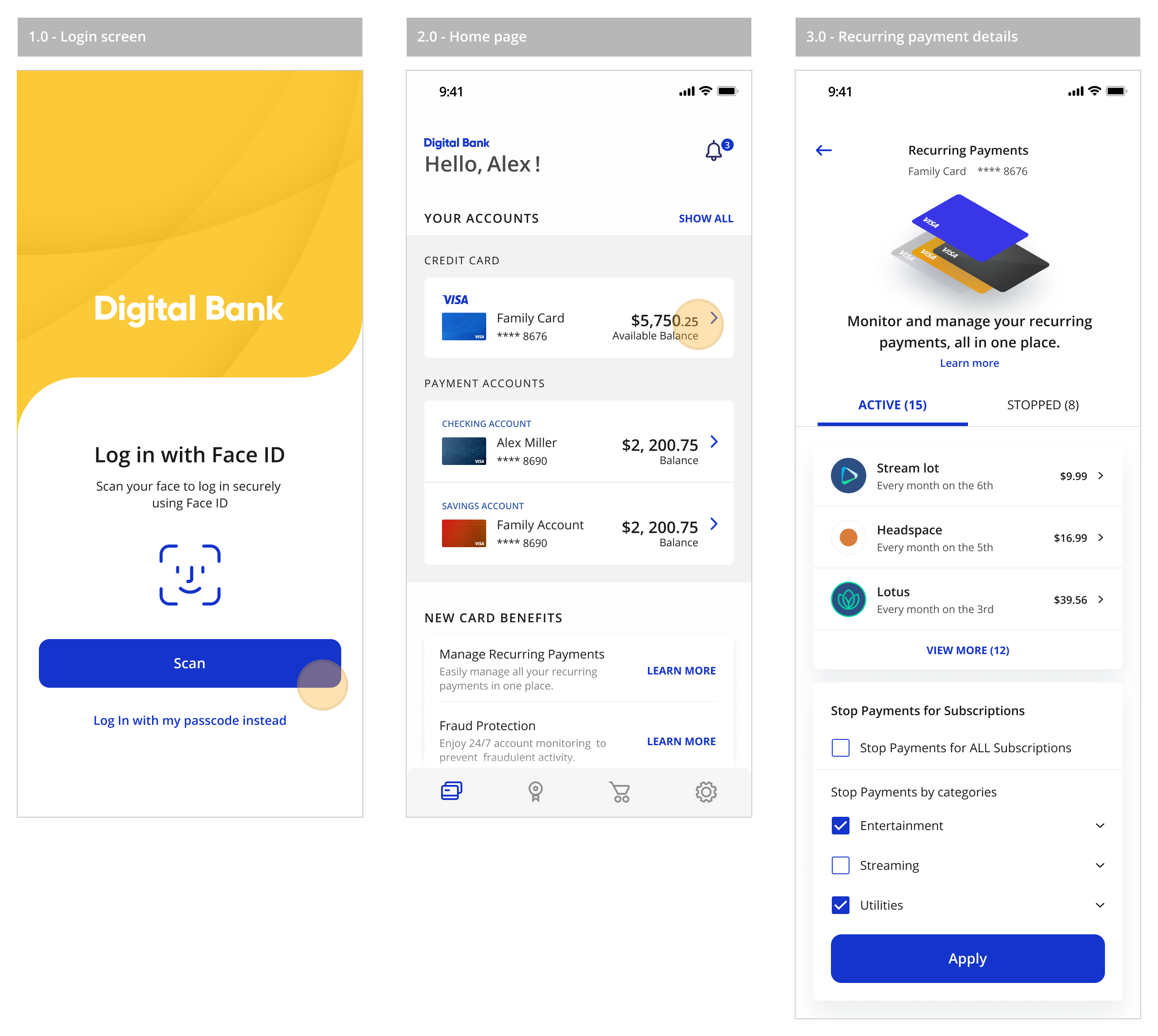

How to Enable Cardholder Mobile Experiences

Issuers can create a frictionless and consistent recurring payment or subscription management mobile experience for cardholders using the Visa Stop Payment Service (VSPS).

VSPS allows cardholders to manage recurring payments directly, reducing the need to contact cardholder support for help. Cardholders can access VSPS account management tools online or using their issuer app anytime, allowing them to instantly address payment issues and saving them time and energy.

This page provides UX recommendations and best practices, and technical implementation guidance to help issuers develop an optimal user experience for cardholders.

An optimal user experience allows cardholders to

- More easily manage their account and control everyday transactions

- Monitor their recurring payments, promoting transparency into their finances.

- Set up account notifications for upcoming/scheduled payments, driving increased use of mobile vs. other channels.

Issuers can create optimal mobile user experiences by choosing the right VSPS solution for their cardholders from among these three API implementation options:

Use this solution to help provide cardholders with maximum control and flexibility. You can build a customized mobile solution, choosing from a set of 10 APIs that not only help you search for eligible transactions, create stop instructions and cancel existing stop instructions, but also help you search, retrieve, extend and update existing stop instructions. Learn more about the 10 VSPS APIs.

Use this solution if you are trying to provide cardholders with a self-service mobile solution to manage their subscription or card on file (COF) payments quickly and easily. You will get access to a suite of four APIs that can help your cardholders understand where their cards are stored and quickly stop any unwanted transactions at specific merchants for a preset duration. Reach out to your Visa Representative to learn more about managing subscriptions.

* Only available in select markets

.png)

Note: Yellow arrow = Issuer/merchant requesting data/action from Visa.

Blue arrow = Visa responding back with data/status.

You may want to consider offering third party cancellation services alongside VSPS. Please note that these services are independent of Visa's services and Visa has not insight into or control over them. These third party cancellation services may provide services that can help cancel merchant subscriptions, services or memberships associated with these payments. Clients opting for third party services may not need to integrate with VSPS APIs. They may access VSPS functionalities through integrations with third party services.

Overview of the stop instruction creation and management flow across issuers, third party value providers, and Visa. Each box corresponds to a screen detailed later in this document. This section focuses on creating stop instructions.

Third party subscription management processes depend on type of merchant interaction (third party API, SDK direct human outreach, and the like). All user flows and messaging shown are for illustrative purposes only. They are not comprehensive and do not constitute legal or marketing advice or replace participant's own analysis.

Recommended Mobile User Experiences

To create an optimal user experience, provide cardholders multiple options to stop unwanted payments based on their intent while using the mobile app.

Examples of cardholder intent and subsequent management flows for unwanted payments.

.png)

ACCOUNT MONITORING

In this user journey, the customer uses their issuer mobile application to monitor their spend/transactions. They look deeper into a particular transaction, identify it as an unwanted recurring charge, and place a request to stop / pause all future recurring charges for that specific retailer.

Stop payments for an active subscription/service/membership

View all screens seen in this user flow here

Technical Specifications and User Experience Recommendations corresponding to each screen shown in the prorotype is provided to help simplify implementation.

All user flows and messaging shown are for illustrative purposes only. They are not comprehensive and do not constitute legal or marketing advice or replace participant's own analysis.

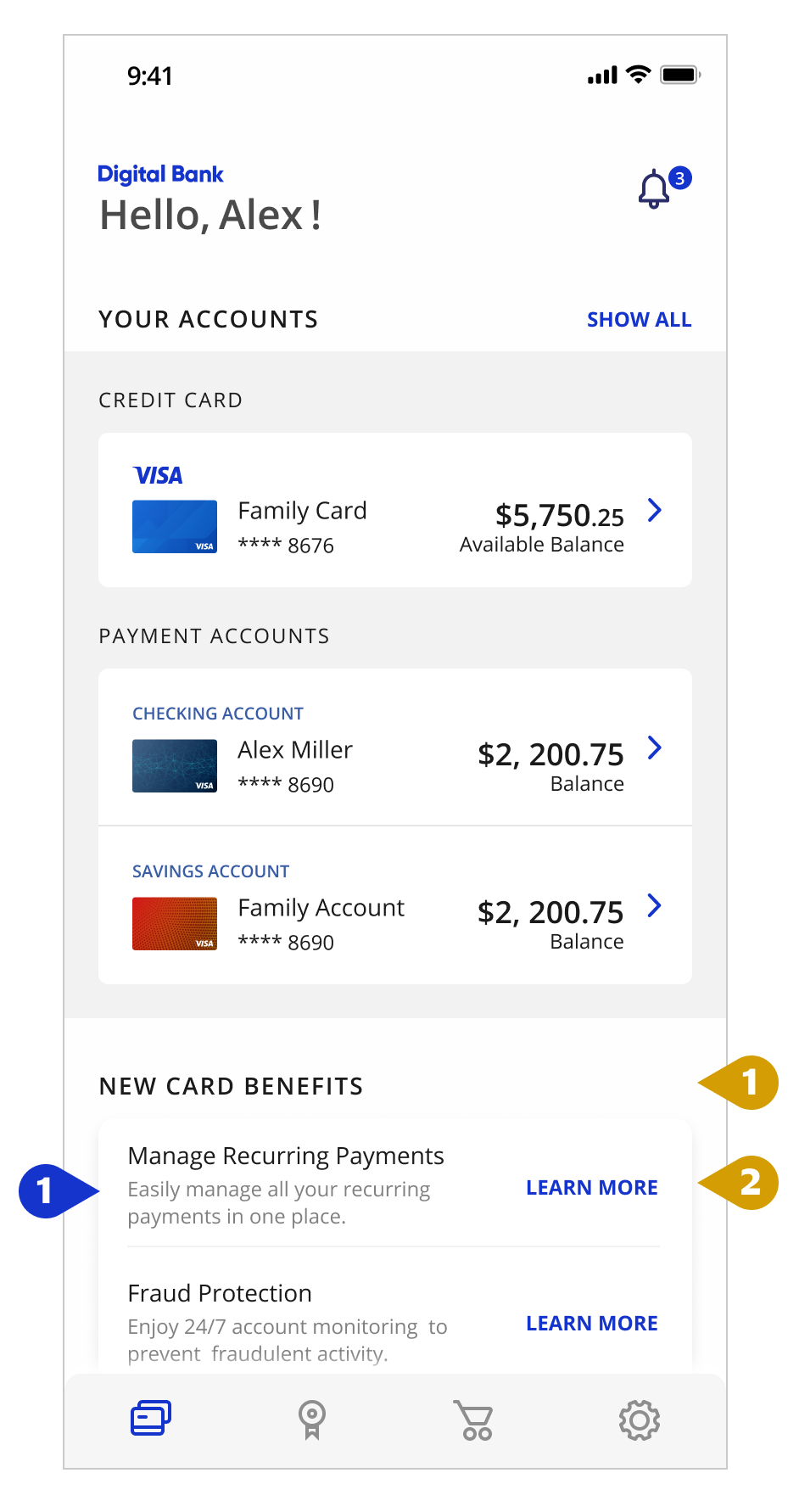

STOP PAYMENT - HOME SCREEN

| Tech Specs |

|

|

|

Account Home fields will be dynamically populated by issuers using internal data sources. | |

| Please review the VSPS API reference for sample API requests and responses | ||

| UX Recommendations | ||

| Use key customer touch points, such as the Welcome screen, to alert cardholders to new features available to manage their finances – e.g., use a “New Card Benefits” promo to introduce cardholders to VSPS. | ||

| Provide cardholders an easy way to get more information about new services – e.g., link to a “Learn More” popup with more information about VSPS benefits to help drive enrollment. | ||

|

Tip: Use clear, simple calls to action, such as “Learn More.” Link to the content vs. using a button so cardholders understand this isn’t a step they need to complete. | |

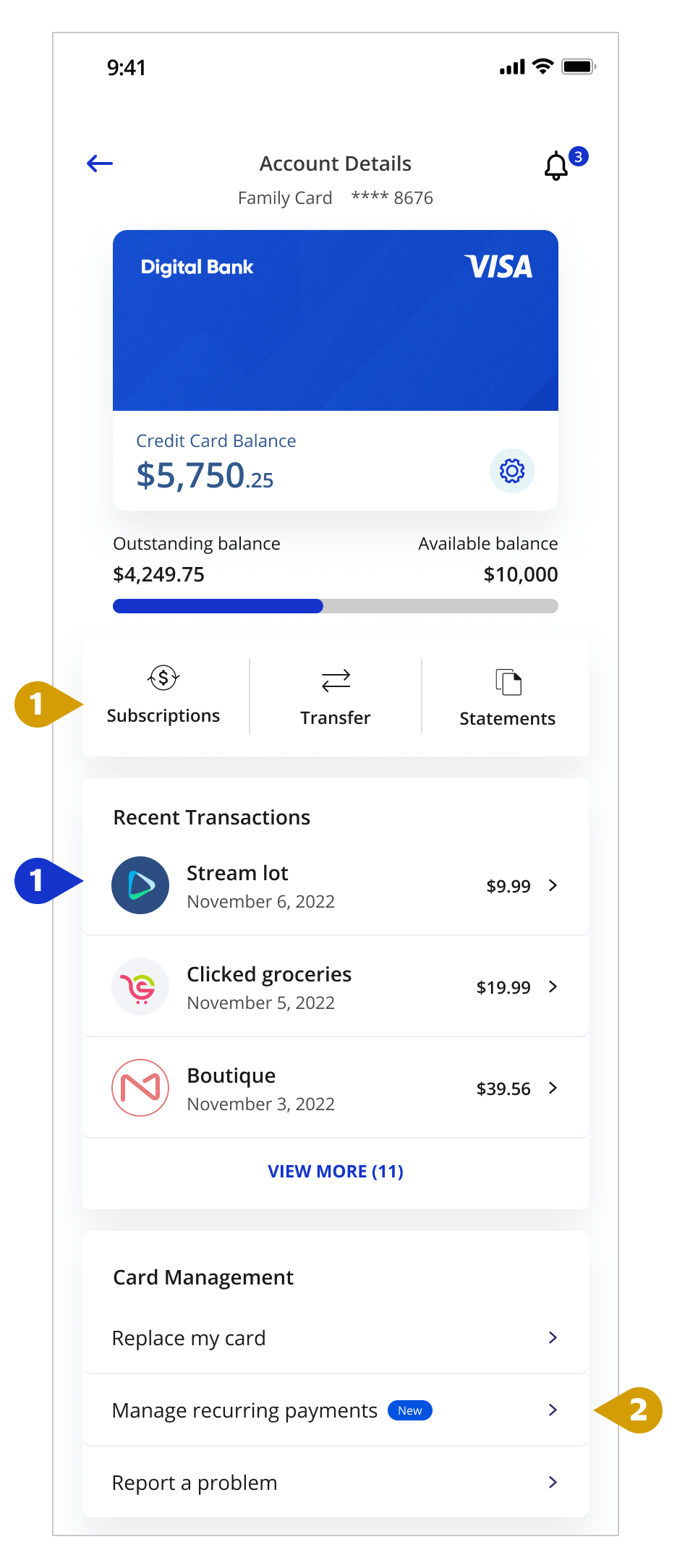

STOP PAYMENT - ACCOUNT DETAILS

| Tech Specs |

|

|

|

Recent transactions are assumed to be available to the issuer internally. | |

| Please review the VSPS API reference for sample API requests and responses | ||

| UX Recommendations | ||

| Offer multiple entry points for cardholders to access account management tools. | ||

| If the Account Details screen is the cardholder’s first interaction with recurring payments, include a “Learn More” link to provide an easy way to get answers to their questions about the feature to encourage engagement. | ||

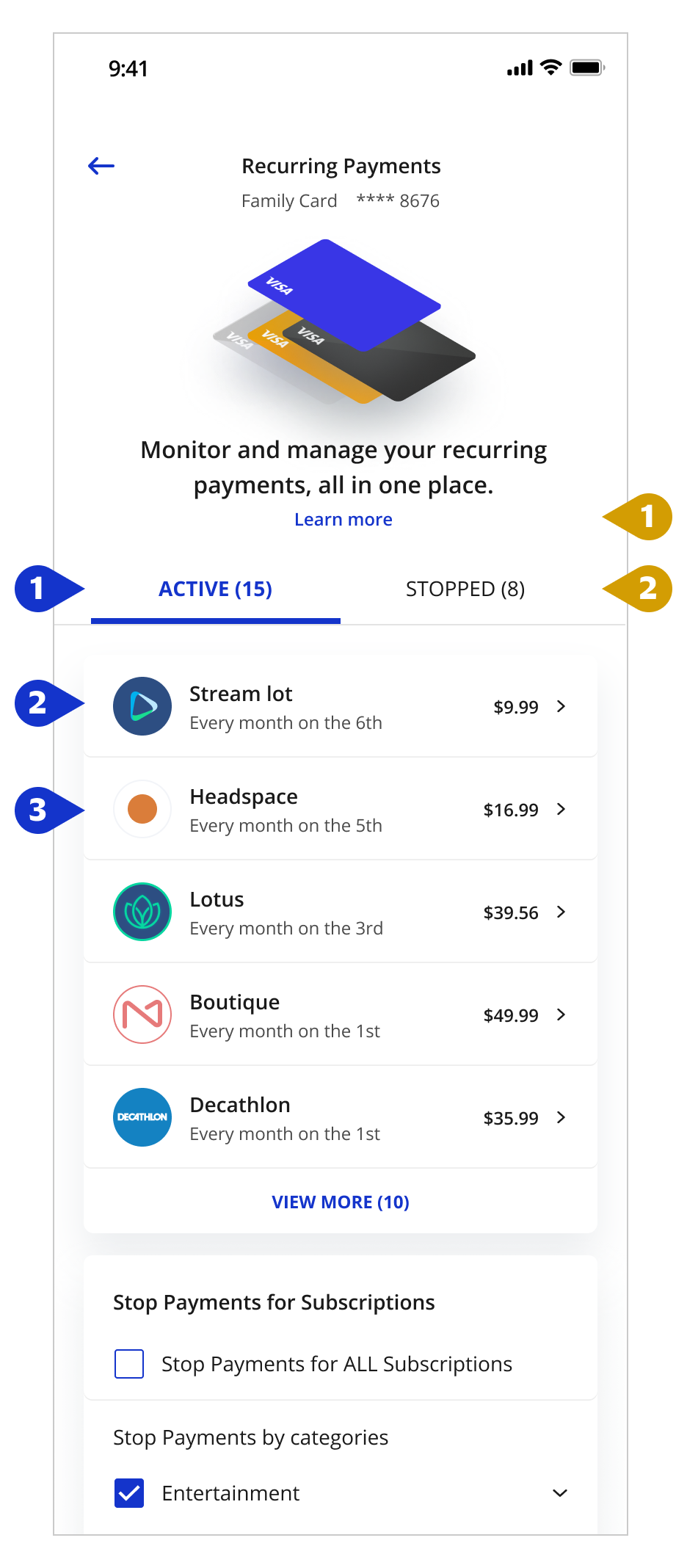

STOP PAYMENT - RECURRING PAYMENT

| Tech Specs |

|

|

|

To distinguish between Active and Stopped payments, use |

|

|

To get a list COF merchants where the PAN is used for recurring or installment type payments, use URL: /vsps/eligibleTransactions Field: merchantName |

|

To get payment date, use URL: /vsps/eligibleTransactions Request 180 days of data to determine the frequency |

||

| Tip: All transactions with stopInstructionType=MERCHANT returned by the Search API will be placed under the ‘Stopped’ section of the screen. Filter our these transactions from the results returned by the Eligible transaction search API to get a list of merchants to be displayed under the ‘Active’ section of the screen. Make sure you only select transaction with stopInstructionType=MERCHANT |

||

| Please review the VSPS API reference for sample API requests and responses | ||

| UX Recommendations | ||

| “Learn more” aids cardholders in understanding how this feature can help them gain more visibility and control over their finances and encourage enrollment. | ||

| Clearly communicate the status of subscriptions so cardholders can easily distinguish between active and stopped subscriptions. | ||

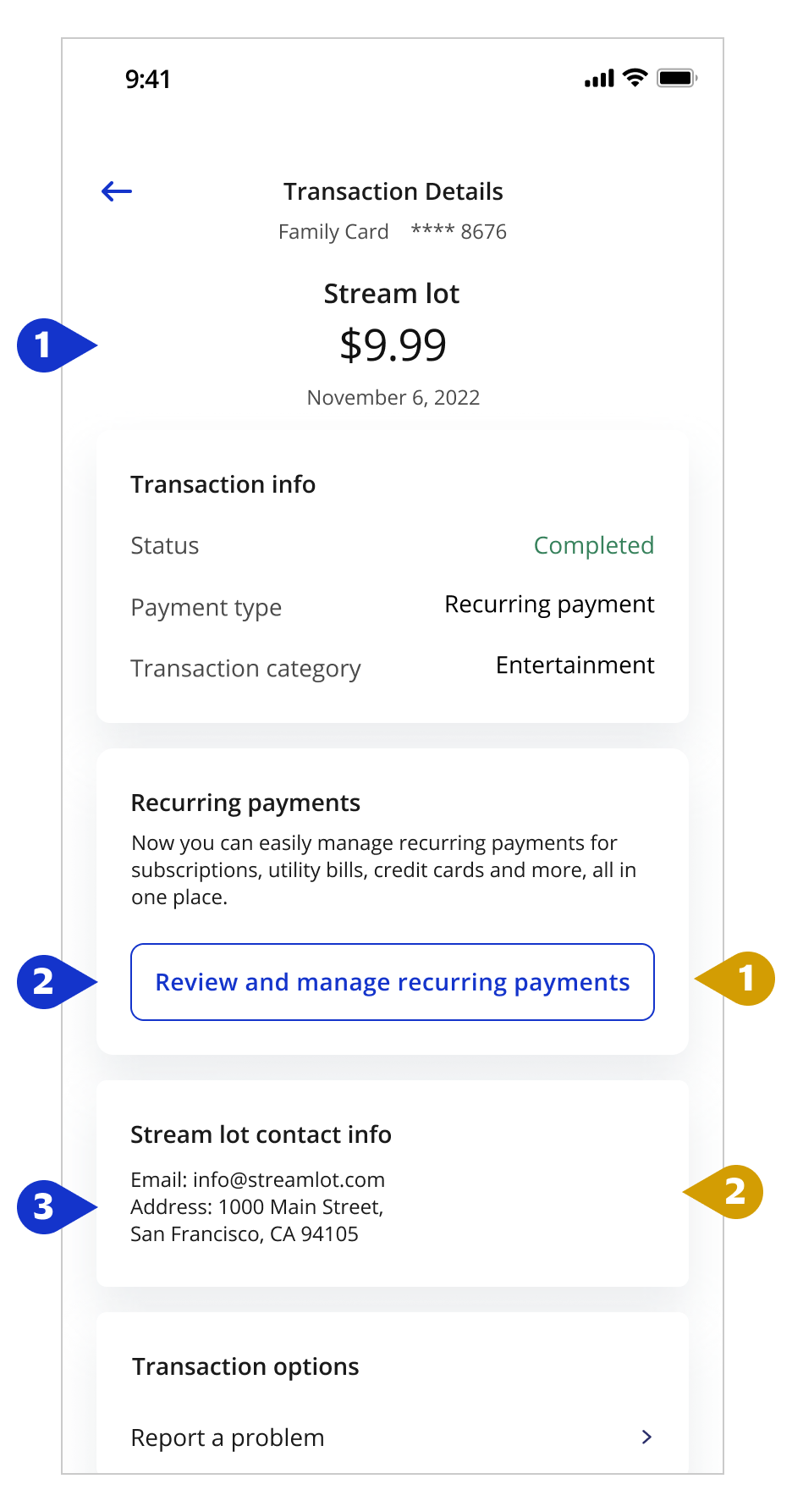

STOP PAYMENT - TRANSACTION DETAILS

| Tech Specs |

|

|

|

To get transaction amount, use |

|

|

To get transaction type, use |

|

| Address is not provided by VSPS APIs. Issuers can get this info from transaction history or the COF API. | ||

| Please review the VSPS API reference for sample API requests and responses | ||

| UX Recommendations | ||

| Have clear call outs for any action that the user needs to take to manage their payments. | ||

| Providing merchant contact information will encourage issuers to contact the merchant to report problems prior to stopping or pausing the payment. | ||

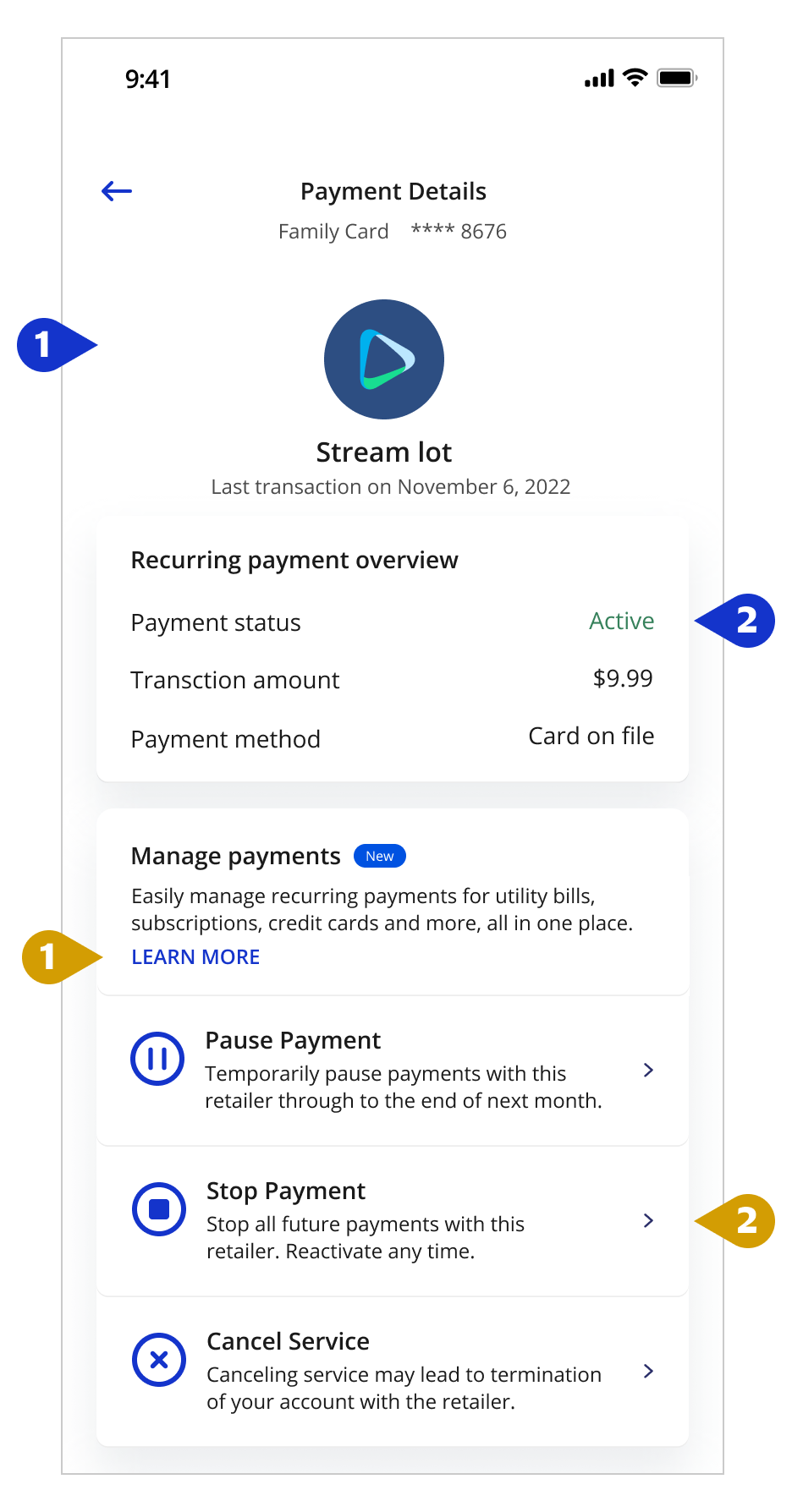

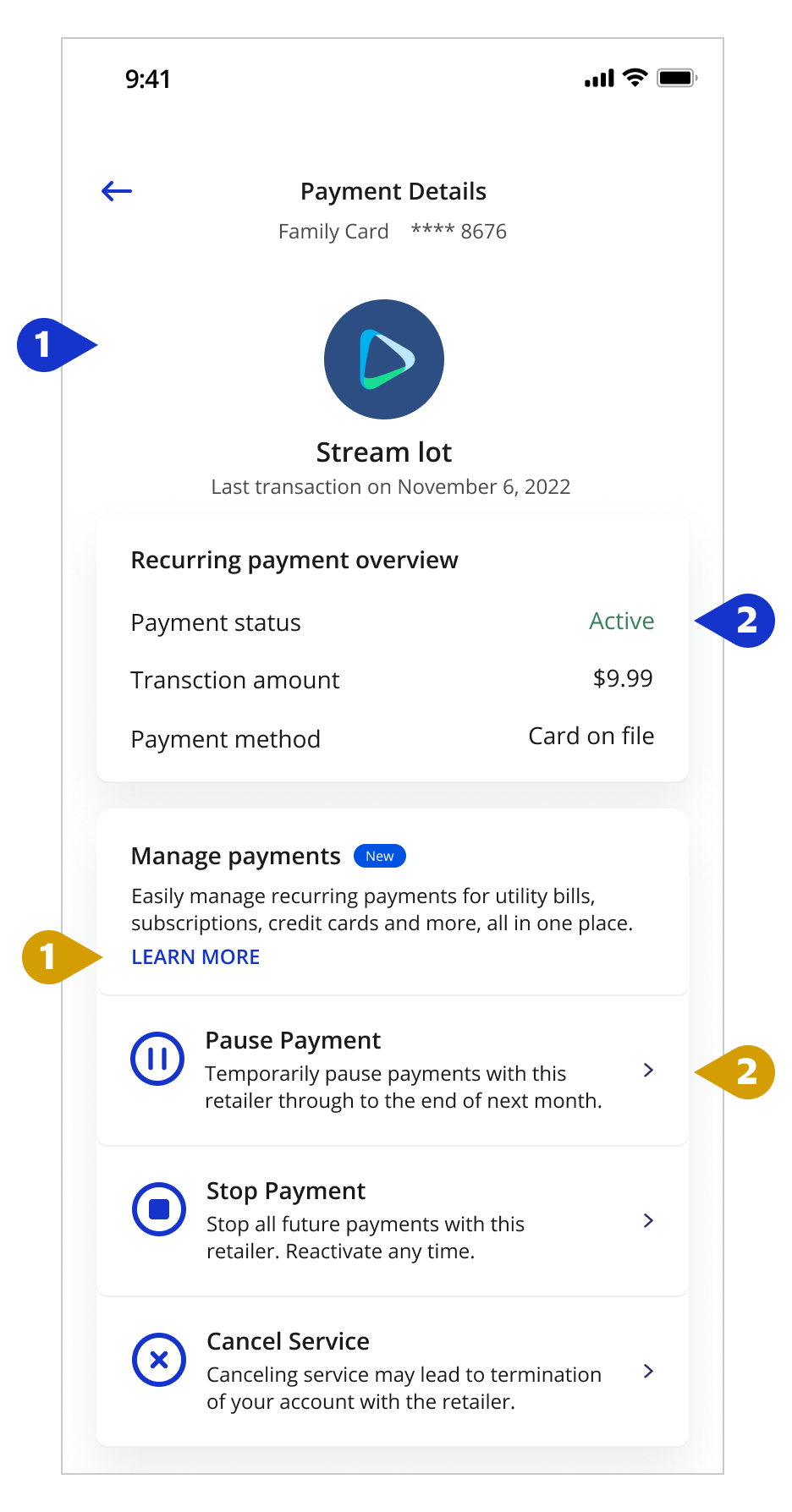

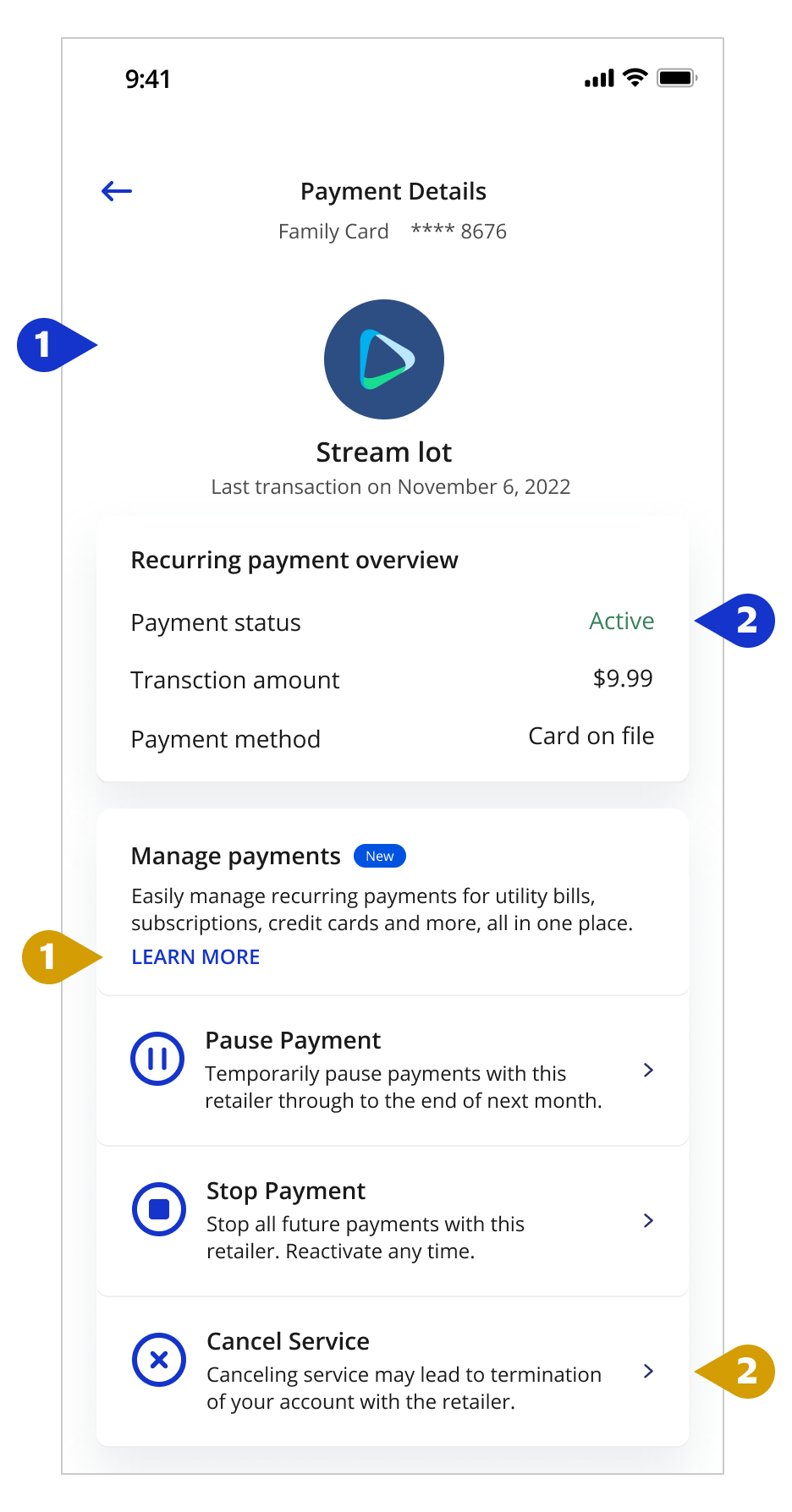

STOP PAYMENT - PAYMENT DETAILS

| Tech Specs |

|

|

|

Merchant logos are to be sourced internally by the issuer. | |

| To get the payment status and determine if the payment is active / paused use URL: /vsps/search Include the PAN If the response doesn't include the transaction being displayed, then the status can be assumed to be 'active'. This API returns all transactions that have been stopped on a PAN. |

||

| Please review the VSPS API reference for sample API requests and responses | ||

| UX Recommendations | ||

| Include a “Learn More” link to provide an easy way to get answers to their questions about each of the options. | ||

| Clearly call out all all options available to the cardholder to manage payments. Also include additional information related to each of these options so cardholders clearly understand what each option will result in. | ||

|

Tip: Use clear, simple calls to action, such as “Learn More.” Link to the content vs. using a button so cardholders understand this isn’t a step they need to complete. | |

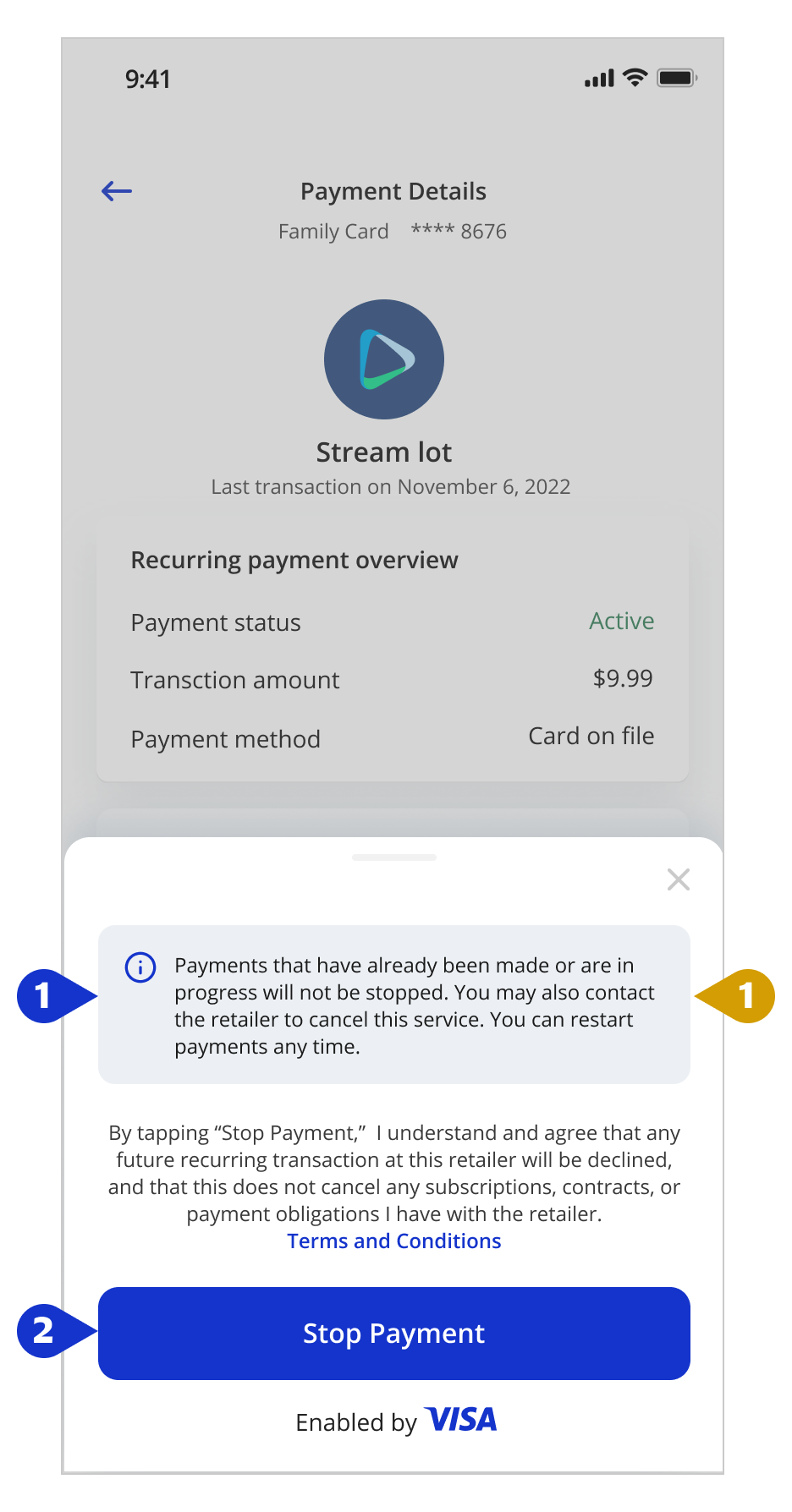

STOP PAYMENT - T&C

| Tech Specs |

|

|

|

All legal and information text to be hosted internally by the issuer. | |

To place a stop instruction (R1) use |

||

| Please review the VSPS API reference for sample API requests and responses | ||

| UX Recommendations | ||

Clearly communicate that stopping recurring charges will only stop future charges to set cardholder expectations about how the feature works and reduce inquiries to the call center and customer dissatisfaction. Ensure cardholders understand that they should contact the merchant first to ensure the service / subscription is canceled or their payment concerns are addressed. |

||

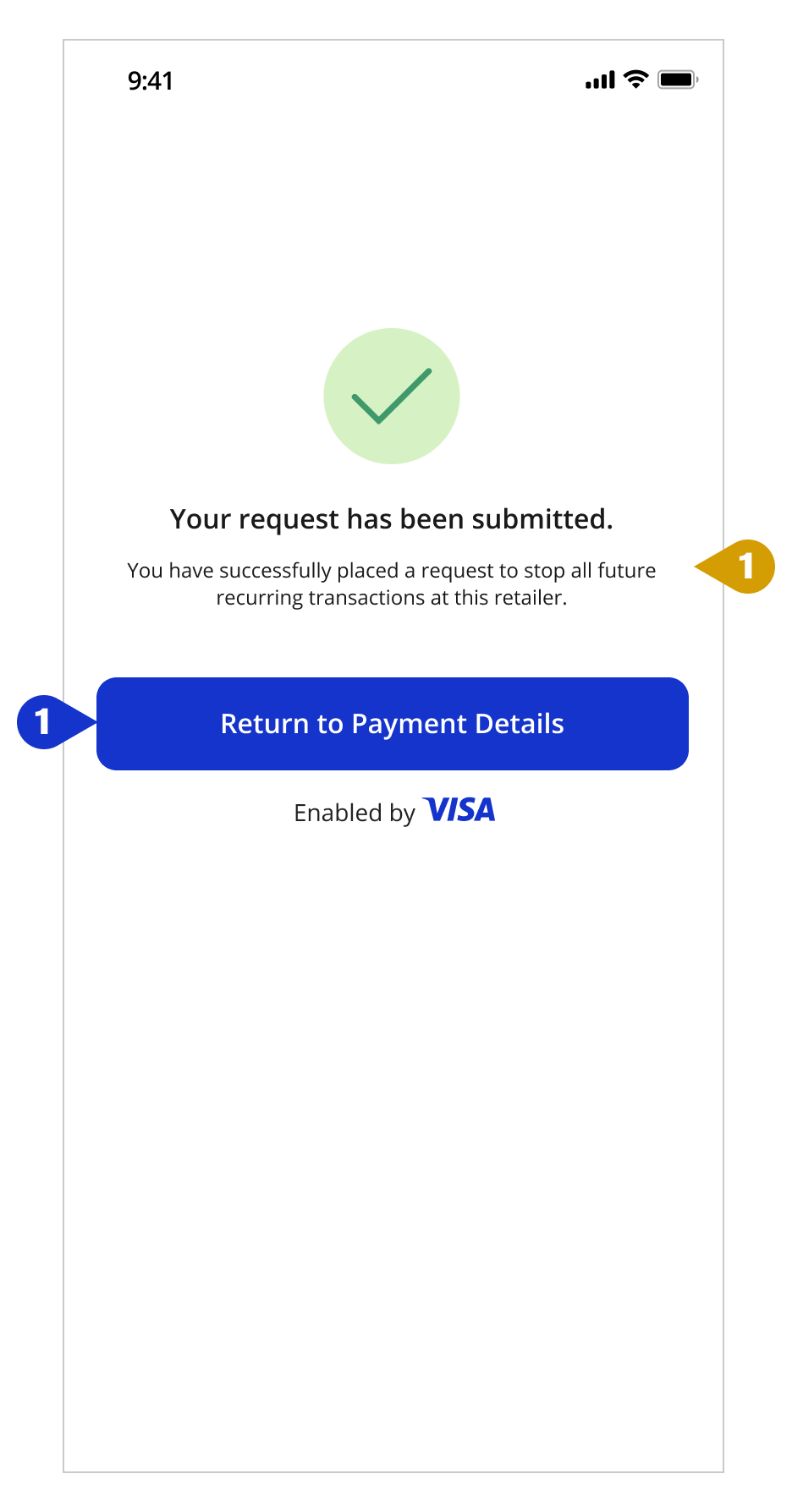

STOP PAYMENT - CONFIRMATION

| Tech Specs |

|

|

|

Once the Add Merchant API call is placed, a 200 or 400 response is returned along with stop instruction ID and details. A 200 response will also include the status of the request, which includes success (00), partial success (01) or fail (02). | |

| Please review the VSPS API reference for sample success and error responses. | ||

| UX Recommendations | ||

| Clearly communicate all settings associated with a stop to ensure cardholders understand and agree to the stop payment terms and reduce cardholder support inquiries. Create default stop settings for your organization. Providing too many customized options can overcomplicate the user flow and increase API calls if a cardholder sets a duration that is not long enough to block the recurring payment. |

||

| Tip: The VSPS default stop payment is 13 months. A good rule of thumb is to set the stop payment duration for monthly payments to 6 months and for yearly payments to 13 months. | ||

|

Tip: Use the auto cancel and auto extend features to ensure better customer experience and cost reduction. | |

Pause payments for an active subscription/service/membership

View all screens seen in this user flow here

Technical Specifications and User Experience Recommendations corresponding to each screen shown in the prorotype is provided to help simplify implementation.

All user flows and messaging shown are for illustrative purposes only. They are not comprehensive and do not constitute legal or marketing advice or replace participant's own analysis.

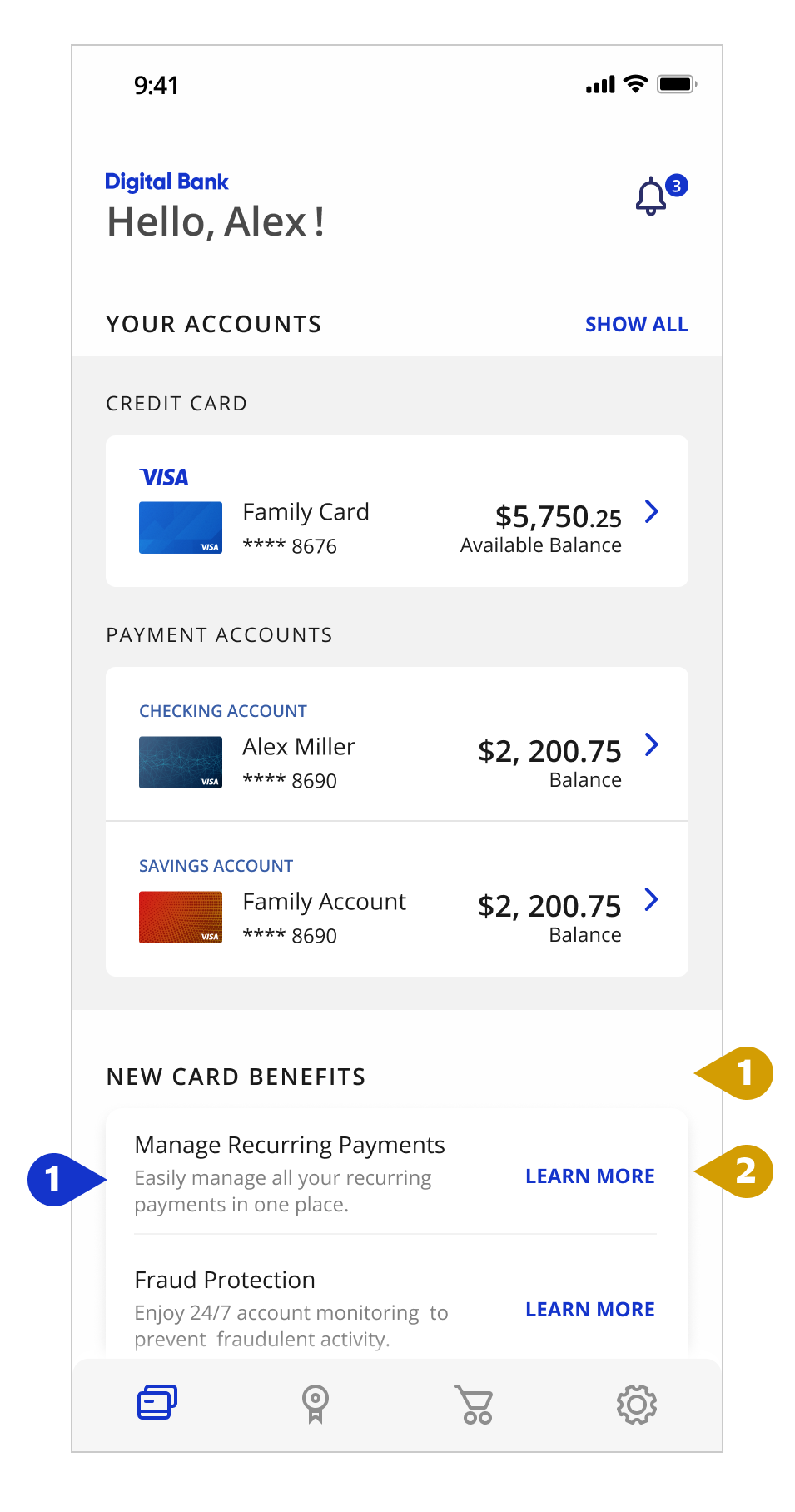

PAUSE PAYMENT - HOME SCREEN

| Tech Specs |

|

|

|

Account Home fields will be dynamically populated by issuers using internal data sources. | |

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

| Use key customer touch points, such as the Welcome screen, to alert cardholders to new features available to manage their finances – e.g., use a “New Card Benefits” promo to introduce cardholders to VSPS. | ||

| Provide cardholders an easy way to get more information about new services – e.g., link to a “Learn More” popup with more information about VSPS benefits to help drive enrollment. | ||

|

Tip: Use clear, simple calls to action, such as “Learn More.” Link to the content vs. using a button so cardholders understand this isn’t a step they need to complete. | |

PAUSE PAYMENT - ACCOUNT DETAILS

| Tech Specs |

|

|

|

Recent transactions are assumed to be available to the issuer internally. | |

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

| Offer multiple entry points for cardholders to access account management tools. | ||

| If the Account Details screen is the cardholder’s first interaction with recurring payments, include a “Learn More” link to provide an easy way to get answers to their questions about the feature to encourage engagement. | ||

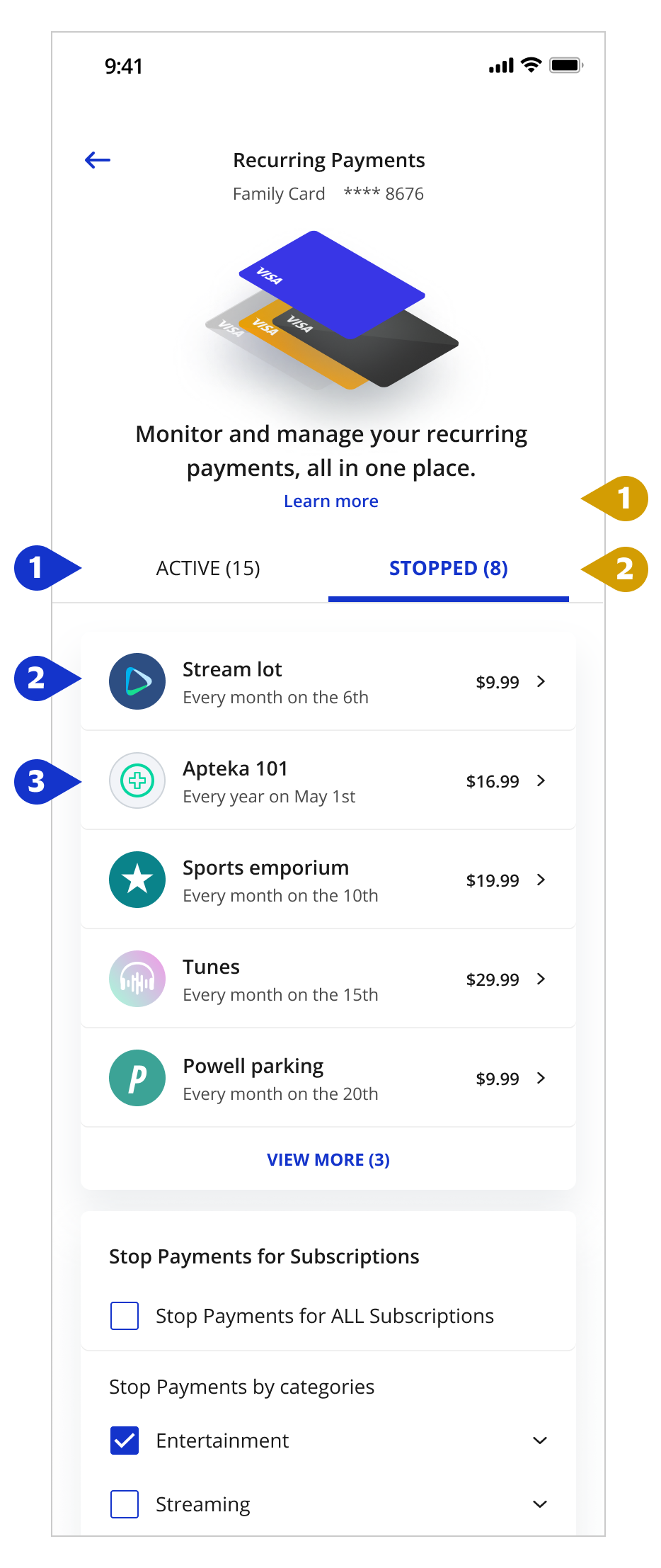

PAUSE PAYMENT - RECURRING PAYMENTS

| Tech Specs |

|

|

|

To distinguish between Active and Paused payments, use |

|

|

To get a list COF merchants where the PAN is used for recurring or installment type payments, use URL: /vsps/eligibleTransactions Field: merchantName |

|

To get payment date, use URL: /vsps/eligibleTransactions Request 180 days of data to determine the frequency |

||

| Tip: All transactions with stopInstructionType=MERCHANT returned by the Search API will be placed under the ‘Stopped’ section of the screen. Filter our these transactions from the results returned by the Eligible transaction search API to get a list of merchants to be displayed under the ‘Active’ section of the screen. Make sure you only select transaction with stopInstructionType=MERCHANT |

||

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

| “Learn more” aids cardholders in understanding how this feature can help them gain more visibility and control over their finances and encourage enrollment. | ||

| Clearly communicate the status of subscriptions so cardholders can easily distinguish between active and stopped subscriptions. | ||

PAUSE PAYMENT - TRANSACTION DETAILS

| Tech Specs |

|

|

|

To get transaction amount, use |

|

|

To get transaction type, use |

|

| Address is not provided by VSPS APIs. Issuers can get this info from transaction history or the COF API. | ||

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

| Have clear call outs for any action that the user needs to take to manage their payments. | ||

| Providing merchant contact information will encourage issuers to contact the merchant to report problems prior to stopping or pausing the payment. | ||

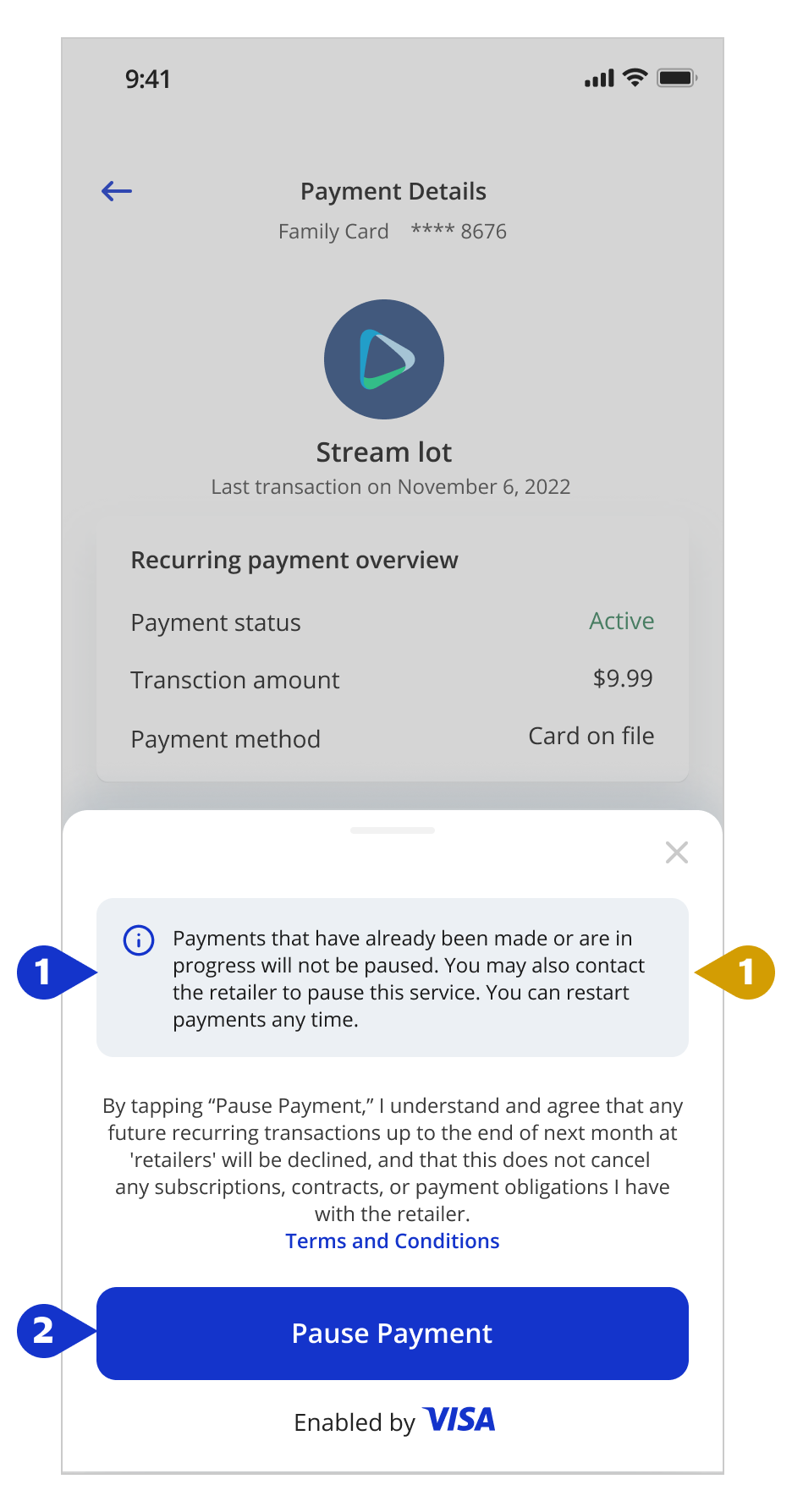

PAUSE PAYMENT - PAYMENT DETAILS

| Tech Specs |

|

|

|

Merchant logos are to be sourced internally by the issuer. | |

| To get the payment status and determine if the payment is active / paused use URL: /vsps/search Include the PAN If the response doesn't include the transaction being displayed, then the status can be assumed to be 'active'. This API returns all transactions that have been stopped on a PAN. |

||

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

| Include a “Learn More” link to provide an easy way to get answers to their questions about each of the options. | ||

| Clearly call out all all options available to the cardholder to manage payments. Also include additional information related to each of these options so cardholders clearly understand what each option will result in. | ||

|

Tip: Use clear, simple calls to action, such as “Learn More.” Link to the content vs. using a button so cardholders understand this isn’t a step they need to complete. | |

PAUSE PAYMENT - T&C

| Tech Specs |

|

|

|

All legal and information text to be hosted internally by the issuer. | |

To place a stop instruction (R1) use |

||

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

Clearly communicate that stopping recurring charges will only stop future charges to set cardholder expectations about how the feature works and reduce inquiries to the call center and customer dissatisfaction. Ensure cardholders understand that they should contact the merchant first to ensure the service / subscription is canceled or their payment concerns are addressed. |

||

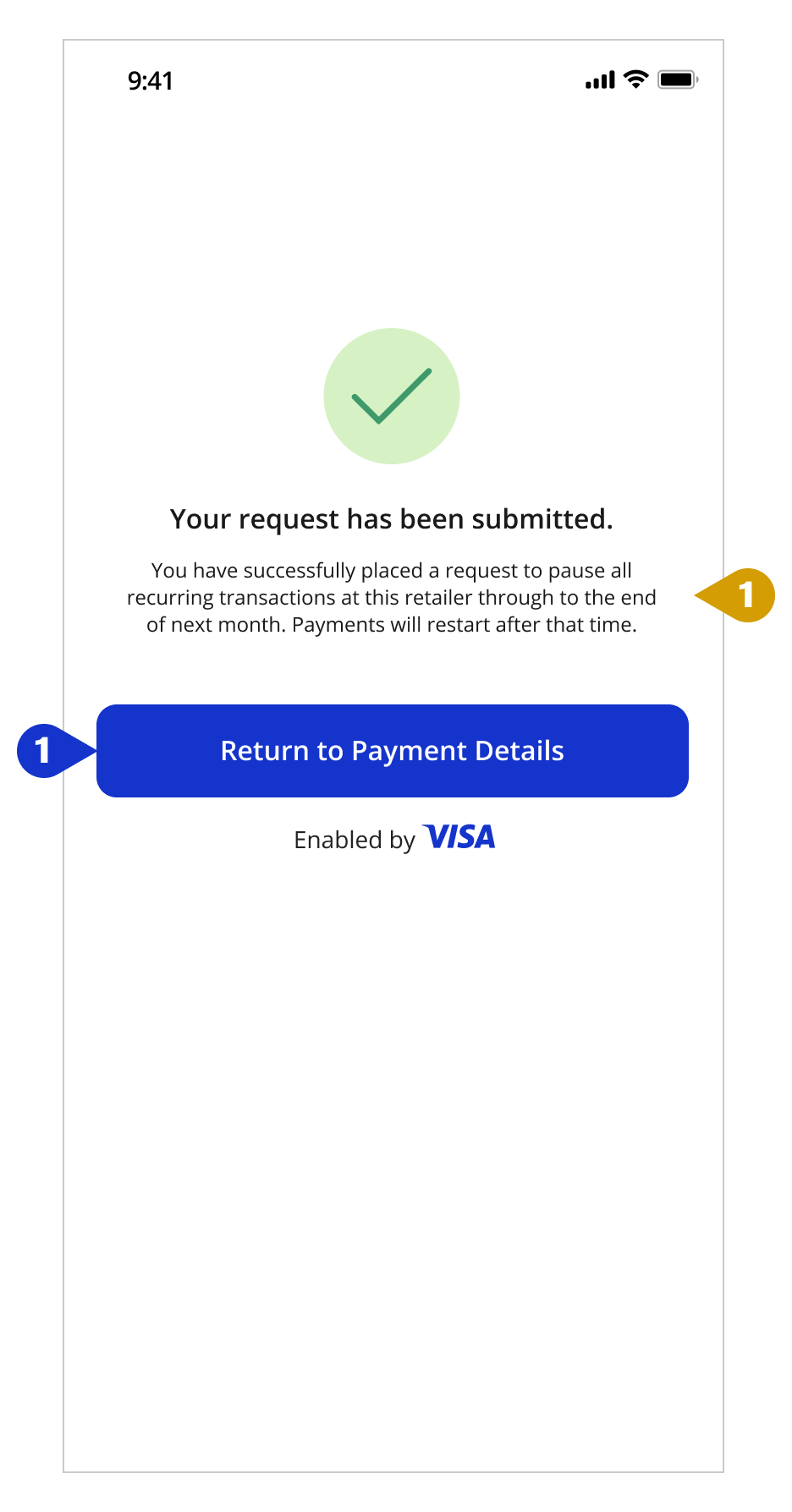

PAUSE PAYMENT - CONFIRMATION

| Tech Specs |

|

|

|

Once the Add Merchant API call is placed, a 200 or 400 response is returned along with stop instruction ID and details. A 200 response will also include the status of the request, which includes success (00), partial success (01) or fail (02). | |

| Please review the VSPS API reference for sample success and error responses. | ||

| UX Recommendations | ||

| Clearly communicate all settings associated with a stop to ensure cardholders understand and agree to the stop payment terms and reduce cardholder support inquiries. Create default stop settings for your organization. Providing too many customized options can overcomplicate the user flow and increase API calls if a cardholder sets a duration that is not long enough to block the recurring payment. |

||

| Tip: The VSPS default stop payment is 13 months. A good rule of thumb is to set the stop payment duration for monthly payments to 6 months and for yearly payments to 13 months. | ||

|

Tip: Use the auto cancel and auto extend features to ensure better customer experience and cost reduction. | |

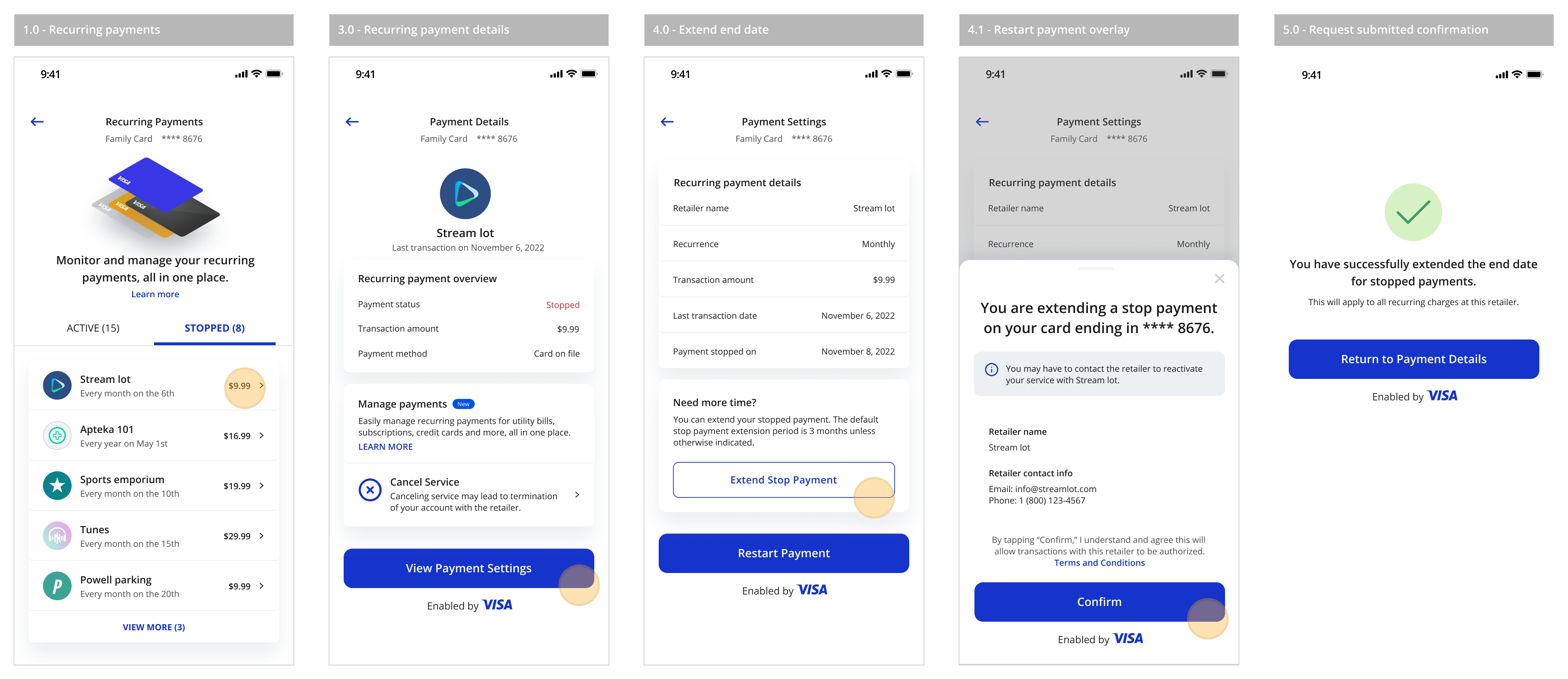

ACCOUNT MONITORING

In this user journey, the customer accesses the issuer mobile application with the intent to manage their recurring payments. They review all recurring transactions against a card categorized as active and stopped, and place a request to remove an active stop instruction so that they can restart the payment for a specific retailer. In some cases, issuers may also want provide customers the option to cancel an active retailer subscription through their issuer's mobile application. This would require issuer integration with other third party partner services that provide merchant cancellation services.

Restarting payments for a previously stopped subscription/service/membership

View all screens seen in this user flow here

Technical Specifications and User Experience Recommendations corresponding to each screen shown in the prototype is provided to help simplify implementation.

All user flows and messaging shown are for illustrative purposes only. They are not comprehensive and do not constitute legal or marketing advice or replace participant's own analysis.

RESTART PAYMENT - HOME SCREEN

| Tech Specs |

|

|

|

Account Home fields will be dynamically populated by issuers using internal data sources. | |

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

| Use key customer touch points, such as the Welcome screen, to alert cardholders to new features available to manage their finances – e.g., use a “New Card Benefits” promo to introduce cardholders to VSPS. | ||

| Provide cardholders an easy way to get more information about new services – e.g., link to a “Learn More” popup with more information about VSPS benefits to help drive enrollment. | ||

|

Tip: Use clear, simple calls to action, such as “Learn More.” Link to the content vs. using a button so cardholders understand this isn’t a step they need to complete. | |

RESTART PAYMENT - ACCOUNT DETAILS

| Tech Specs |

|

|

|

Recent transactions are assumed to be available to the issuer internally. | |

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

| Offer multiple entry points for cardholders to access account management tools. | ||

| If the Account Details screen is the cardholder’s first interaction with recurring payments, include a “Learn More” link to provide an easy way to get answers to their questions about the feature to encourage engagement. | ||

RESTART PAYMENT - RECURRENT PAYMENTS

| Tech Specs |

|

|

|

To distinguish between Active and Stopped payments, use |

|

|

To get a list COF merchants where the PAN is used for recurring or installment type payments, use |

|

To get payment date, use URL: /vsps/eligibleTransactions Request 180 days of data to determine the frequency

|

||

To get transaction amount, use |

||

| ll transactions with stopInstructionType=MERCHANT returned by the Search API will be placed under the ‘Stopped’ section of the screen. Filter our these transactions from the results returned by the Eligible transaction search API to get a list of merchants to be displayed under the ‘Active’ section of the screen. Make sure you only select transaction with stopInstructionType=MERCHANT | ||

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

| “Learn more” aids cardholders in understanding how this feature can help them gain more visibility and control over their finances and encourage enrollment. | ||

| Clearly communicate the status of subscriptions so cardholders can easily distinguish between active and stopped subscriptions. | ||

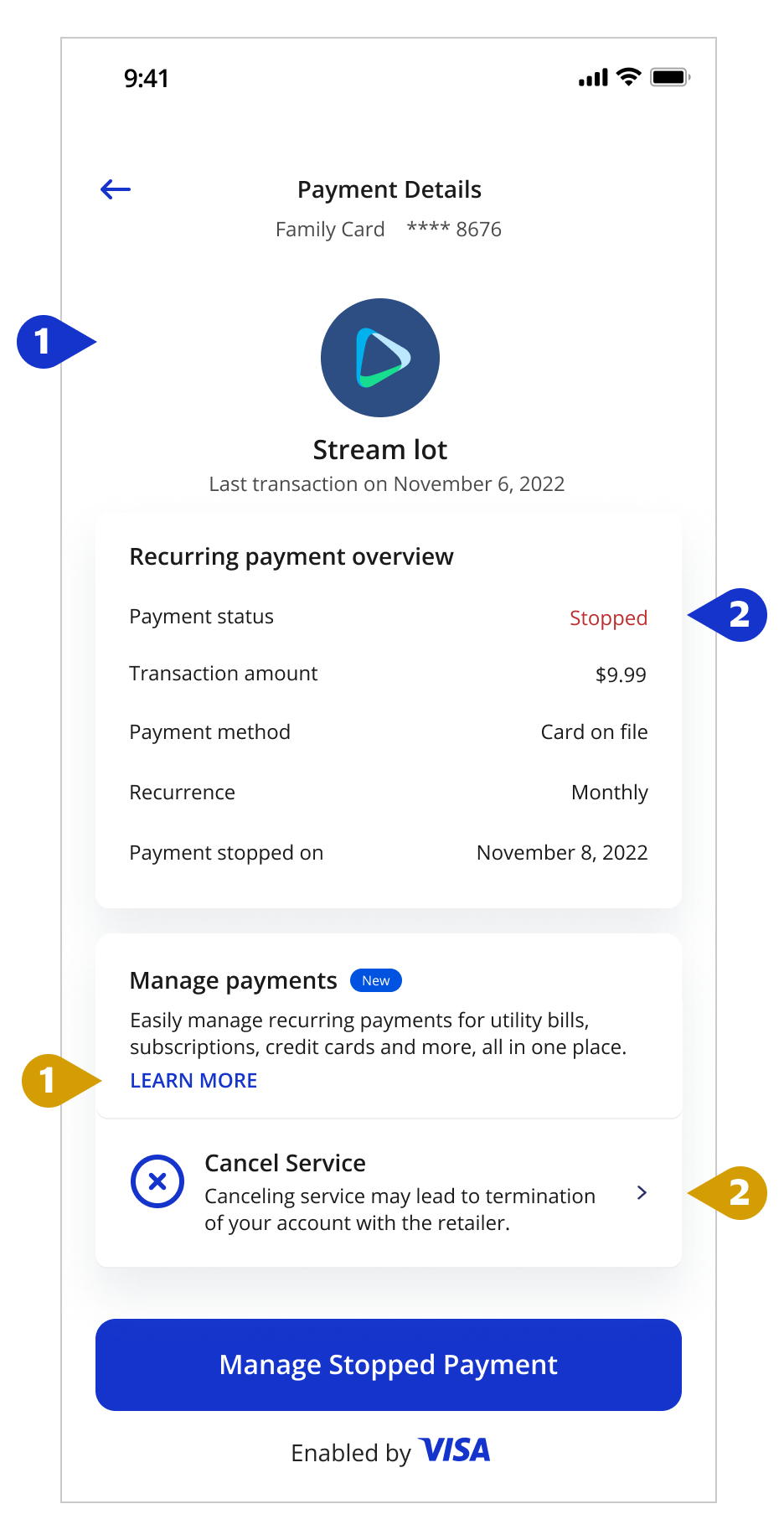

RESTART PAYMENT - PAYMENT DETAILS

| Tech Specs |

|

|

|

Merchant logos are to be sourced internally by the issuer. | |

|

Select all transactions returned in from the VSPS Search API with field "stopInstructionType": "MERCHANT" to get a list of stopped transactions. |

||

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

| Include a “Learn More” link to provide an easy way to get answers to their questions about each of the options. | ||

| Clearly call out all all options available to the cardholder to manage payments. Also include additional information related to each of these options so cardholders clearly understand what each option will result in. | ||

|

Tip: Use clear, simple calls to action, such as “Learn More.” Link to the content vs. using a button so cardholders understand this isn’t a step they need to complete. | |

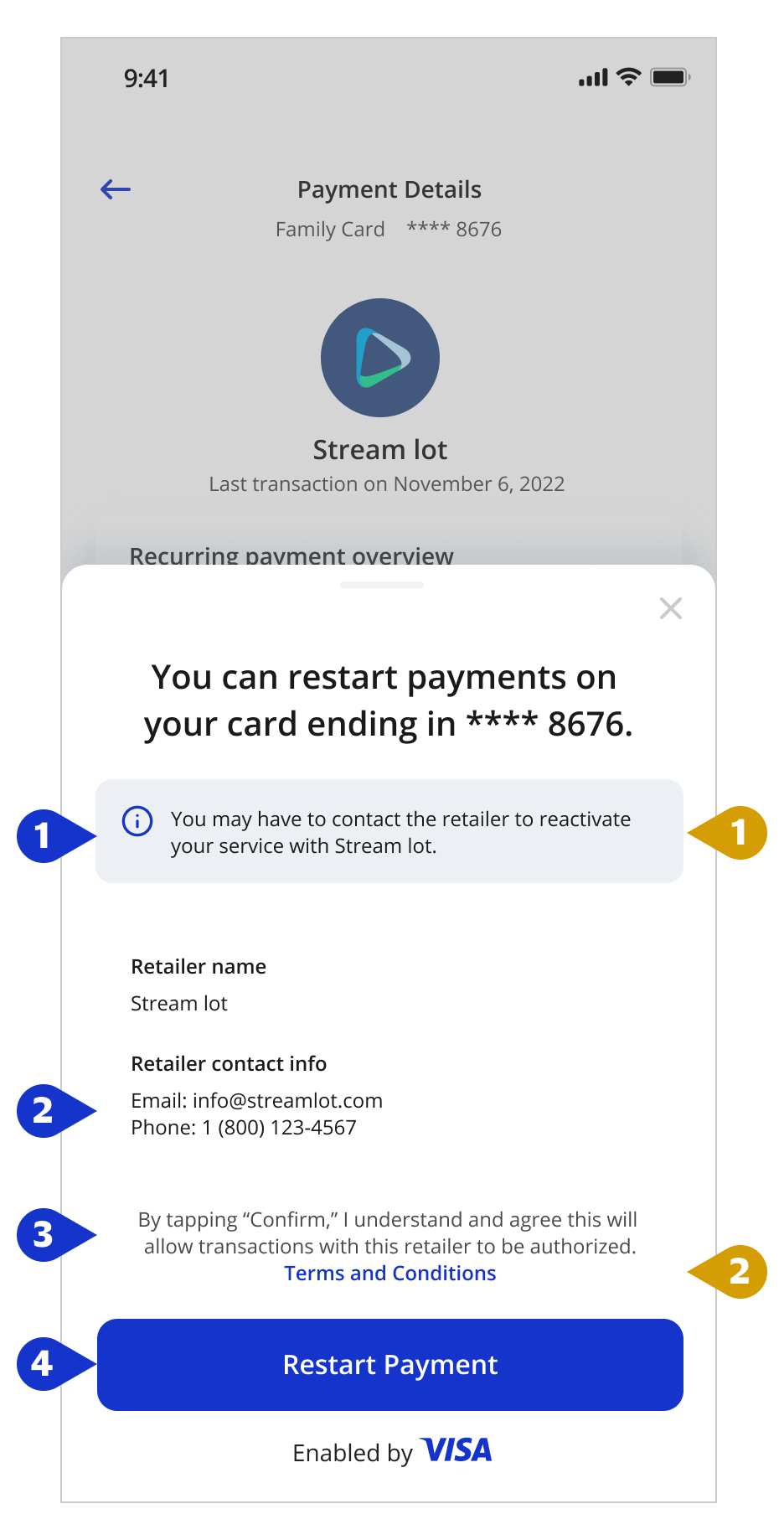

RESTART PAYMENT - T&C

| Tech Specs |

|

|

|

All legal and information text to be hosted internally by the issuer. |

|

|

Not provided by VSPS. Issuers can get this info from transaction history or the COF API. | |

|

URL: 1) /vsps/search to get stop instruction ID from field "stopInstructionId". 2) /vsps/cancel to cancel the stop instruction using the stop instruction Id Use the Linked Stop API to retrieve any active stop instruction created by the VAU-VSPS linking feature. |

|

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

Clearly communicate that stopping recurring charges will only stop future charges to set cardholder expectations about how the feature works and reduce inquiries to the call center and customer dissatisfaction.

|

||

|

Ensure cardholders understand that they should contact the merchant first to ensure the service / subscription is canceled or their payment concerns are addressed. |

|

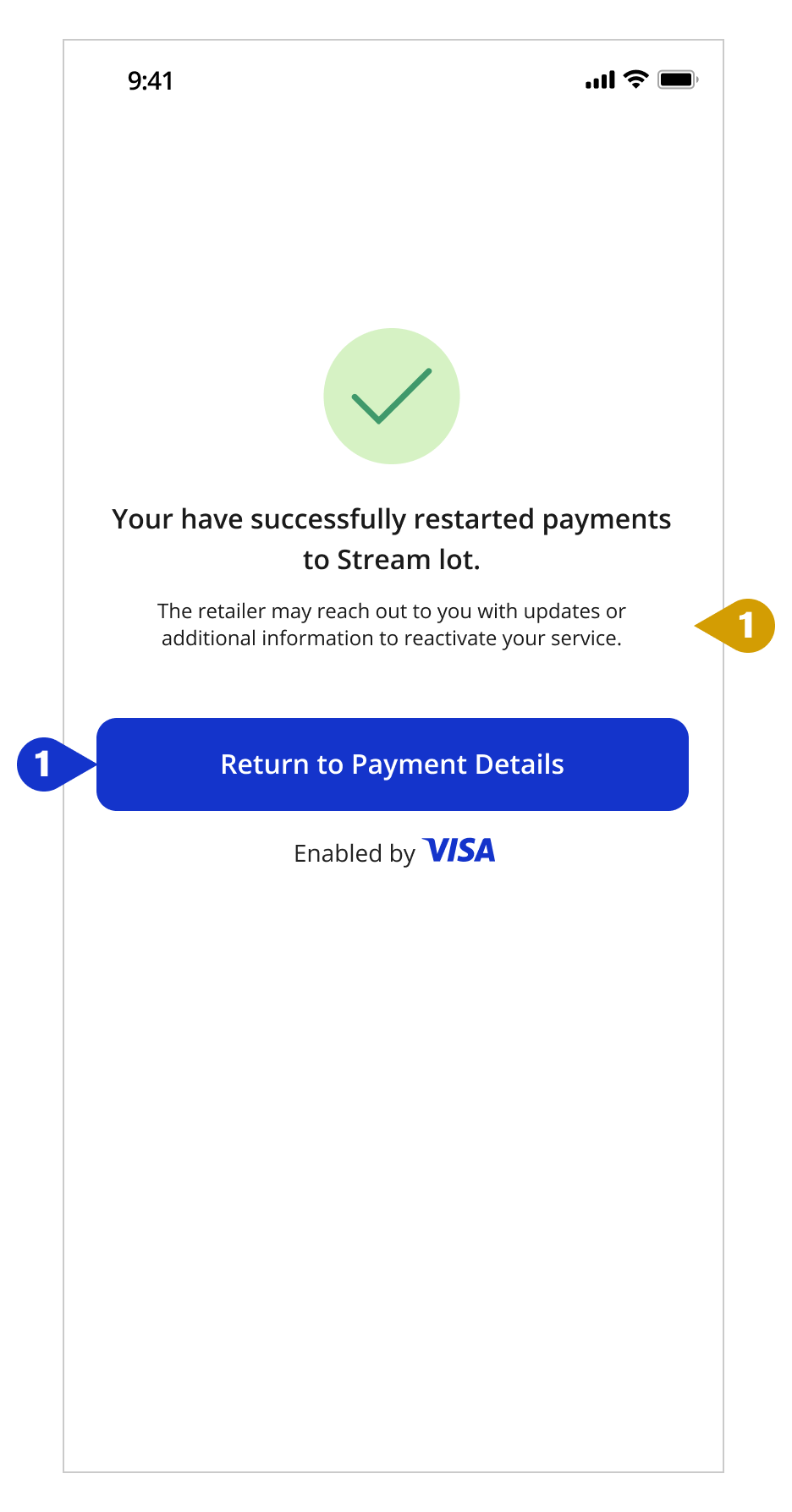

RESTART PAYMENT - CONFIRMATION

| Tech Specs |

|

|

|

Once the Cancel API call is placed, a 200 or 400 response is returned along with stop instruction ID and details. A 200 response will also include the status of the request, which includes success (00), partial success (01) or fail (02). A 400 response will include an error code along with the reason for failure. | |

| Please review the VSPS API reference for sample success and error messages. | ||

| UX Recommendations | ||

| Clearly communicate that it may require interactions between the merchant and cardholder to have the service reactivated. The issuer will not work with the retailer to handle any contracts or terms with the retailer. | ||

RESTART PAYMENT - ADDITIONAL MESSAGING TO AVOID MISUSE

| Additional Recommendation |

|

|

|

Capture customer behavior patterns to make sure cardholders are not misusing the service to get out of payment obligations. | |

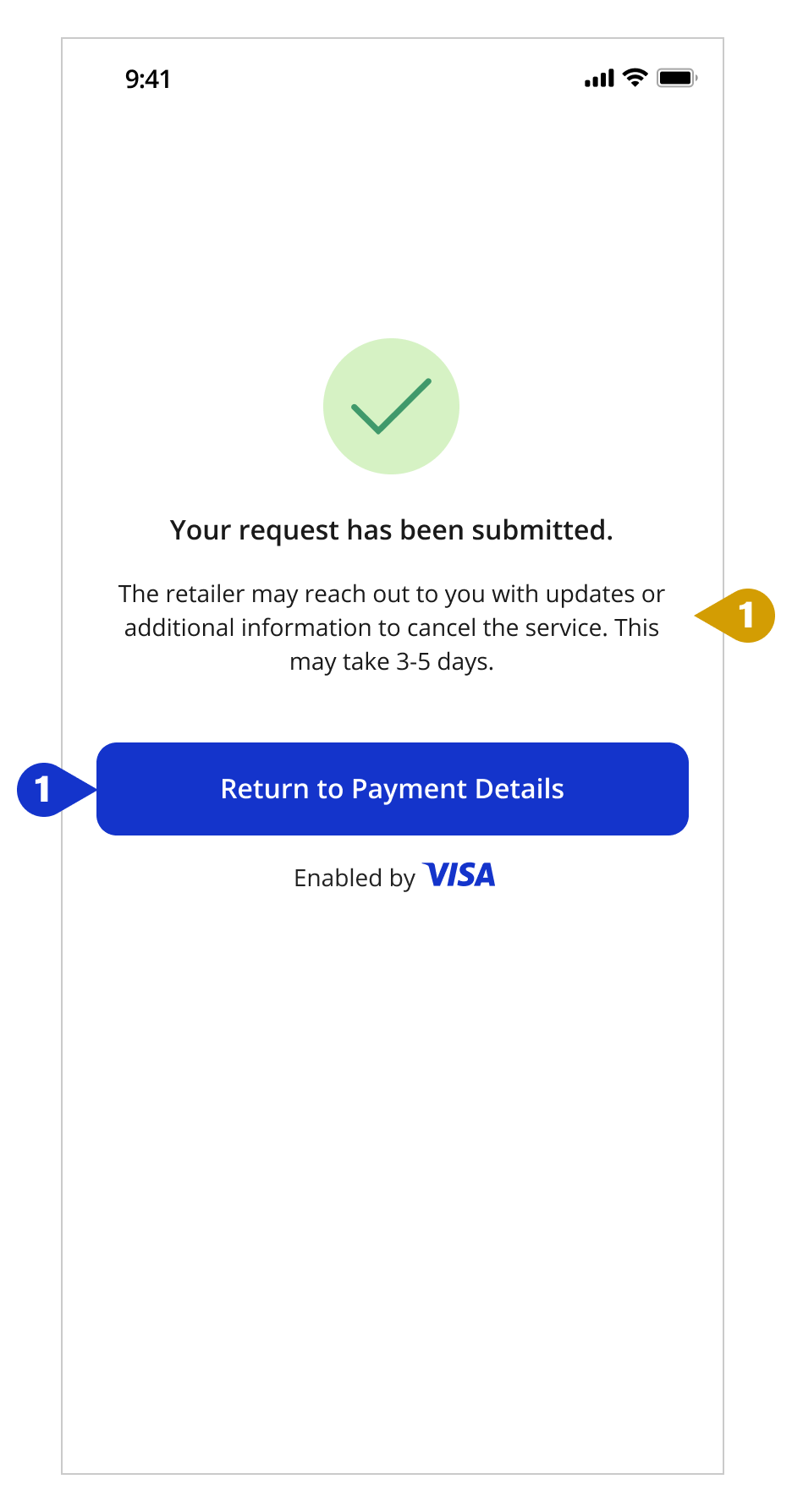

Cancel an active service/subscription using a third party service

Experience for cardholders who wish to cancel a service they no longer need or who are challenged by difficult, non-responsive retailers. Once the service is canceled, clients might not expect to be able to restart their service through their issuer (based on preferences of participants in Visa user testing study of 2022). Issuers may want to consider working with third party services that provide merchant contract cancellation services.

Technical Specifications and User Experience Recommendations corresponding to each screen shown in the prototype is provided to help simplify implementation.

All user flows and messaging shown are for illustrative purposes only. They are not comprehensive and do not constitute legal or marketing advice or replace participant's own analysis.

CANCEL SERVICE - HOME SCREEN

| Tech Specs |

|

|

|

Account Home fields will be dynamically populated by issuers using internal data sources. | |

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

| Use key customer touch points, such as the Welcome screen, to alert cardholders to new features available to manage their finances – e.g., use a “New Card Benefits” promo to introduce cardholders to VSPS. | ||

| Provide cardholders an easy way to get more information about new services – e.g., link to a “Learn More” popup with more information about VSPS benefits to help drive enrollment. | ||

|

Tip: Use clear, simple calls to action, such as “Learn More.” Link to the content vs. using a button so cardholders understand this isn’t a step they need to complete. | |

CANCEL SERVICE - ACCOUNT DETAILS

| Tech Specs |

|

|

|

Recent transactions are assumed to be available to the issuer internally. | |

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

| Offer multiple entry points for cardholders to access account management tools. | ||

| If the Account Details screen is the cardholder’s first interaction with recurring payments, include a “Learn More” link to provide an easy way to get answers to their questions about the feature to encourage engagement. | ||

CANCEL SERVICE - RECURRING PAYMENTS

| Tech Specs |

|

|

|

To distinguish between Active and Stopped payments, use |

|

|

To get a list COF merchants where the PAN is used for recurring or installment type payments, use |

|

To get payment date, use URL: /vsps/eligibleTransactions Request 180 days of data to determine the frequency |

||

| Tip: All transactions with stopInstructionType=MERCHANT returned by the Search API will be placed under the ‘Stopped’ section of the screen. Filter our these transactions from the results returned by the Eligible transaction search API to get a list of merchants to be displayed under the ‘Active’ section of the screen. Make sure you only select transaction with stopInstructionType=MERCHANT |

||

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

| “Learn more” aids cardholders in understanding how this feature can help them gain more visibility and control over their finances and encourage enrollment. | ||

| Clearly communicate the status of subscriptions so cardholders can easily distinguish between active and stopped subscriptions. | ||

CANCEL SERVICE - TRANSACTION DETAILS

| Tech Specs |

|

|

|

To get transaction amount, use URL: /vsps/eligibleTransactions Field: transactionAmount |

|

|

To get transaction type, use Field: transactionType": "Recurring |

|

| Address is not provided by VSPS APIs. Issuers can get this info from transaction history or the COF API. | ||

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

| Have clear call outs for any action that the user needs to take to manage their payments. | ||

| Providing merchant contact information will encourage issuers to contact the merchant to report problems prior to stopping or pausing the payment. | ||

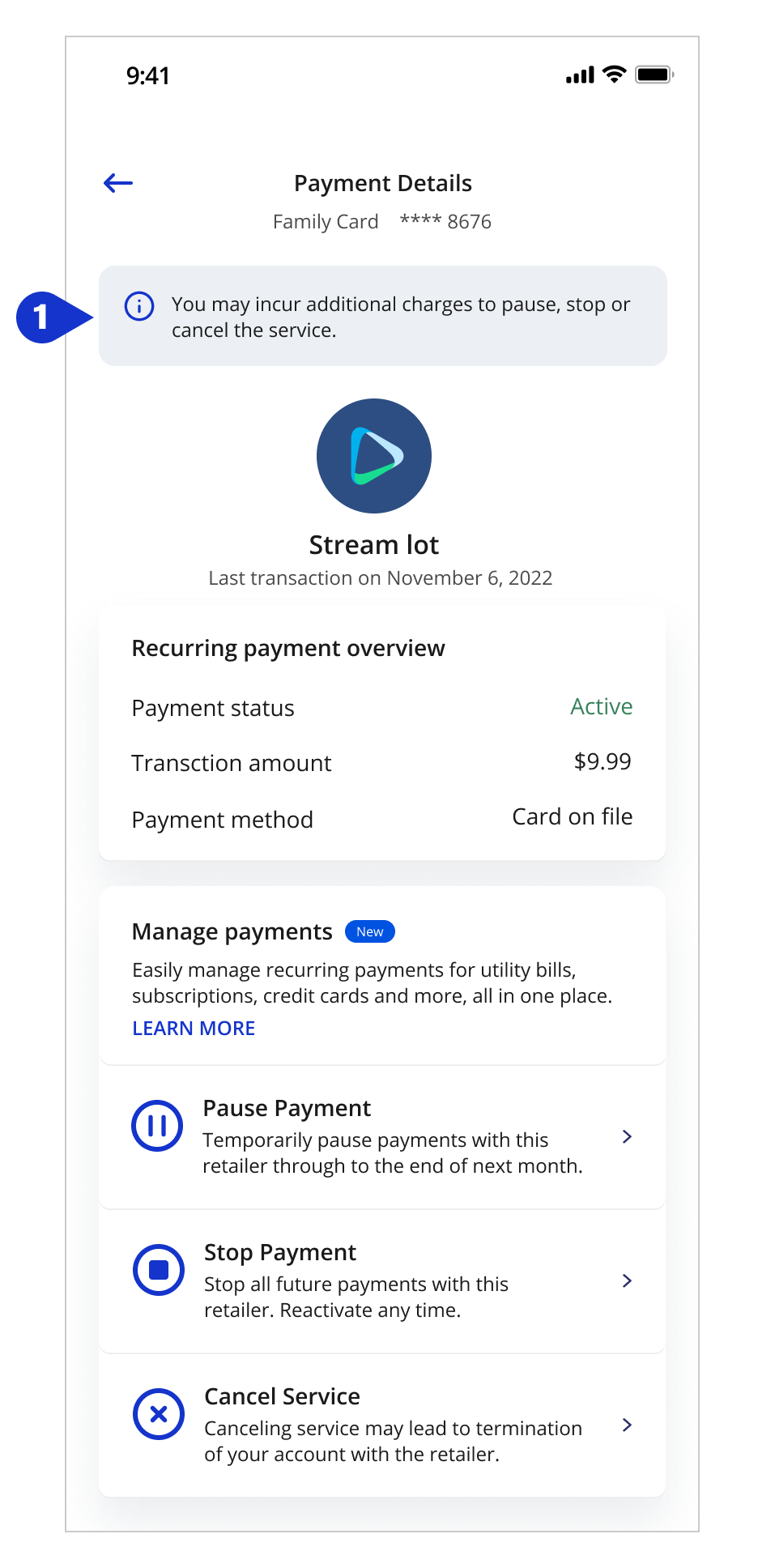

CANCEL SERVICE - PAYMENT DETAILS

| Tech Specs |

|

|

| Merchant logos are to be sourced internally by the issuer. | ||

| To get the payment status and determine if the payment is active / paused use URL: /vsps/search Include the PAN If the response doesn't include the transaction being displayed, then the status can be assumed to be 'active'. This API returns all transactions that have been stopped on a PAN. |

||

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

| Include a “Learn More” link to provide an easy way to get answers to their questions about each of the options. | ||

| Clearly call out all all options available to the cardholder to manage payments. Also include additional information related to each of these options so cardholders clearly understand what each option will result in. | ||

|

Tip: Use clear, simple calls to action, such as “Learn More.” Link to the content vs. using a button so cardholders understand this isn’t a step they need to complete. | |

CANCEL PAYMENT - T&C

| Tech Specs | |

|

|

All legal and information text to be hosted internally by the issuer. | |

To cancel a stop instruction/s (R1) use To retrieve the Stop Instruction Id to provide as input in the Cancel API, use URL: vsps/search To get a list of associated Stop Instruction Ids (Stop IDs created on the CAID and merchant name), use the Linked Stop API. URL: vsps/linked This will retrieve a list of stop Instructions associated with the transaction. |

||

| Please review the VSPS API reference for sample API requests and responses. | ||

| UX Recommendations | ||

Clearly communicate that canceling the service will only ensure that future payment requests from the merchant are stopped and will not automatically cancel any existing contracts or interrupt the service. |

||

| Clearly communicate canceling of the contract or service is handled by a third party service, and that cardholder information may be shared with the third party. Ensure all issuer and vendor terms and conditions are clearly visible and accepted by the user. | ||

CANCEL PAYMENT - CONFIRMATION

| Tech Specs |

|

|

|

Once the Add Merchant API call is placed, a 200 or 400 response is returned along with stop instruction ID and details. A 200 response will also include the status of the request, which includes success (00), partial success (01) or fail (02). | |

| Please review the VSPS API reference for sample success and error responses. | ||

| UX Recommendations | ||

| Set clear expectations around the time it may take for any subscription contracts or terms to be canceled, and that it may require interactions between the merchant and cardholder. | ||

| Tip: The VSPS default stop payment is 13 months. A good rule of thumb is to set the stop payment duration for monthly payments to 6 months and for yearly payments to 13 months. | ||

|

Tip: Use the auto cancel and auto extend features to ensure better customer experience and cost reduction. | |

Proactive Notifications

Experience for cardholders who wish to receive account notifications on their bank’s mobile app about recurring payment updates, and take appropriate action. The sample experience below shows how cardholders can extend the duration of a stop payment instruction that they had previously set up. This experience is only applicable for issuers who have chosen to provide additional information control and flexibility to their cardholders. For example, communicating the end date of a stop instruction, allowing the set up of stop instructions for a spefic amount or range, etc.

Use the Extend Stop Instruction API to extend the duration of a stop instruction. To check if the stop instruction had other linked stop instructions created by VAU, use the Linked API to get the stop Id of the VAU created stop instrcution, pass the value in the Extend API.

URL for Extend API: /vsps/extend

URL for Linked API: /vsps/linked, field: stopInstructionId

All user flows and messaging shown are for illustrative purposes only. They are not comprehensive and do not constitute legal or marketing advice or replace participant's own analysis.

Additional Mobile User Experiences

This section covers additional use cases on top of the core end- to- end experiences.

Pausing/ Stopping all recurring payments on a PAN or for a Merchant Category Code (MCC)

Issuers can opt to provide additional types of experiences that allow cardholders to stop payments against a PAN or a Merchant Category Code (MCC). An example of a PAN level stop instruction would be a cardholder or issuer stopping transctions on a PAN with insufficient funds, irrespective of the retailer placing the authorization request or clearing message.

An example of an MCC level stop instruction may be a cardholder placing a stop instruction on all gambling retailers.

URL for PAN level stop instructions - /vsps/add/pan

URL for MCC level stop instructions - /vsps/add/mcc

All user flows and messaging shown are for illustrative purposes only. They are not comprehensive and do not constitute legal or marketing advice or replace participant's own analysis.

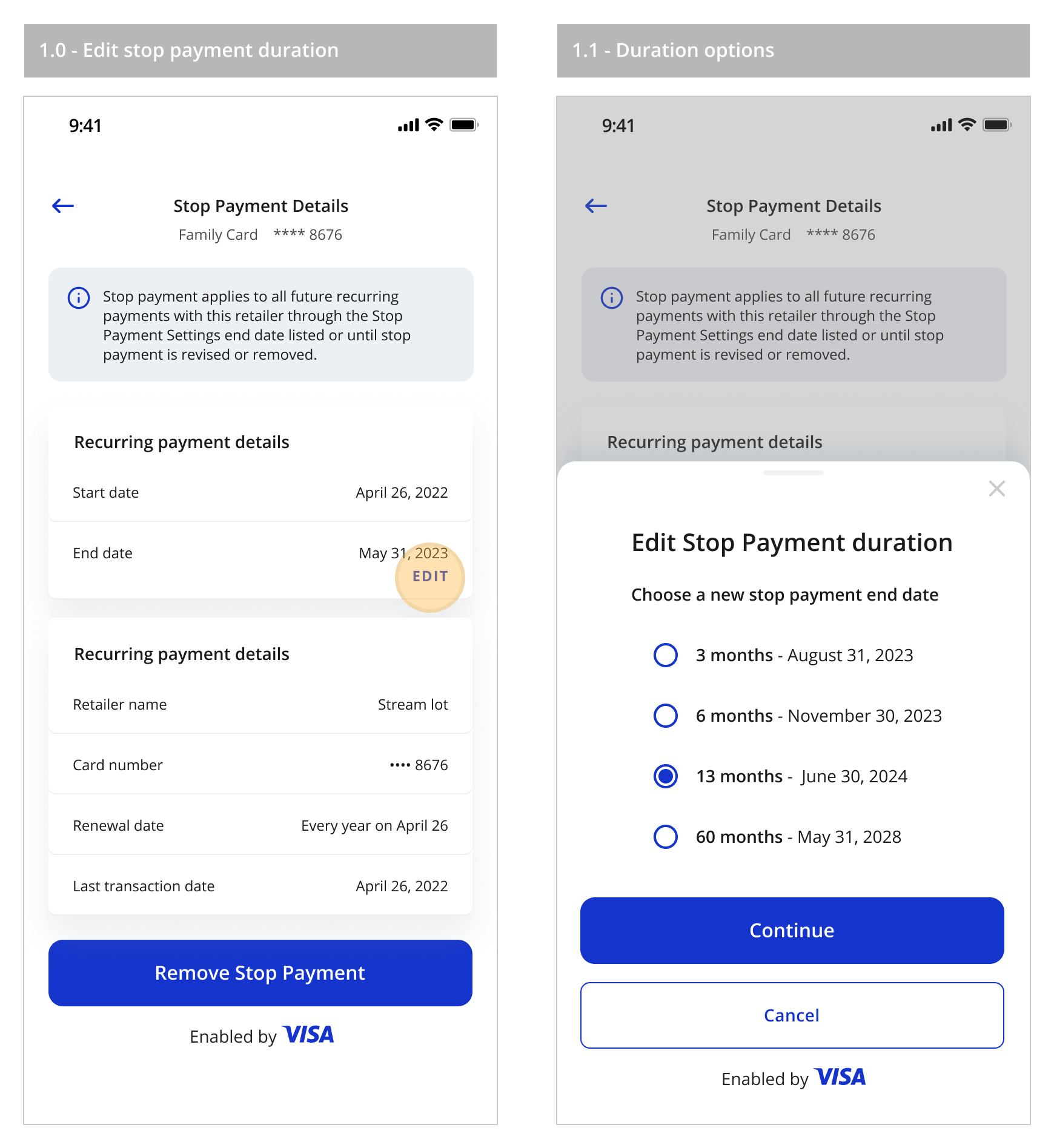

Allowing cardholders to select the stop duration

The following screens show how issuers can allow cardholders to choose the duration of the stop payment. This is not a recommended experience as cardholders may not be accurately educated on the merchant's authorozation pattern or practices, which may lead to unwanted transactions not being accurately stopped.

Use the Extend Stop Instruction API to extend the duration of a stop instruction. To check if the stop instruction had other linked stop instructions created by VAU, use the Linked API to get the stop Id of the VAU created stop instrcution, pass the value in the Extend API.

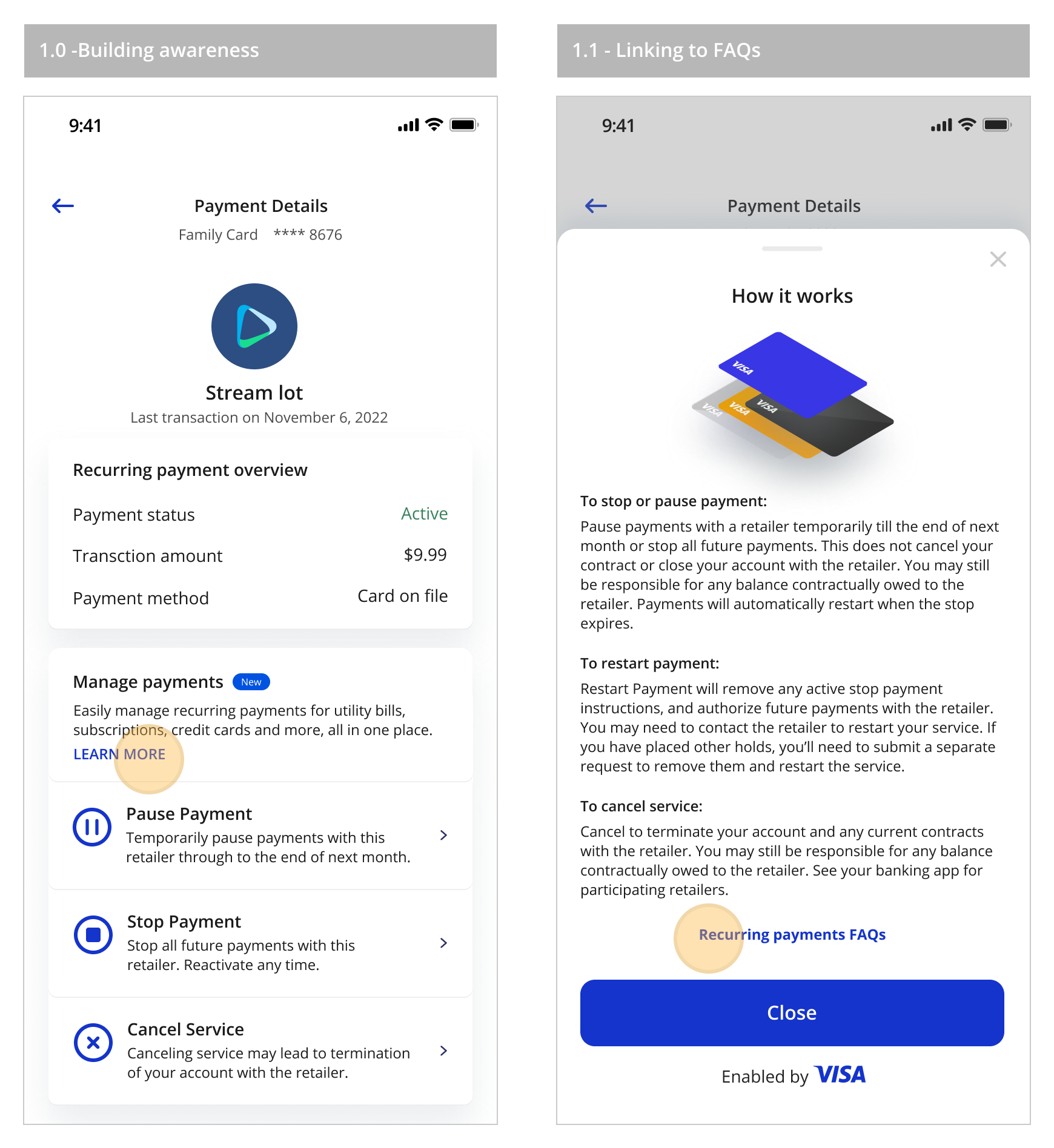

Informational Messaging

The following user experience screens contain messaging to communicate the value of VSPS and how it works. It is important to build awareness and understanding of stop payment capabilties available within the issuer's mobile application. Issuers can provide additional information about the service using a “Learn More” overlay. You can also include recurring payment guidelines on the “Recurring Payment Details” screen to help cardholders understand how to pause / stop a recurring payment, extend a stop payment or restart a stopped payment. Additionally, you can provide cardholders with information about the stop payment service to help increase cardholder satisfaction and engagement and reduce the issuer’s cardholder support volume. All informational messaging will be owned and internally hosted by the issuer.

All user flows and messaging shown are for illustrative purposes only. They are not comprehensive and do not constitute legal or marketing advice or replace participant's own analysis.

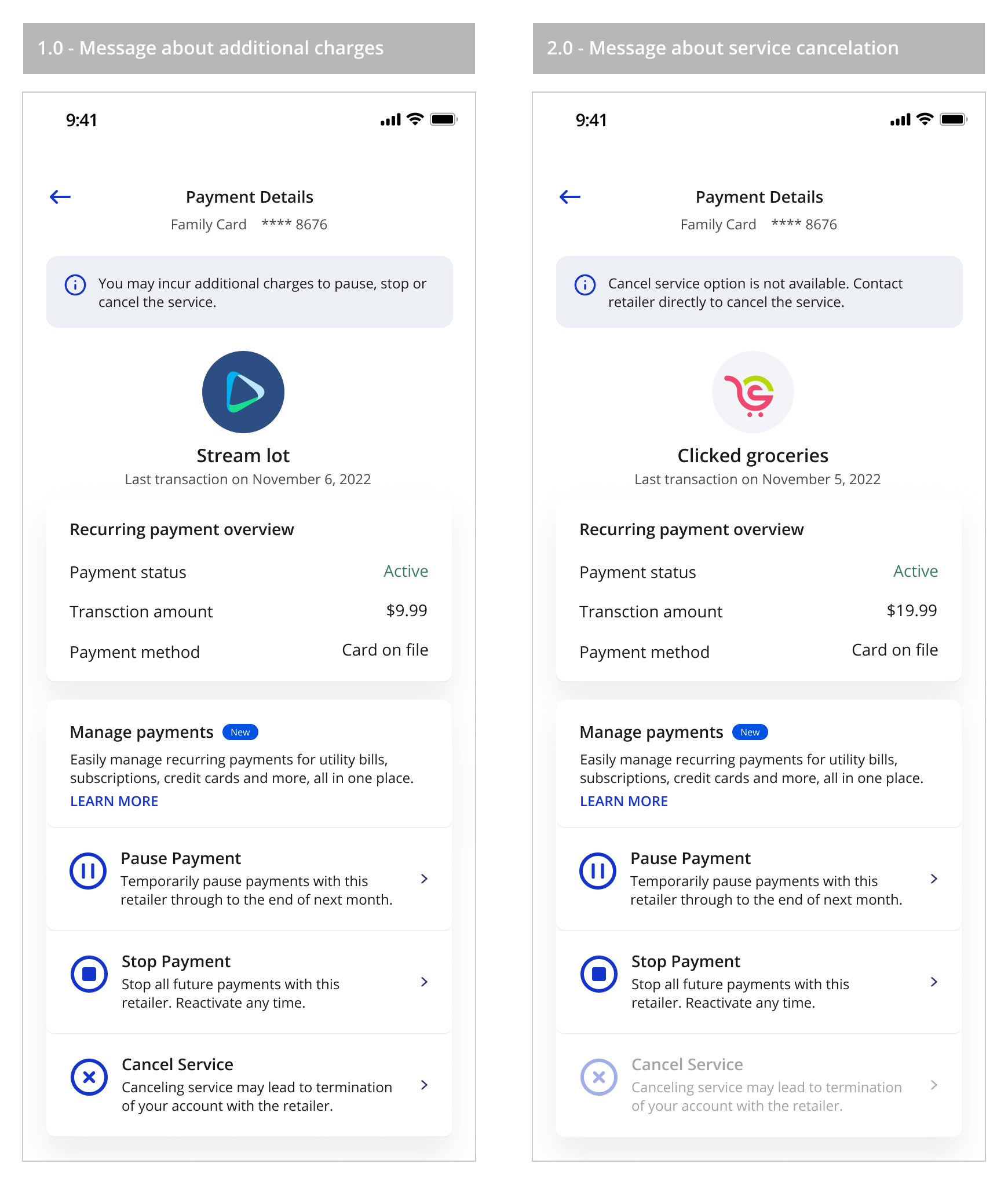

Contextual messaging

Use contextual messaging to share important information at different stages of the user journey to ensure cardholders understand the results of their stop payment choices. For example, screen 1.0 below explains that frequent use of the service at the same retailer could result in charges to discourage cardholders from misusing the service. Issuers may also use notifications at the top of the screen to make it easy to help cardholders understand limitations. Not all retailers offer the same service management options. Informing cardholders up front that a certain option isn’t available will reduce frustration.

All user flows and messaging shown are for illustrative purposes only. They are not comprehensive and do not constitute legal or marketing advice or replace participant's own analysis.

Implementation Best Practices

Create stop instructions with precision

The number of unwanted transactions stopped depends on the quality of transaction data, specifically merchant details, and stop instructions placed. Follow these best practices to create stop instructions that can help optimize performance and cost.

- Choose the merchant identifiers from the most recent authorization transaction. Check previous authorizations and associated clearing transactions for additional variations and consider also using those identifiers to maximize stop performance. (Note: Individual stop instructions will be created for every variation.)

- Use merchant identifiers and other parameters, if applicable, from prior transactions for the account in question.

- Use all available merchant identifiers (name plus CAID, or PFID/SMID if present) .

- Set the “recurring and installment indicator” to “true” if you want to only stop recurring payments. If you want all eligible transactions at the merchant to be stopped, do not set this indicator to “true.”

- The more specific your instruction is, the fewer transactions are stopped. For example, if you set the transaction amount to $25.99, this will stop all transactions for that exact amount (irrespective of the subscription type or future price changes) while allowing all other transactions to pass through.

- Subscribe to VSPS-VAU linking to help make sure a cardholder’s account remains protected after a card/account is replaced .

- Use the “additional notes” field to record information, such as case number, that may help later during audit or updates. Do not add PAN-data to this field.

Display recurring and installment payments only

This helps prevent cardholders from blocking single payments, which increases issuer costs and can cause acceptance problems for the merchant/cardholder.

- To ensure only recurring transactions are stopped and all other transactions are processed, select the “recurring and installment transaction only” indicator while triggering the eligible transactions API.

Benefit from cost-control features

- In addition to using VSPS’s proactive mechanisms to prevent duplicate stop instructions from being created, you can also use automatic cost-control features to improve performance and reduce service costs.

- Make use of the auto-extend setting for your VSPS subscription. The VSPS system will automatically extend the end date of a stop instruction if the merchant continues trying to take payment. This can prevent the cardholder's account from becoming debited again and necessitate the processing of subsequent chargebacks.

- Apply the auto-cancel setting for your VSPS subscription. The VSPS system will automatically cancel stop instructions that have never stopped a payment after a set period. This helps control long-term stop instruction fees.

Additional Legal Terms

Visa does not provide legal, regulatory, tax or financial advice. Each client is fully responsible for ensuring that its program operates in compliance with applicable legal and regulatory requirements and is responsible for conducting independent legal and regulatory reviews through its legal counsel. The best practices, recommendations and sample user interfaces herein, including any sample legal language therein, are provided for informational purposes, non-comprehensive, illustrative and provided for reference only. They are neither mandatory, nor should they be relied upon for marketing, legal, regulatory or other advice. Each client needs to conduct its own independent analysis in light of its specific business needs and any applicable laws and regulations. Visa is not responsible for your use of any of the information herein, including errors of any kind.

Benefits are illustrative only and depend on implementation details and business factors.

Without limiting any other VSPS requirement as set forth in the Visa Rules, usage of VSPS does not remove any obligation of the cardholder to meet payment terms or any other agreement with the merchant, including but not limited to informing the merchant the cardholder wishes to cancel the respective service. Clients that wish to use third party services in order to provide cancellation services to their cardholders do so at their own risk. Visa does not have insight into the operations of such third party providers and disclaims any and all liability or responsibility in that regard. |