Visa Accounts Receivable Manager (Visa AR Manager)

Transform the way virtual card transactions are managed by reducing friction with commercial payment acceptance

available for use by

Issuer Banks

Independent Developers

Regional Availability

View Details- N. America

- Asia-Pacific

- Europe

- CEMEA

- LAC

FEES & TERMS

Free to use in Sandbox. Contact Visa for pricing and commercial details to use in Production

Visa AR Manager is designed to help grow and maintain existing virtual card volume by automating the virtual card transaction process, addressing a significant pain point for B2B accepting merchants.

What it Does

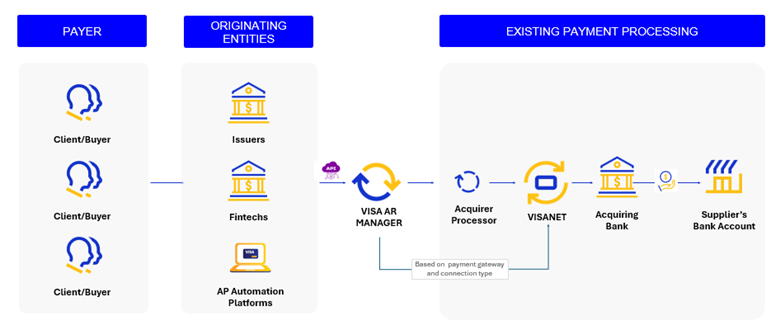

Visa AR Manager streamlines the virtual card transaction process through three key steps:

Capture

Retrieves card account details from a merchant’s customers

Transmit

Relays those details to acquirer’s designated payment gateway, acquirer, acquirer processor or VisaNet

Reconcile

Delivers meaningful and timely reconciliation data.

Key Benefits

Visa AR Manager is a useful tool designed to help you achieve your B2B payment volume growth and retention goals.

Issuers and Fintechs:

- Helps improve virtual card adoption: Supports expanded virtual card use and create predictable payments for buyers

- Efficiency: Assists in reducing manual virtual card exceptions for buyers

- Flexible integration: Batch file, email or API options

Merchants

- Efficiency: Assists in reducing manual effort required to process virtual cards

- Cost effectiveness: No additional cost for Visa cards

- No card data to store: No need to store card numbers and related PCI data

How Does It Work?

See Visa AR Manager Product Implementation Guide for full details; pre-requisites include signed and fully executed Visa AR Manager Participation Agreement.

API Suite

Visa AR Manager APIs are currently available in North America (U.S. only). For details on implementation and regional availability, contact your Visa representative.

Payment API

This API handles individual virtual card transactions and comprehensive invoice related details. The Payment API requires customer, payment and invoice information to transmit virtual card details securely.

Status Inquiry Workflow API

This API provides visibility into payment status and supports comprehensive status reporting with pagination for large result sets. This API is essential for monitoring payment transactions and handling asynchronous processing scenarios.