Keyno

Keyno

Keyno used Visa’s dynamic CVV2 (dCVV2) APIs to provide a turnkey and easy to implement fraud prevention solution for Visa card issuers.

APIs Used:

Helping to Prevent Online Fraud

A turnkey dynamic CVV2 (dCVV2) Solution using Visa APIs

Online Card Not Present (CNP) fraud is a major concern for card issuers today, and by using dCVV2 and the Keyno solution, dynamic data is introduced into the authorization message, which helps prevent fraud. Keyno is integrated with dCVV2, so card issuers can implement this solution with minimal effort.

Now, because Keyno has already implemented the dCVV2 APIs, issuers are able to offer quick and easy ways to implement dCVV2 solutions for both new and existing Visa cards is validated on VisaNet, worldwide.

What is CVVkey?

The CVVkeyTM solution from Keyno allows cardholders to request dynamic CVV2 values, either through a stand-alone app or integrated into an issuer’s mobile banking app.

CVVkey includes code delivery via a white label mobile app or SDK plugin, a customer service interface with reporting, an API connection for new card issuance, performance optimizations, security features, and a roadmap of enhancements. CVVkey supports mixed BINs with AllIn / OptIn / OptOut card enrollment.

Implementation Approach

Keyno collaborated closely with Visa to implement the CVVkeyTM Solution starting in March of 2019.

“Visa has been a trusted partner of Keyno, supporting us throughout the design, implementation, and rollout phases; Visa has the proven production support capability that we can rely on. Any questions we had were quickly addressed by the team, allowing us to move forward with delivering.”

Robert J Steinman, CEO of Keyno, Inc.

Key Results

Besides delivering a safer cardholder experience, Keyno helps issuers

- provide the safety and security that cardholders expect

- reduce online fraud

- provide card issuers with cost and operational savings

- increase transaction volume

- show technological leadership

Here’s how Visa APIs helped Keyno

Step 1

Opening screen

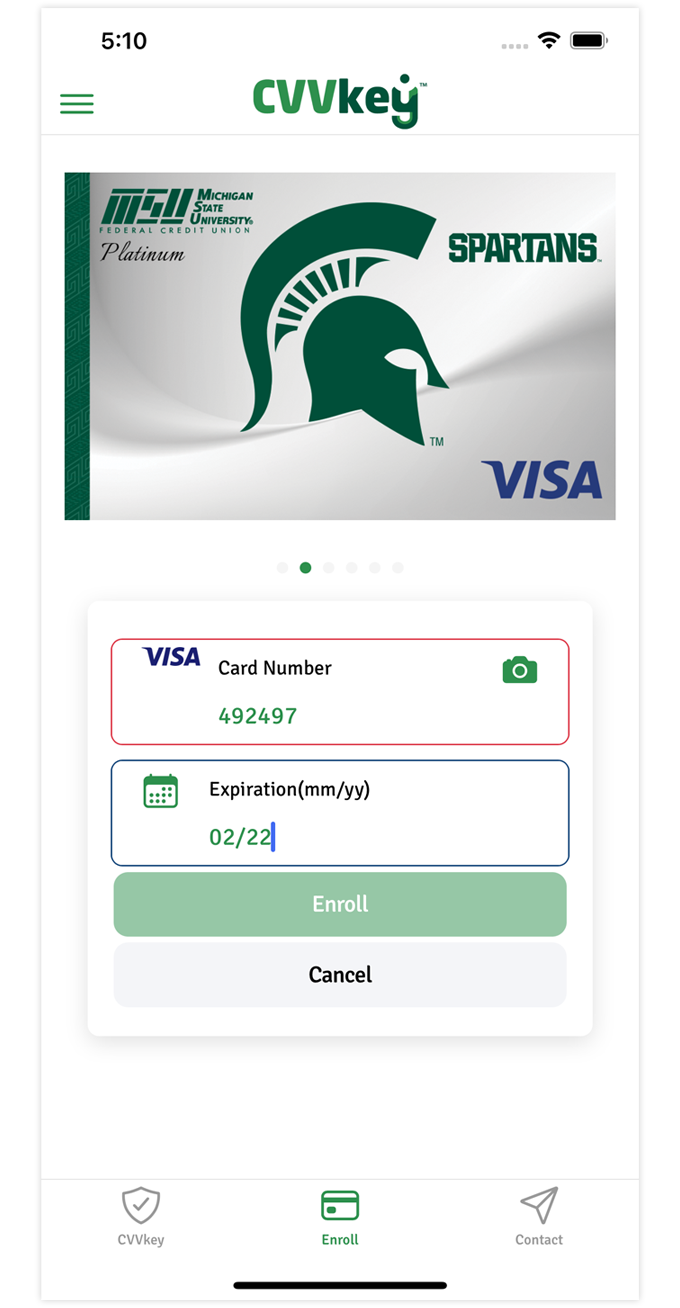

Step 2

Enrolling a new card in dCVV2

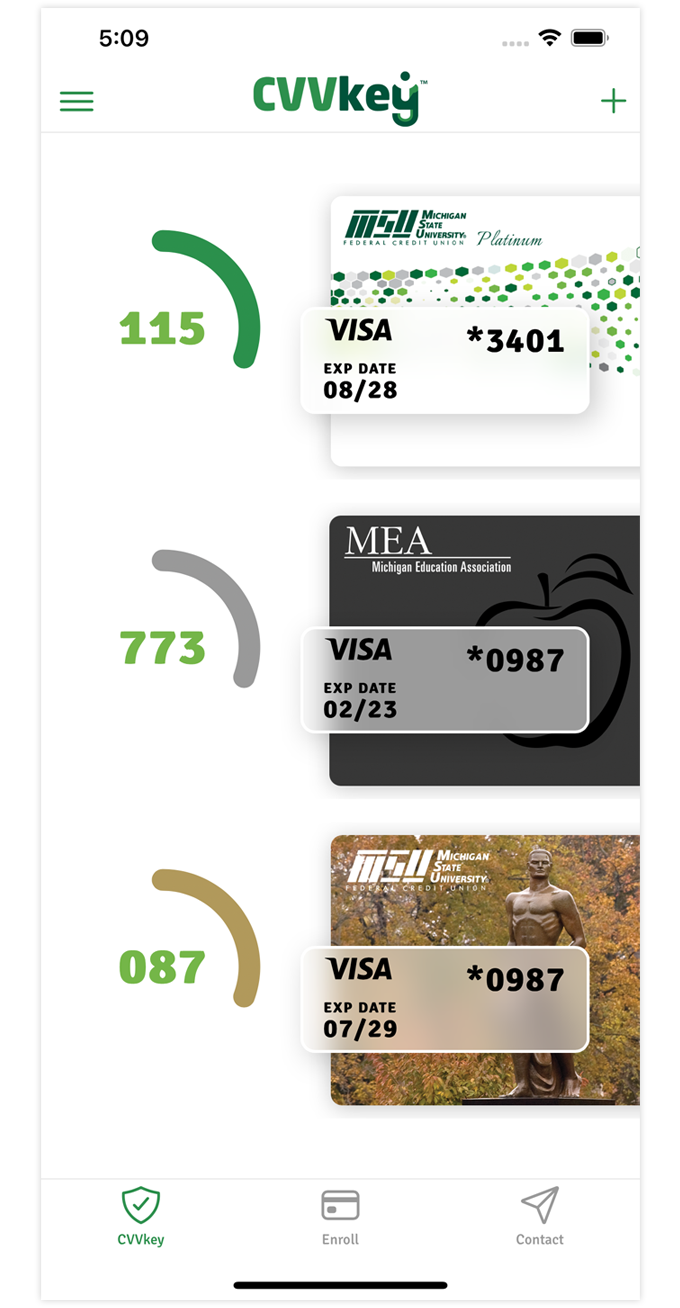

Step 3

View your current dCVV2 code

Disclaimer: All brand names and logos are the property of their respective owners, used for identification purposes only, and do not imply product endorsement or affiliation with Visa. Any third party solutions and links to third party sites are for your information only and equally do not constitute a Visa endorsement. Benefits depend on implementation details and business factors. Depictions are illustrative only and use of capabilities and features are subject to Visa’s terms and conditions and may require development, implementation and resources by you based on your business and operational details. Please refer to the specific API documentation for details on the requirements, eligibility and geographic availability.