Getting Started with Visa Digital Enablement SDK

About Visa Digital Enablement SDK

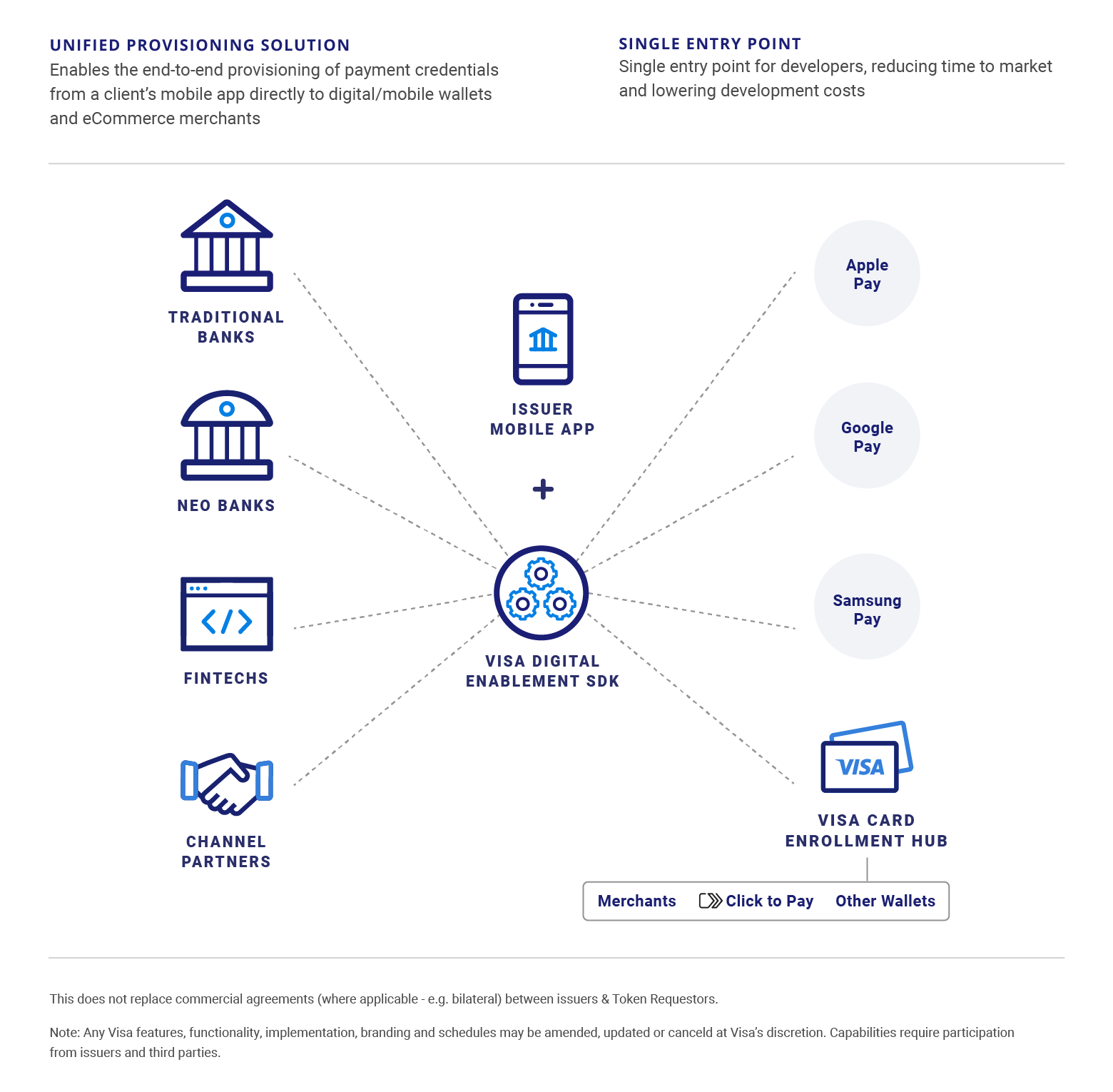

The Visa Digital Enablement SDK (VDE SDK) is a configurable mobile application component which supports a variety of digital use cases, including push provisioning to multiple digital wallets and the secure display of cardholder account details within a mobile application. The VDE SDK can help significantly reduce software development complexity and expense, support digital issuance initiatives and use cases while delighting cardholders with a frictionless experience.

The VDE SDK provides a secure method for cardholders to view and provision their payment credentials from within the client’s mobile application. The SDK aggregates multiple connections on behalf of our clients simplifying development efforts, helping to improve speed to market, and reducing the expense and complexity of connecting directly into multiple end points.

The VDE SDK supports two unique and configurable feature sets, one or both can be enabled depending upon a client’s needs and use case. These features can be configured at a BIN, BIN Extension and/or Account Range level:

- In-App Provisioning: The ability to push provision card account data to several digital wallets such as Apple Pay, Google Pay, Samsung Pay, and Visa Click to Pay

- Digital Card Display: The ability to display payment credentials within the mobile app

If interested in using the Visa Digital Enablement SDK, please contact your Visa sales representative or email [email protected].

Thing to Know

The VDE SDK is designed to be provided to a client, issuer/processor, mobile application provider, Fintech or Channel Partner and may be embedded within the relevant mobile app(s) by the team responsible for the mobile app development, which may be either the client or a party licensed by the client to provide their mobile solution.

| North America | Asia-Pacific | Europe | CEMEA | LAC | Notes |

|---|---|---|---|---|---|

-

KEY

- Available in entire region

- Not available

- See notes for available countries

Visa Digital Enablement SDK: In-App Provisioning

About VDE SDK: In-App Provisioning

Today’s provisioning experience for issuers supporting the pay wallets may be limited to ‘behind the scenes’ BIN tokenization setup and may often require possession of an active physical card. In addition, end users may experience friction by possible yellow-path token step-up authentication and manual CVV2 entry.

The Visa Digital Enablement SDK enables cardholders to seamlessly provision cards to mobile wallets and ecommerce merchants from within their mobile banking application. The mobile banking application provides user authentication and can utilize the SDK to support provisioning of physical and digitally issued credentials with no need to perform yellow path token step up authentication. The Visa Digital Enablement SDK can play a critical role in easily enabling digital provisioning flows for clients who are looking to support digital issuance use cases across the card account life cycle.

The SDK will facilitate the required “Pay” Token Eligibility validations, encrypt the card using the Visa In-App Provisioning API and manage required SDK/API integration requirements from Apple Pay1, Google Pay2 or Samsung Pay3, Click to Pay, and other ecommerce merchants, removing the need for the Mobile App Provider to interface directly with the “Pays” in order to provision a card directly from their app. The SDK can be utilized to support one, many, or all of these endpoints for both Visa and Mastercard credentials depending on client requirements.

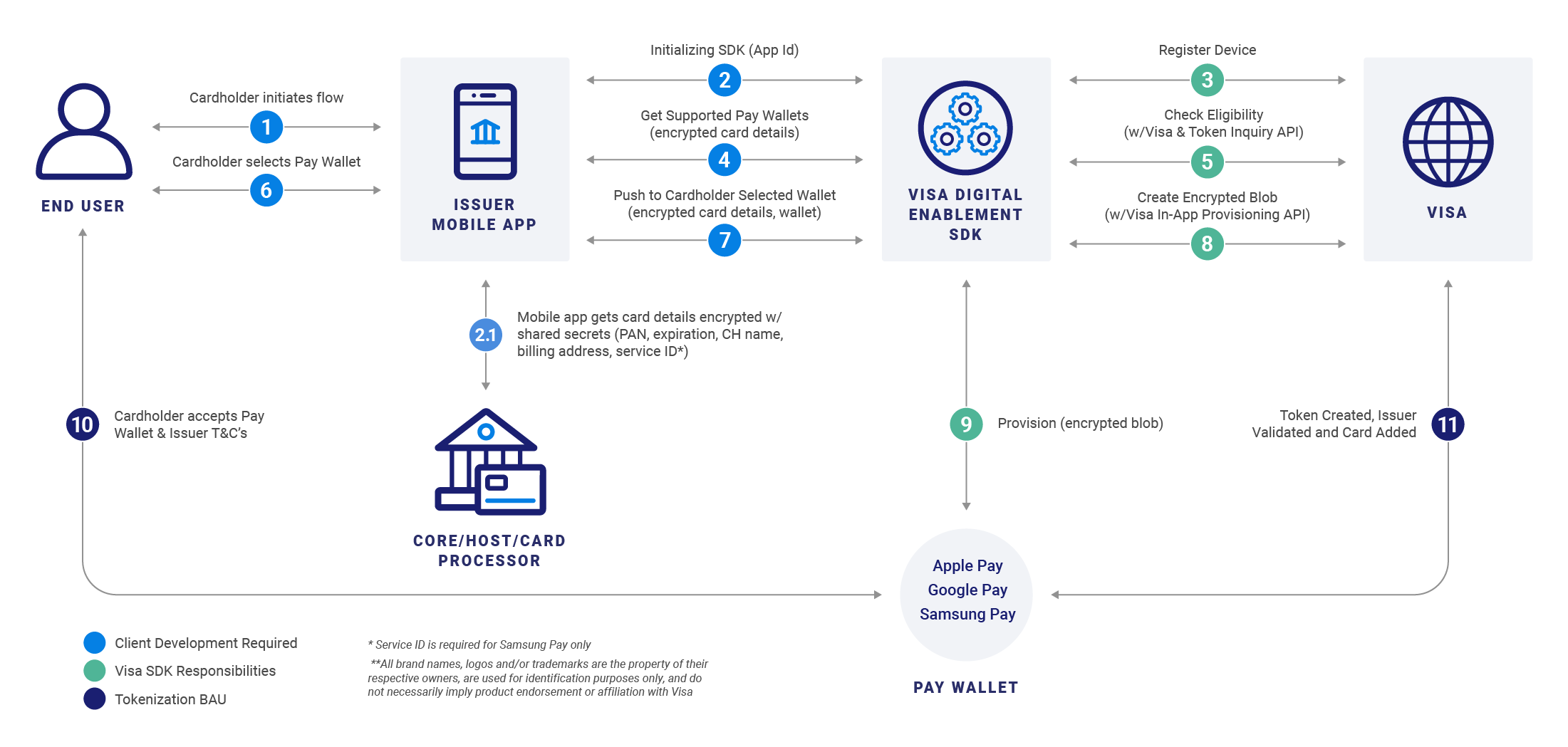

How Does It Work

The mobile application provider is responsible for presenting the action buttons to the end user, according to the brand guidelines required by every digital wallet. After the end user selects the appropriate action button from their mobile app, the end user will be presented with the default wallet screens required and controlled by the Pays display during the push provisioning user experience (screens relating to terms and conditions, etc.). It is the responsibility of the client to ensure all mobile application user experiences comply with the mandated requirements of each supported Pay, including branding and use of trademarks. It is also the client’s responsibility to obtain any required approvals from each supported Pay of their mobile application user experience through their existing mobile app store submission and approval process prior to production launch.

Things to Know

For a mobile app developer to implement in-app provisioning on their own, they would need to interface with API’s from multiple sources, including the issuer or core/host/card processor, Visa, Apple, Google and Samsung APIs as demonstrated below. Each mobile wallet provider has a different set of APIs and requires different approaches to perform device and token eligibility checks and other functions. These variations introduce a level of complexity that can increase time to market and requires a unique set of integration requirements for each supported digital wallet, requiring the mobile app developer to aggregate APIs from multiple sources into a cohesive user experience.

With the Visa Digital Enablement SDK

With the Visa Digital Enablement SDK, the connectivity to the Pay Wallet APIs is simplified for the mobile developer and handled by the SDK. The SDK manages all technical touchpoints with Visa and the wallet providers. The mobile app developer embeds the SDK within the mobile app, gathers the card details and passes that information into the SDK.

The mobile app developer has only three touch points with the SDK

- To start up, or initialize the SDK

- To pass the card details to the SDK and get a list of supported digital wallets from the SDK

- To make a request for the SDK to push the card to the wallet that the user selected

APIs Included

Visa Digital Enablement SDK: Digital Card Display

About VDE SDK: Digital Card Display

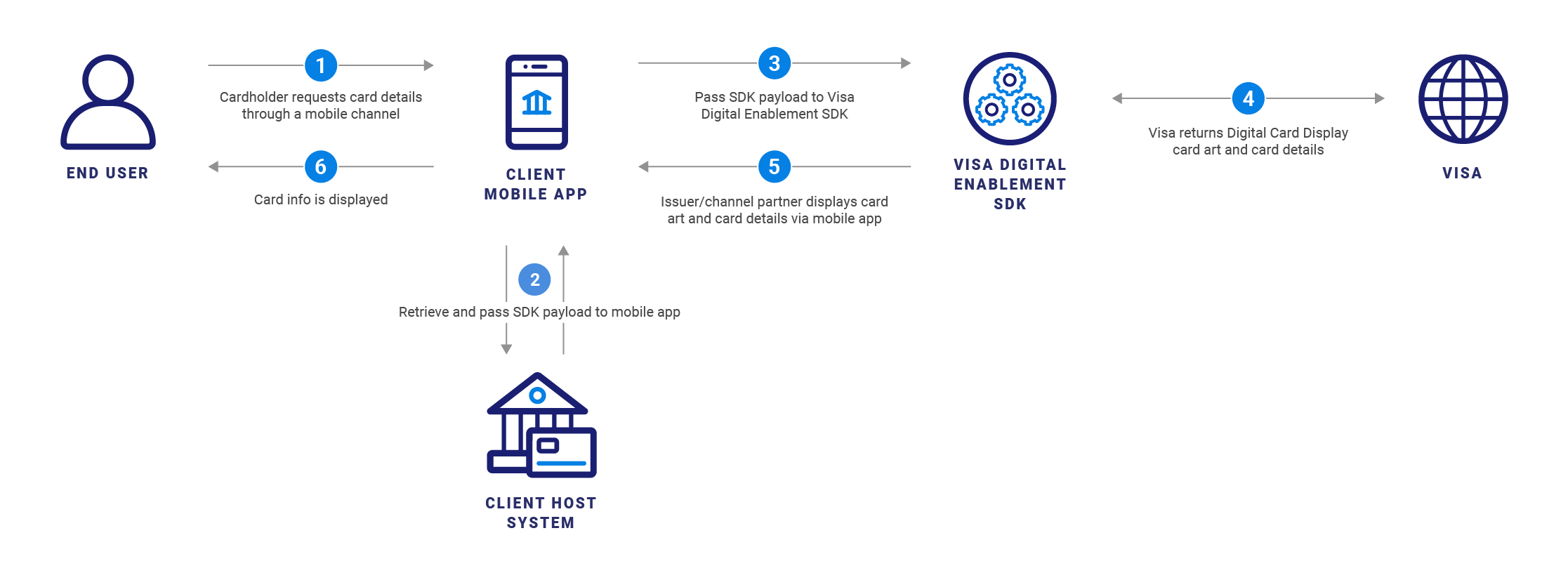

Visa Digital Enablement SDK: Digital Card Display enables real-time retrieval and display of card details (card number, expiry date, and security code) to cardholders through digital banking channels (e.g. online banking, mobile banking). With this information, cardholders are able to perform card-not-present transactions when they don’t have access to their physical card, driving activation and usage, increasing the ability to capture top-of-wallet positioning, and providing a leading digital-first experience.

How Does it Work

Visa Digital Enablement SDK: Digital Card Display enables real-time retrieval and display of card details (card number, expiry date, and security code) to authenticated cardholders through digital banking channels (e.g. online banking, mobile banking). With this information, cardholders can perform card-not-present transactions when they don’t have access to their physical card, driving usage, with the potential to increase the ability to capture top-of-wallet positioning, and provide a leading digital-first experience.

The Digital Card Display feature includes an optional set of user interface (UI) screens designed by Visa that can be leveraged to simplify the mobile app development effort or to avoid the handling of PCI-related account data. Clients that wish to use these screens will be configured on Visa’s systems to enable the SDK User Interface and will operate in the ‘UI SDK’ mode. Clients that do not use these screens will operate in a ‘Headless SDK’ mode. For purposes of this document, ‘Headless’ references will always be indicative of an SDK operation that does not involve the use of Visa’s UI screens. For purposes of this document, ‘Headless’ references will always be indicative of an SDK operation that does not involve the use of Visa’s UI screens.

Things To Know

Support for this feature requires the client’s compliance with applicable law and regulations, including but not limited to step-up authentication, and the ability for the Security Code to be generated and retrieved on a real-time basis from the client’s issuer/processor or other host system for use in the display of the data.

Availability

| North America | Asia-Pacific | Europe | CEMEA | LAC | Notes |

|---|---|---|---|---|---|

-

KEY

- Available in entire region

- Not available

- See notes for available countries

Prerequisites

To get started with the Visa Digital Enablement SDK, please reach out to your Visa Account Executive. Once a VDP API Agreement for the Visa Digital Enablement SDK has been signed and any necessary authorizations have been granted, Visa will assign an Implementation Manager to support the initial client implementation, as well as any subsequent projects in which new clients and/or new BINs are added to (or removed from) the SDK configuration. The Visa Implementation Manager will coordinate the overall project, establish timelines and milestone dates, address completion of the required Visa system configurations and handle the various technical onboarding requirements.

Enablement of the Digital Card Display feature requires that clients must verify the identity of the cardholder before any unmasked card account data can be retrieved and displayed within the mobile app, which includes step-up authentication as well as compliance with other requirements by applicable law and regulation.

The client must also ensure that any required integrations and dependent system configurations are in place to support the generation and retrieval of the card’s Security Code (CVV2, CVC2) prior to the testing stage of the SDK implementation project.

When using a Visa-provided method of cardholder identity verification, confirm that the client’s issuer/processor or other host system can provide the required cardholder data, including first and last name, email address and/or mobile number. Also, verify that the cardholder contact data is reliably available on card account records.

For clients that do not have email address and/or mobile numbers on the card account records, a cardholder data clean-up effort should be completed prior to implementation.

Should a new system integration be required with an issuer/processor or other host system in support of any of the above functionality, this should be handled as a separate project prior to the SDK implementation. Visa can provide standard API specifications upon request.

Please reach out to your Visa Account Manager for more information.

APIs Included

¹ Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries

² Google Pay is a trademark of Google LLC.

³ Samsung Pay is a trademark of Samsung Electronics Co., Ltd