Visa B2B Payment Controls

Authorization-based payment controls solutions for B2B market segments.

available for use by

Issuer Banks

Issuer Banks for Small Business

Regional Availability

View Details- N. America

- Asia-Pacific

- Europe

- CEMEA

- LAC

Fees & terms

Free to use in Sandbox. Contact for Production fees. Product terms located at end of the page.

Visa B2B Payment Controls (VPC) is a sophisticated solution tailored for various B2B market segments, including Government, Corporate, Commercial, and Small Business. This service aims to enhance the security and safety of commercial payments by providing issuers and their third-party providers with robust spend protection mechanisms.

You can also define when, where, how, and for how much accounts can be used along with capabilities to see their usage and end client notifications.

The Visa B2B Payment Controls APIs use the well-known Visa B2B Payment Controls (VPC) rules engine that already protects commercial payments via Visa B2B Payables and Visa Spend Clarity for Enterprise (VSCE) and protects small business accounts through Visa Spend Clarity for Business (VSCB). These APIs are an addition to the selection of Visa Commercial Solutions APIs designed to meet your commercial needs.

Here are some key features and benefits:

Authorization-Based Payment Controls:

- Allows precise control over when, where, how, and for how much accounts can be used.

- Enables the definition of specific spending parameters to prevent unauthorized transactions.

Enhanced Security Measures:

- Provides a higher level of security for commercial payments.

- Helps to protect against fraud and unauthorized usage.

Spend Monitoring and Notifications:

- Offers capabilities to monitor account usage in real-time.

- Sends notifications to end clients regarding their account activities.

Intelligent Payment Controls (GenAI):

- An AI-driven system that recommends and sets suitable controls according to the business use case prompted by the user

Supplier Validation:

- API Service to register, maintain and retrieve trusted merchant (supplier) information

Key Features

Set dynamic controls on physical or virtual cards in near-real time on Visa network.

Protect payments, reducing fraud and misuse.

Configure contacts to receive timely email or SMS notifications.

Use Gen-AI to recommend and set suitable controls.

Use trusted merchant information to safeguard payments with Supplier Validation APIs.

Why Use It?

Incorporating Visa B2B Payment Controls APIs into your user experience or workflow offers numerous advantages, including enhanced security, dynamic payment controls, and improved usability. By leveraging these APIs, you can ensure that your commercial payments are secure, controlled, and aligned with your business needs. This integration not only protects your payments but also enhances the overall efficiency and reliability of your financial operations.

Provides a Custom User Experience

Fintechs (on behalf of issuers) and issuers have the flexibility to create their own user experience and incorporate Visa B2B Payment Controls functionality directly within their platform – setting controls on both plastic and virtual cards in near real-time.

- Controls include spend rules, merchant groups, location, channel, and time rules

- Setup notification/distribution for decline emails and SMS

- Retrieve card and notification details – including consumed amount

- Utilize GenAI capabilities to set appropriate controls

Supports Multiple Use Cases

You have direct access to set and manage controls on new or existing accounts. Some of the possible use cases include these potential scenarios:

- A company needs to set and manage controls on a range of cards for employee usage.

- Set dynamic controls on individual accounts. You want to set spending limits for employee use on physical plastic cards only after an internal approval process.

- You already have card accounts for commercial or small business use cases – plastic or virtual cards service. Once you register the card accounts to Visa B2B Payment Controls, you can start setting rules using the Rules Management Service.

- Set controls on an account used by a personal shopper/service powered by commercial card use cases.

- Block employee cards from usage until the employee has a business need to spend.

- Set merchant level controls to ensure payments are made to the intended merchants and avoid fraudulent transactions.

- Register trusted merchants and utilize the information for making authorization decisions.

Drives Card Usage

This service can encourage card issuance by organization, improving confidence and peace of mind to ensure spending adheres to company policies by controlling how, when, and where those cards are used. It also protects commercial, larger payments from potential fraud or misuse.

There are flexible rules to manage things like:

- Employee purchasing

- On-demand purchases

- Supplier Payments

- Business travel

- Centralized Accounts Payables

- Fleet purchases

Encourages Efficiency

You can use this service as a standalone capability for your card portfolio, or you can combine it with other Visa API services such as Visa Commercial Solutions APIs. With Intelligent Payment Controls, you can also eliminate the need for clients to understand the complex controls, while introducing new controls without the need for client integration.

How Does It Work?

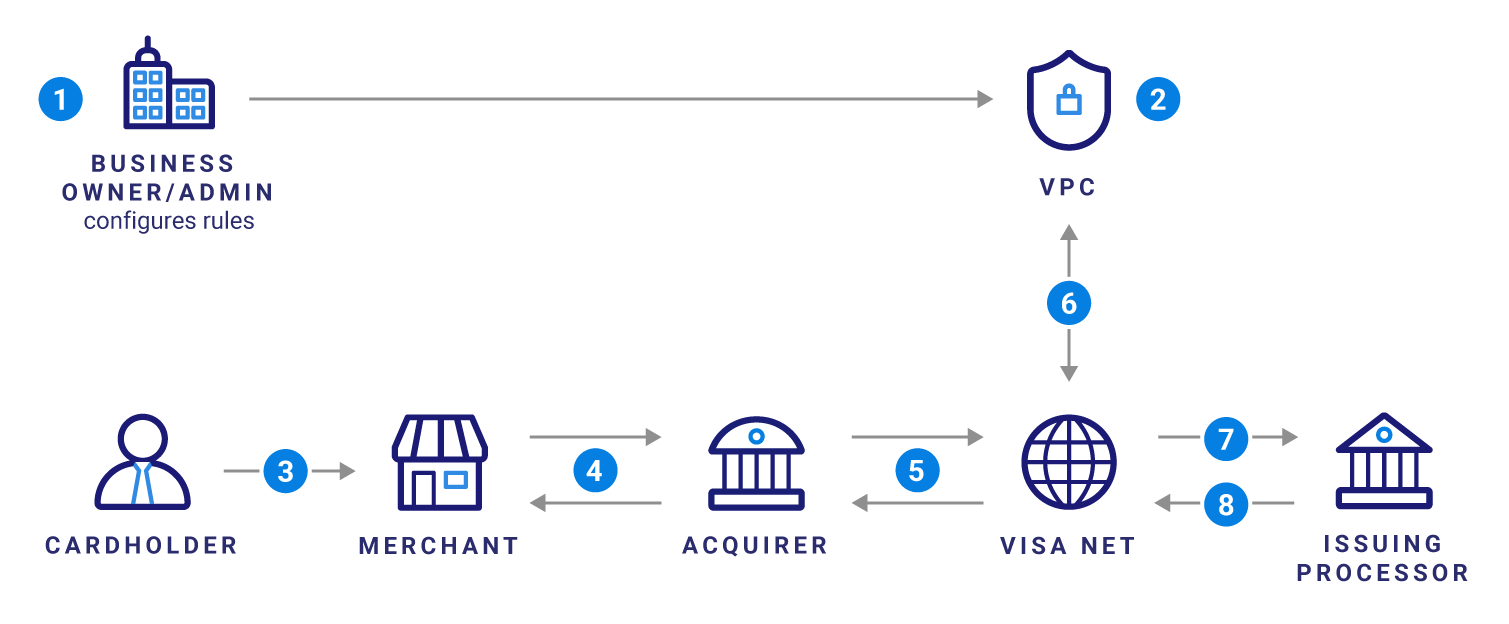

Visa B2B Payment Controls can be used to set authorization-based payment controls on your plastic or virtual accounts. The first illustration shows how transactions are processed when controls have been applied.

Process Flow for a Transaction with Visa B2B Payment Controls

This illustration shows a process flow for a transaction using Visa B2B Payment Controls.

- Business Owner/Admin accesses their UI portal connected to the Visa B2B Payment Controls APIs to configure accounts rules.

- The UI portal triggers API calls using the Visa B2B Payment Controls to set rules on the account. The controls are then applied at VisaNet.

- Cardholder presents the card at a merchant location or via computer to make a purchase.

- Merchant processes the transaction, and the authorization process moves through the card rails and the transaction is routed to VisaNet.

- VisaNet checks for any predefined rules set in Visa B2B Payment Controls for the account.

- One of two things happen:

- If payment aligned with Visa B2B Payment Controls rules, the payment is passed to the issuer for an authorization decision.

- If the block criteria are met, the transaction is declined due to Visa B2B Payment Controls rules.

- The issuer authorizes or declines the transaction.

- The issuer returns it to VisaNet.

APIs Included

Account Management Service

The Account Management Service is used to create accounts within the ranges specified during the onboarding of an Issuer or a Commercial Client. This service also allows users to add payment controls, manage account contacts, update company information, delete accounts, and access account details from the system.

Rules Management Service

The Rules Management Service enables users to establish dynamic controls on the Visa network in near-real time for individual cards. This service also allows users to disable, enable, or remove controls that are no longer required, and access control details to view a user's current rule configuration at the card level.

Reporting Management Service

The Reporting Management Service allows users to retrieve both transaction and notification details for a card.

Notification Service

The Notification Service lets issuers, fintechs, or users choose how they receive optional alerts—by email or SMS—when VPC blocks or approves a transaction authorization request. These notifications are delivered to the contacts specified when the card account is created via the Account Management Service.

Intelligent Payment Controls Service (Gen AI)

The Intelligent Payment Controls System evaluates user prompts to recommend suitable controls for payment Transactions. Users have the option to review, adjust, and approve these suggested controls to implement them. This AI-powered system provides recommendations and establishes appropriate controls based on the business use case specified by the user. It offers a collection of APIs for submitting prompts, receiving recommendations, and implementing the suggested controls.

Supplier Validation

The Supplier Validation solution allows clients to efficiently identify and trust suppliers. Clients may search for and retrieve trusted supplier information, including Acquirer ID and CAID, which can then be used to establish or update payment controls through existing B2B Payment Controls APIs or B2B Payables APIs. This solution supports fraud mitigation in virtual commercial transactions by ensuring that payments are authorized exclusively for verified, trusted suppliers.

Related Content

B2B Virtual Account Payments Method

The B2B Virtual Account Payment Method involves a suite of APIs which allows you to use virtual accounts to automate the process of paying your suppliers. Additionally, the B2B Virtual Account Payment Method can enable you to develop flexible solutions across industries and segments.

Request a Virtual Account and Set Controls

Third party FinTechs can request virtual accounts on behalf of a commercial issuer and specify account controls for digital presentment.

Visa Business Data Solutions

The Visa Business Data Solutions API provides a faster and more efficient way for participating issuers and their commercial clients to pull their commercial card transaction data and make strategic decisions based on data-driven insights. Current APIs provide access to transaction and enhanced data along with supplier data via different data groupings.

Regional Availability

The following table lists the regional availability for Visa B2B Payment Controls. To view availability of all products, refer to the Regional Availability.

| North America | Asia-Pacific | Europe | CEMEA | LAC | Notes |

|---|

-

KEY

- Available in entire region

- Not available

- See notes for available countries