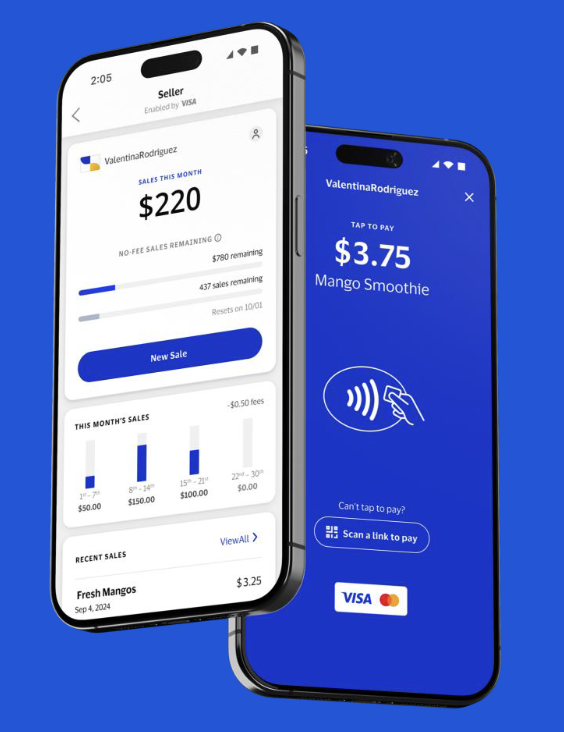

Visa Accept

Visa Accept enables small sellers to easily accept card payments with an NFC-enabled device

available for use by

Issuer Banks

Acquirer Banks

Merchants

Independent Developers

Issuer Banks for Small Business

Regional Availability

View Details- N. America

- Asia-Pacific

- Europe

- CEMEA

- LAC

Visa Accept Overview

Visa Accept is a new solution designed to give micro merchants with a Debit or Prepaid Visa credential a simple way to start accepting digital payments and settle funds in near-real time.

Onboarding and access to the solution will be through the merchant’s banking application, making the solution easy to use. During use, buyers will tap their payment cards or use a pay-by-link to facilitate a near-real-time funds transfer, broadening merchants’ payment options and allowing them to accept card payments in addition to cash.

Visa Accept will limit the payment volume and the number of transactions that a micro merchant can accept per month. Once this limit is reached, merchants cannot accept further payments using Visa Accept until the next payment period when the limits are reset. Merchants that wish to continue accepting transactions before limits are reset can graduate to a full-service acceptance product offered by their partner financial institution.

Key Features

Designed for micro seller needs

Simple signup, applying existing account KYC and consumer history. Segment specific pricing, with thresholds that drive adoption, growth, and graduation to full merchant services

Ready to support buyer payment preferences

Accept card payment across Visa & Mastercard, including Credit Cards and Cross-Border buyer. No longer have to rely on buyers having cash or limited closed-loop money movement app

Simplified experience for better conversion

Simply Tap to Pay, supporting contactless cards and digital wallets. Simple, fast, convenient buyer experience driving buyer conversion and improved checkout operations

Funds readily available in sellers' primary account

Funds settle in near-real time to existing bank account balances. Seller sales in one place, no more money transfers and associated fees for access and use of funds