Order Insight

Avoid chargebacks and get real-time fraud notifications.

Order Insight for sellers and resellers is now a Verifi hosted product. Please reach out to Verifi at [email protected]![]() . We’re no longer onboarding merchants, acquirer banks, and resellers directly through the Visa Developer Portal.

. We’re no longer onboarding merchants, acquirer banks, and resellers directly through the Visa Developer Portal.

available for use by

Acquirer Banks

Merchants

Regional Availability

View Details- N. America

- Asia-Pacific

- Europe

- CEMEA

- LAC

fees & terms

Free to use in Sandbox. Contact for Production fees.

Avoid chargebacks and get real-time fraud notifications

Order Insight enables Visa merchants with the ability respond to cardholder inquiries around unrecognized transactions and other potential disputes by providing relevant supplemental merchant information, in close to real-time.

Key Features

Provide key information to both Issuers and cardholders at the point of investigation.

Stifle Chargebacks and dispute losses from occurring.

Receive Real-Time Fraud Notifications.

Why Use It?

In 2015, Visa saw over 2.6 million chargebacks initiated because cardholders did not recognize the transactions, an increase of over 13% from the prior year. In addition, 20% of all chargebacks were tied to purchases of digital goods, which includes electronic downloads of movies, music, and phone application purchases. As the number of transactions related to digital goods continues to increase, so does the potential for an increased number of disputes. And this can be expensive, as the cost of working a dispute can be far greater than the purchase itself. Merchants and issuers need a more proactive way to prevent a dispute from occurring if a cardholder does not recognize the transaction. While digital goods merchants are certainly important due to the volume, use cases exist for ALL merchants looking to reduce dispute volume, including brick and mortar merchants, travel and entertainment and online merchants.

Order Insight connects issuers and merchants with the combined goal of reducing disputes that aren't really disputes.

How Does It Work?

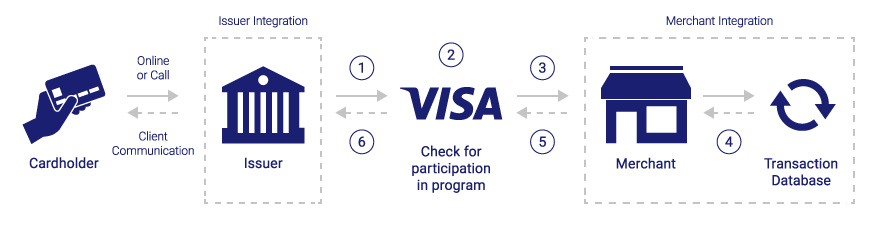

The first step in getting started with Order Insight is to understand how it works. The process allows merchants to seemlessly share information through VROL to the issuer, and involves the following steps:

1. Cardholder contacts issuer about a transaction they may dispute. Issuer access Visa Resolve Online (VROL) to identify the transaction

2. Visa checks to see if the merchant participates in Order Insight.

3. VROL creates an XML message to send to the merchant with data elements the merchant can use to identify the transaction within their own internal databases.

4. Merchant identifies transaction and pulls key data elements

5. Merchant responds in near-real-time back to VROL

6. Visa shares enhanced data (and/or intent to credit account) with issuer, who then uses the data with the cardholder

APIs Included

Purchase Inquiry Callback API

This API supports services that allow merchants to provide additional purchase and customer account information to Visa’s dispute management platform—Visa Resolve Online (VROL).

Related Content

Transaction Recognition: Dispute or Legitimate Purchase?

Provide purchase details to cardholders to confirm purchases are legitimate and/or if fraud has occurred.