Getting Started with Visa Digital Enablement SDK: Push Provisioning

About Visa Digital Enablement SDK: Push Provisioning

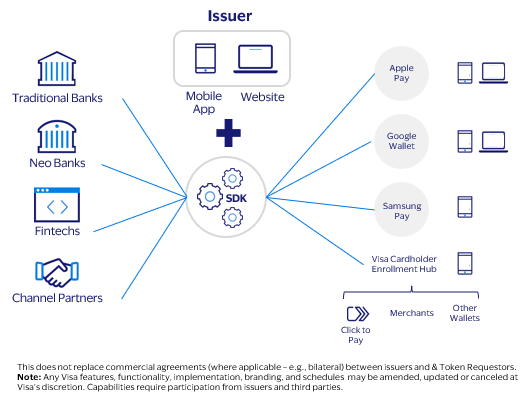

The Visa Digital Enablement SDK provisioning solutions are a common point of entry that enables end-to-end provisioning of payments credentials (Visa and Mastercard1) from a client’s mobile app or website* directly to a mobile wallet and eCommerce merchants.

VDE SDK: Push Provisioning

- In-App Provisioning: Apple Pay2, Google Wallet3, Samsung Pay4, and Visa Click to Pay

- In-Wallet Provisioning for Apple Pay (Apple Wallet Extensions): Allows cardholders to provisioning from the Apple Wallet app using account information provided by the issuer mobile app on the cardholder’s device

- *Web Provisioning: Apple Pay, Google Wallet

The VDE SDK will facilitate the required "pay" token eligibility validations for Visa and Mastercard credentials, encrypt the card using the Visa In-App Provisioning API and manage required SDK / API integration requirements the supported wallets and other e-commerce merchants, reducing the need for the mobile app or website provider to interface directly with these endpoints to provision a card directly from their app5.

The VDE SDK can be utilized to support one, many, or all these endpoints depending on client requirements.

If interested in using the Visa Digital Enablement SDK, please contact your sales representative or email [email protected].

Things to Know

For an issuer to implement push provisioning on their own, they would need to interface with APIs from multiple sources, including the issuer or core/host/processor: Visa, Apple, Google, Samsung APIs as demonstrated below.

Each mobile wallet provider has a different set of APIs and requires different approaches to perform device and token eligibility checks and other functions. These variations introduce a level of complexity that can increase time to market and requires a unique set of integration requirements for each supported digital wallet requiring the mobile app or website developer to aggregate APIs from multiple sources into a cohesive user experience.

Unified Provisioning Solution: Enables the end-to-end provisioning of payment credentials from a client's mobile app or website direclty to digital wallets and eCommerce merchants.

Unified Entry Point: Unified entry point for developers, reducing time to market and lowering decelopment costs.

With the Visa Digital Enablement SDK

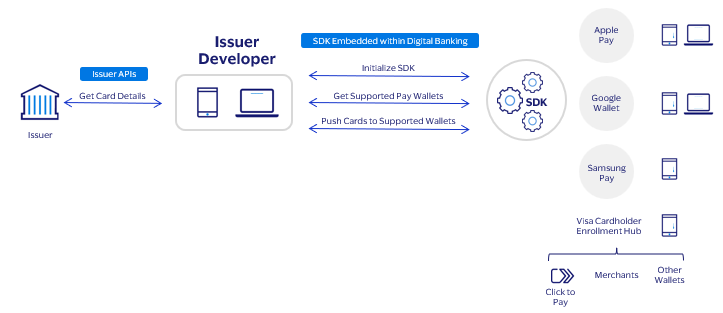

With the Visa Digital Enablement SDK, the connectivity to the Pay Wallet APIs is simplified for the developer and handled by the SDK. The SDK manages all technical touchpoints with Visa and the wallet providers. The developer, within the digital banking experience, embeds the SDK within the mobile app or website, gathers the card details and passes that information into the SDK.

The digital banking developer has only three touch points with the SDK:

- To start up, or initialize the SDK

- To pass the card details to the SDK and get a list of supported digital wallets from the SDK

- To make a request for the SDK to push the card to the wallet that the user selected

In-Wallet Provisioning for Apple Pay (Apple Wallet Extensions)

The Wallet Extensions for Apple can make it easy for cardholders to add a payment pass/card for use with Apple Pay from within the Apple Wallet by retrieving card account data via the client’s mobile application on the device using an App Extension. This functionality is a direct extension of the standard Apple Wallet in-app push provisioning experience originating from a client’s mobile app, which is enabled by the Visa Digital Enablement (VDE) SDK.

App extensions allow clients to extend custom functionality and content beyond their mobile app and make it available to users while they’re interacting with other apps or the system. These extensions become part of the parent mobile application.

The In-App Provisioning feature utilizing Wallet Extensions for Apple relies on two extensions, created by the client:

- Non-UI Extension: This allows your mobile app to track the extension status and the cards that can be added to the Apple Wallet. It also performs the card data lookup, similar to when adding cards to the Apple Wallet from within your app.

- UI Extension: This extension is needed to authenticate the user in cases where the non-UI extension indicates that authentication is necessary. It is not a redirect to your app, but a separate screen that uses the same login credentials of your app

Regional Availability

| North America | Asia-Pacific | Europe | CEMEA | LAC | Notes |

|---|

-

KEY

- Available in entire region

- Not available

- See notes for available countries

¹ Mastercard is a trademark of Mastercard Inc.

² Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries

³ Google Pay is a trademark of Google LLC.

4 Samsung Pay is a trademark of Samsung Electronics Co., Ltd

5 For clarity, the VDE SDK does not replace the need for an underlying agreement between the client and the respective wallet or service provider.