The Visa Payments Processing (VPP) APIs are available on a trial basis to gather feedback and enable future development.

The Authorization API can be used by any developer in the Sandbox. To use a complete suite of the Visa Payments Processing APIs in the Sandbox, Certification or Production you must be pre-approved by your acquirer and Visa. The approval process is available as part of Production Onboarding. Use of the VPP APIs is subject to the use restrictions and other terms and conditions set forth in the applicable agreement. For further information, contact [email protected].

The following table lists the regional availability for Visa Payments Processing. To view availability of all products, refer to the Availability Matrix.

| North America | Asia-Pacific | Europe | CEMEA | LAC | Notes |

|---|---|---|---|---|---|

|

North America : Available in the United States |

The Visa Payments Processing APIs enable Visa clients, such as acquirers, acquirer processors, approved merchants and payment facilitators to process card-not-present payments through a direct interface to Visa’s global payment system. The VPP APIs supports a simplified processing model with a lightweight interface and doesn’t require clients to submit clearing batches. The VPP APIs deliver all the information needed to authorize and clear transactions reducing the risk and uncertainty related to delays of batch clearing. The VPP APIs support processing of payment requests for Visa credit, debit and prepaid cards. The verification requests may be used to validate payment account information for Visa and supported non-Visa brands.

The VPP APIs enable approved Visa clients to process card or token-based payment requests for Card-Not-Present processing scenarios. Acquirers and other approved clients* connect to Visa over the public Internet.

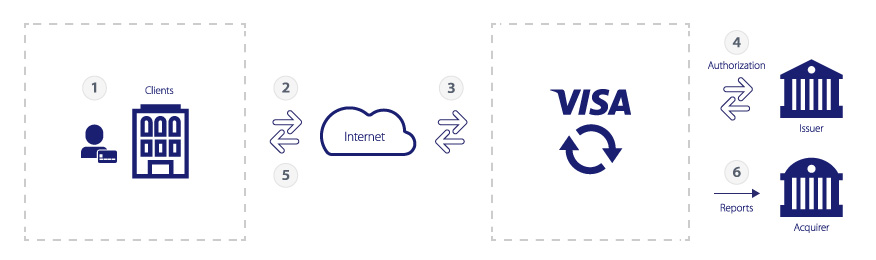

The following infographic illustrates how the VPP APIs function.

Step 1: Cardholder places order.

Step 2: Merchant’s site or project sends payment information directly to Visa using the secure VPP API.

Step 3: Visa validates the client, sending the API payment request and routes the payment request to the issuing bank for payment decision.

Step 4: Issuing bank approves or declines the payment request.

Step 5: Visa returns the payment response to the client.

Step 6: The acquiring bank receives the settlement reports and all transaction details from Visa.

* Clients may include acquirer processors, payment facilitators and merchants where sponsored by Acquirer and approved by Visa.

Authorization API

The Authorization API is used to request approval of card or token-based transactions. To enable the clearing and settlement of an approved transaction, a subsequent Capture API request is required.

In addition to Authorization API, VPP also offers the following APIs that are restricted. To access the following Visa Payments Processing APIs in sandbox, certification and production you must be pre-approved by your acquirer and Visa. For further information, contact [email protected].

Capture API

The Capture API is used to initiate the clearing and settlement of a previously approved authorization request. The Capture API request should be submitted as soon as a client fulfills a customer’s order and must be within 30 days of the original authorization request.

Sale API

The Sale API is used for a purchase when goods or services are delivered immediately to the consumer.

Refund API

The Refund API is used to submit credit vouchers or merchandise returns for card and token based transactions.

Void API

The Void API can be used to reverse an outstanding or previously approved transaction. Voids can be also be submitted in case of time-outs.

Verification API

The Verification API can be used to validate cardholder account information. Account verification is supported for both Visa and non-Visa brands*.

* Non-Visa brands include payment networks supported by Visa Authorization Gateway Service.