Finix Payments

Finix Payments

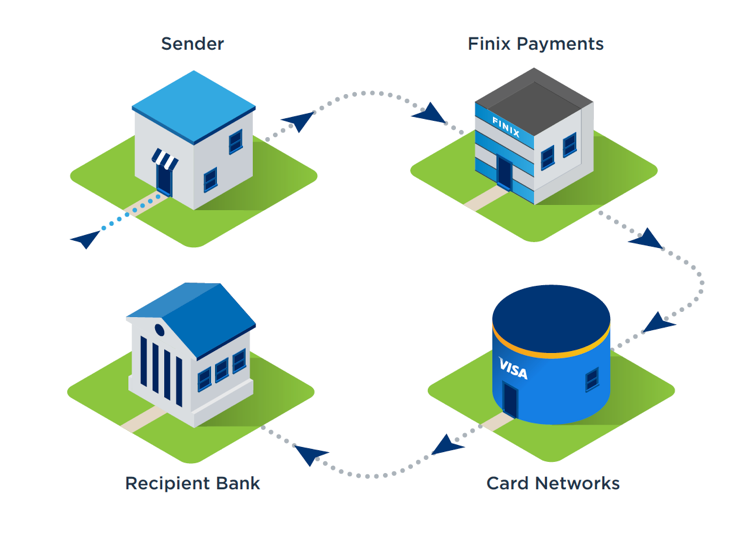

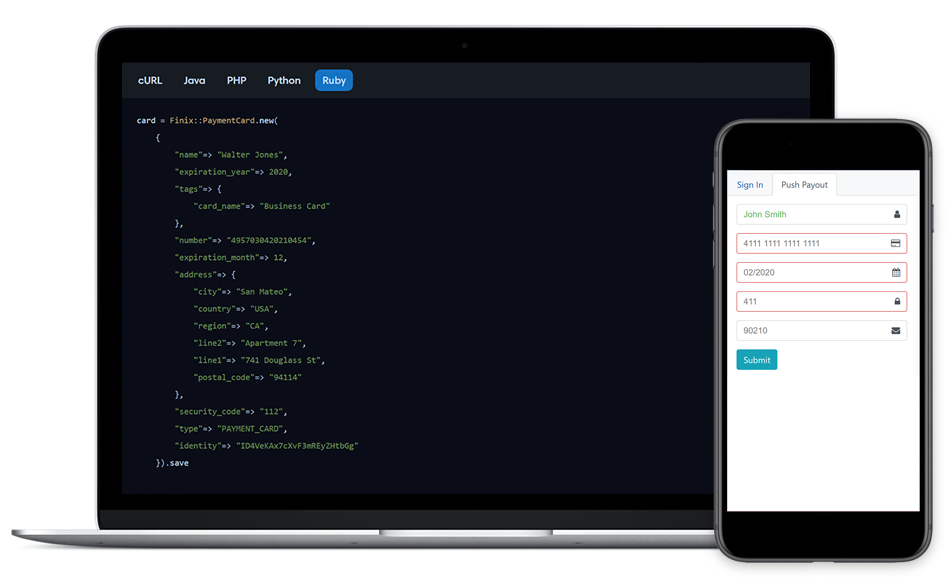

Finix Payments uses Visa Direct to power the Finix push-to-card (P2C) platform that enables real-time debit card payouts for businesses, replacing traditional, slower methods such as paper checks and ACH transfers.

API Used:

Visaʼs developer-friendly APIs help accelerate integration

“Visa’s set of developer friendly API’s was built without the complexities traditionally associated with legacy solutions, which has helped us speed up the integration process of moving money in real time and equip our customers with a more robust solution.”

– Richie Serna, CEO and Co-Founder

Successful implementation with start-to-finish support from Visa

“The Visa team was incredibly responsive and provided the guidance needed to ensure a smooth integration of the Visa Direct API into Finixʼs platform. Their customer support was critical in quickly and successfully advancing from sandbox to production.” – Dan Williams, Head of Business Development and Strategy

A partnership for P2C payments innovation

“We were excited to see Visa open its technology to the developer community. Our partnership demonstrates the innovations made possible by utilizing the power and scale of a company like Visa.” – Sean Donovan, Co-Founder and COO

Helping businesses leverage new P2C payment technology

Providing funding options through the Finix P2C platform

Notifying recipient of payment

Recipient selects payment option

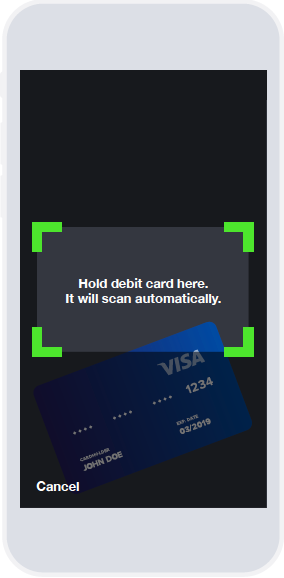

Customer uploads debit card info

Helping businesses leverage new P2C payment technology

Providing funding options through the Finix P2C platform

Finix receives a P2C payment request, runs validity tests and routes validated transaction information through Visa Direct to the recipient's financial institution—making payment funds accessible through any debit channel.

Using Visa Direct to enable P2C payments

The Finix P2C platform offers merchants tailored instant fund disbursement capabilities with the goal of greatly improving customer experiences.

View more partner use cases

View use cases from Visa

Disclaimer: All brand names and logos are the property of their respective owners, used for identification purposes only, and do not imply product endorsement or affiliation with Visa. Any third party solutions and links to third party sites are for your information only and equally do not constitute a Visa endorsement. Benefits depend on implementation details and business factors. Depictions are illustrative only and use of capabilities and features are subject to Visaʼs terms and conditions and may require development, implementation and resources by you based on your business and operational details. Please refer to the specific API documentation for details on the requirements, eligibility and geographic availability.