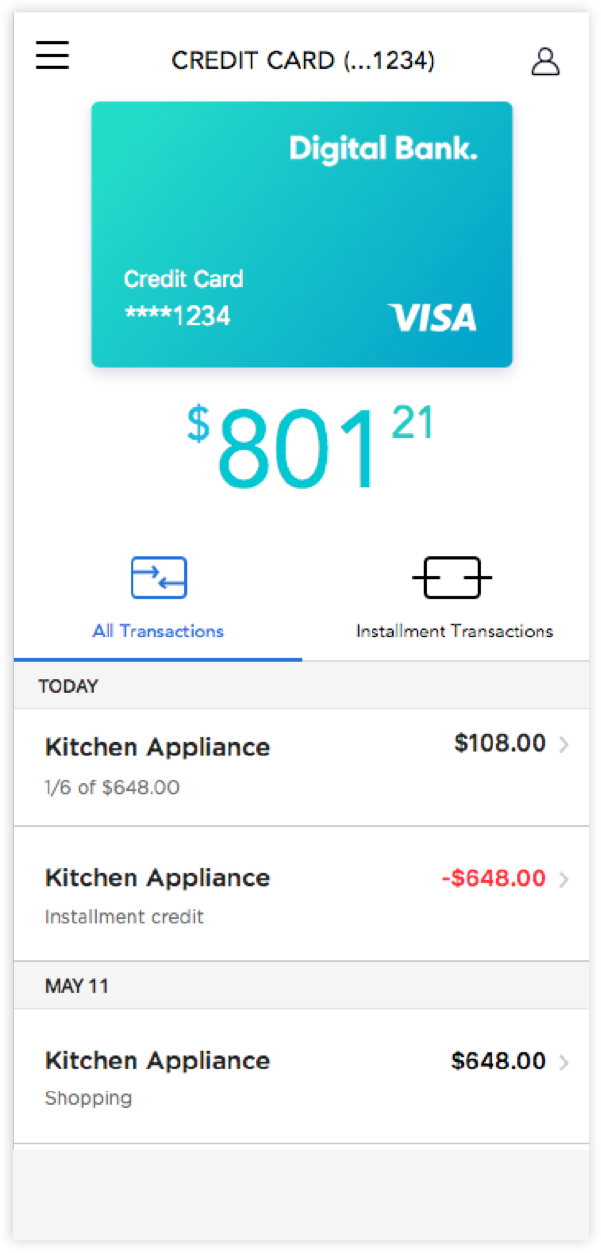

View installment transaction on monthly statement

*Issuer is solely responsible for updating their mobile banking app for installment solutions.