Acquirers review their merchant relationships to determine which merchants are eligible to participate in Visa Account Updater (VAU).

Certain categories of merchants are excluded from participation; for a list of excluded merchant types, see the VAU Terms of Use.

When using VAU, acquirers can:

Acquirers review each merchant’s business model to determine the best time to submit inquiries to VAU. Merchants that bill monthly for recurring payments submit daily files for all accounts scheduled to be billed in the next three or four days. Merchants that bill less frequently, like an insurance company that bills accounts quarterly, may submit an inquiry for their entire credential-on-file (COF) portfolio when they first join VAU and then every three months.

When submitting requests for information, these requirements apply:

Acquirers receive updated information for accounts that have been changed during the past 730 calendar days (24 months).

This figure illustrates the acquirer batch file process flow:

These steps detail the typical VAU acquirer submission file process:

For sample reports, see the Visa Account Updater Reports Reference Guide on Visa Access.

Acquirers must send PANs only to the merchant or third-party processor them. Acquirers must not send a PAN to a merchant that did not provide the full PAN and only has an encrypted or partial PAN.

If an acquirer receives PANs from a merchant’s third-party processor, the acquirer may provide the merchant’s third-party processor with the PANs.

The Visa Account Updater (VAU) Acquirer API enables participating acquirers to access updated account credentials for their enrolled credential-on-file (COF) merchants. This API is an optional service that supplements the VAU batch file process and Real Time VAU.

This API streamlines the inquiry process and reduces the time for merchants to receive responses from days to seconds compared to the batch file process. The API supports reissuance operations similar to the batch file inquiry process, including updates for portfolio conversions from other payment networks.

This API supports single primary account number (PAN) inquiries but can include 100 PANs per API call.

To protect privacy and prevent accidental inquiries from multiple business entities or business identifiers (BIDs), this API supports only one business entity or BID per project and multiple segments. If you have multiple BIDs, create a separate project for each BID and segment. This approach aligns with the batch inquiry process.

The maximum transactions per second (TPS) for this API is 25 per concurrent calls.

Additionally, this API:

This API is available for testing in the Visa Developer Center (VDC). Test cases in the VDC sandbox environment include sample PANs that do not pass Luhn’s (Mod-10) validation. If testing outside the sandbox, turn off the Luhn’s (Mod-10) validation check when using these PANs.

Standard use of the VAU Acquirer API follows these steps:

VAU responds to Visa with issuer updates or returns appropriate error messages.

Real Time VAU is an optional feature in VisaNet that adds supplementary account updates to VisaNet messages for credential-on-file (COF) transactions.

Real Time VAU enables real-time updates, which helps merchants reduce declines and improves the cardholder experience. With Real Time VAU, the pre-authorization step required in the traditional Visa Account Updater (VAU) flow is not needed, which removes the time gap between when merchants request account updates and when they submit authorization requests.

Real Time VAU is best suited for routine updates and helps keep COF data current for eligible Visa transactions.

Real Time VAU supports only Visa updates and brand conversions. It does not support non-Visa primary account numbers (PANs). The service is available for recurring and COF transactions, as well as for account funding transactions (AFTs) and original credit transactions (OCTs) for participating endpoints.

Real Time VAU is supported by Interlink and Plus (ATM) networks for Visa Direct transactions. It can also support transactions that originate and are received on VisaNet, Interlink, and Plus (ATM), including overlapping use cases.

Participating acquirers must be able to send and receive new fields and values in eligible VisaNet transactions and purchase messages, Visa Direct, and person-to-person (P2P) transactions. Acquirers must use the replacement account information for all subsequent processing, including clearings, reversals, and exception or dispute processing. Testing and activation are required to implement Real Time VAU.

Issuers that participate in VAU and Real Time VAU may receive a new PAN replacement status indicator tag and values in authorization and purchase request messages when a replacement event occurs. Activation is required to receive this indicator. For more information, see the Visa Account Updater Client Implementation Guide on Visa Access.

This figure illustrates the Real Time VAU process:

The Real Time VAU process occurs in these steps:

The transaction must be card-not-present (CNP), recurring, a merchandise return, or use Visa Direct. Real Time VAU will not work on card-present transactions or CVV2.

For more information, see the Visa Account Updater Client Implementation Guide on Visa Access.

Account information updates include the PAN, expiration date, or both. The updated account information may be from the same Visa issuer or a different Visa issuer.

Only eligible transactions will receive these additional account information updates during VisaNet transaction processing. Transactions do not require approval to receive updated PANs or expiration dates in the transaction response message. After the account update is posted by the issuer, the information is available to update for 4 years.

Only Visa-branded cards are allowed processed through VisaNet. Therefore, private label cards and other card brands are not allowed to receive updates through Real Time VAU.

Real Time VAU replaces account information during the processing of AFTs and OCTs for participating endpoints.

Issuers that subscribe to receive TLV Field 127.PAN must support the field in AFT and OCT request messages or their equivalent request message type for issuers that do not accept AFTs or OCTs.

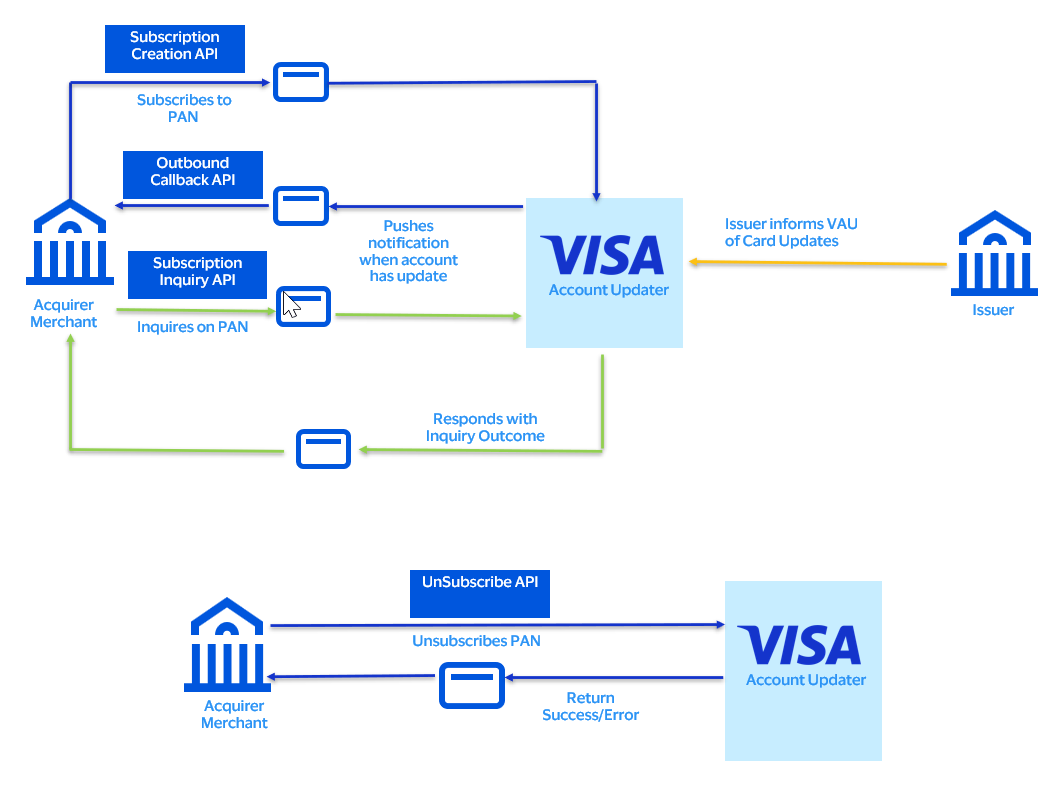

The Visa Account Updater (VAU) Push Subscribe Service is a bundle of APIs that helps maintain current cardholder information for recurring payments and subscriptions. This service is optional and works alongside other VAU channels, including the VAU batch file process, the Acquirer API, and Real Time VAU.

Merchants can subscribe to a list of on-file primary account numbers (PANs) through their acquirers to receive updates. When an issuer updates any PAN on the subscribed list, like for card expiration, replacement, or other account changes, VAU automatically sends these updates to the acquirer.

If a subscribed PAN is updated by the issuer, replacement PANs for the same underlying account are automatically included in the subscription.

This process ensures that the merchants always has the most current cardholder information, reducing the chances of transaction declines due to outdated card details.

Merchants can subscribe to a list of on-file primary account numbers (PANs) through their acquirers to receive updates. When an issuer updates any PAN on the subscribed list, like for card expiration, replacement, or other account changes, VAU automatically sends these updates to the acquirer.

If a subscribed PAN is updated by the issuer, replacement PANs for the same underlying account are automatically included in the subscription.

This process ensures that merchants always have the most current cardholder information, reducing the chances of transaction declines due to outdated card details.

The maximum transactions per second (TPS) for Push Subscribe Service APIs is 25 per concurrent calls.

Additionally, the VAU Push Subscribe Service:

Standard use of the VAU Push Subscribe Service follows these steps:

Acquirer subscribes to a list of PANs using the Subscription Creation API, which can include up to 100 PANs per request.

The VAU Push Subscribe Service validates and stores the subscription details, providing new updates if available or returning appropriate rejection codes and messages. When a subscribed PAN is updated by the issuer, replacement PANs for the same underlying account are automatically subscribed without any extra residency fee.

Issuer sends daily updates to Visa which are processed post-18:00 GMT cutoff.

If there is an update to a subscribed PAN after daily processing, Visa sends the updated data directly to the acquirer’s system through API, ensuring the acquirer receives the latest information automatically and without needing to request it.

The API expects a response of "SUCCESS" from the acquiring system to acknowledge the receipt of the push notification.

When an acquirer’s system is not reachable, the VAU Push Subscribe Service will attempt six daily retries for a period of seven calendar days. Updates will be delivered sequentially once the client’s system is operational. If an update remains undelivered after the retry period due to continued system unavailability, the update will be considered undeliverable.

If an acquirer no longer requires updates for certain PANs, the Unsubscribe API is used to stop receiving updates and avoid monthly residency fees for inactive subscriptions. The service will return "SUCCESS" upon successful completion or provide error codes and messages if issues are detected.

The Subscription Inquiry API is used to check the status of a subscription. This API returns a response of "Subscribed" or "Not Subscribed" depending on a PAN's status or provide error codes and messages if any issues are identified.

The Visa Account Updater (VAU) Merchant Enrollment API enables acquirers and processors to integrate their web-based applications and automate merchant enrollment.

This API removes the need to manually submit merchant information and eliminates paper-based forms. When all required information is provided, the API enrolls merchants in real time.

Up to 100 merchants in a single API call, which reduces the need for multiple calls. This includes non-U.S. merchants assuming successful Office of Foreign Assets Control (OFAC) and anti-money laundering (AML) checks.

This API returns three status values:

A "Reject" status occurs if required fields are missing or input fields are not populated correctly. An "In-Progress" status means that additional research is required by the Visa compliance team.

The VAU Merchant Search API is designed to complement the VAU Merchant Enrollment API by providing updated status information for merchants, and specifically those who are not yet enrolled in VAU and instead have an "In-Progress" status.

This API can also be used to check the status of any merchant that an acquirer has enrolled in its VAU segment. When the API is used, these are the possible outcomes:

Visa Account Updater (VAU) linking enables participating merchants to receive the most current account information, even if an account has changed multiple times.

VAU connects account information change records submitted for primary account numbers (PANs) so that when a merchant submits an inquiry for any PAN in the chain of updates, they receive the most up-to-date account information.

For example, if a merchant submits an inquiry using the original account information for a card that has had its PAN and expiration date updated upon reissuance, the merchant receives the newest PAN and expiration date in the chain of updates due to linking.