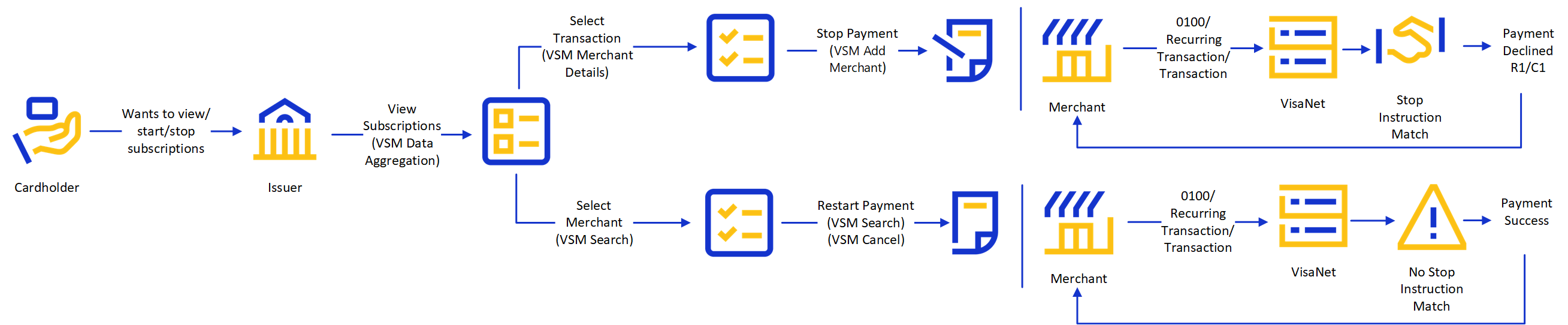

Visa Subscription Manager (VSM) allows issuers to provide cardholders the self-serve capability to monitor and manage their subscription payments through the issuer's mobile application.

Cardholders can:

• Review all card-not-present transactions with merchants that have stored credentials.

• Get a comprehensive view of participating merchants storing their card information. These are merchants where the cardholders transacted in the last 13 months.

• View their recurring and installment payments, including subscriptions, such as streaming services, food delivery, magazines, gym memberships, club memberships, and utility.

• Pause or stop recurring and installment payments from being authorized, cleared, and settled through VisaNet.

• Restart payments while subscribing to a subscription merchant.

The subscription management process starts with the cardholder.