Click to Pay is Visa’s solution for e-commerce payments based upon the EMV® Secure Remote Commerce (SRC) standards and specifications. It helps enable frictionless online checkout using a single payment profile across a variety of consumer devices and participating online merchants.

Visa’s implementation of the EMVCo SRC framework and specifications is an important part of the Visa Digital Commerce Program that aims to address industry concerns surrounding digital payments, including improving cardholder/merchant trust and checkout conversion. Visa Click to Pay supports and builds upon the security provided by Visa Token Service.

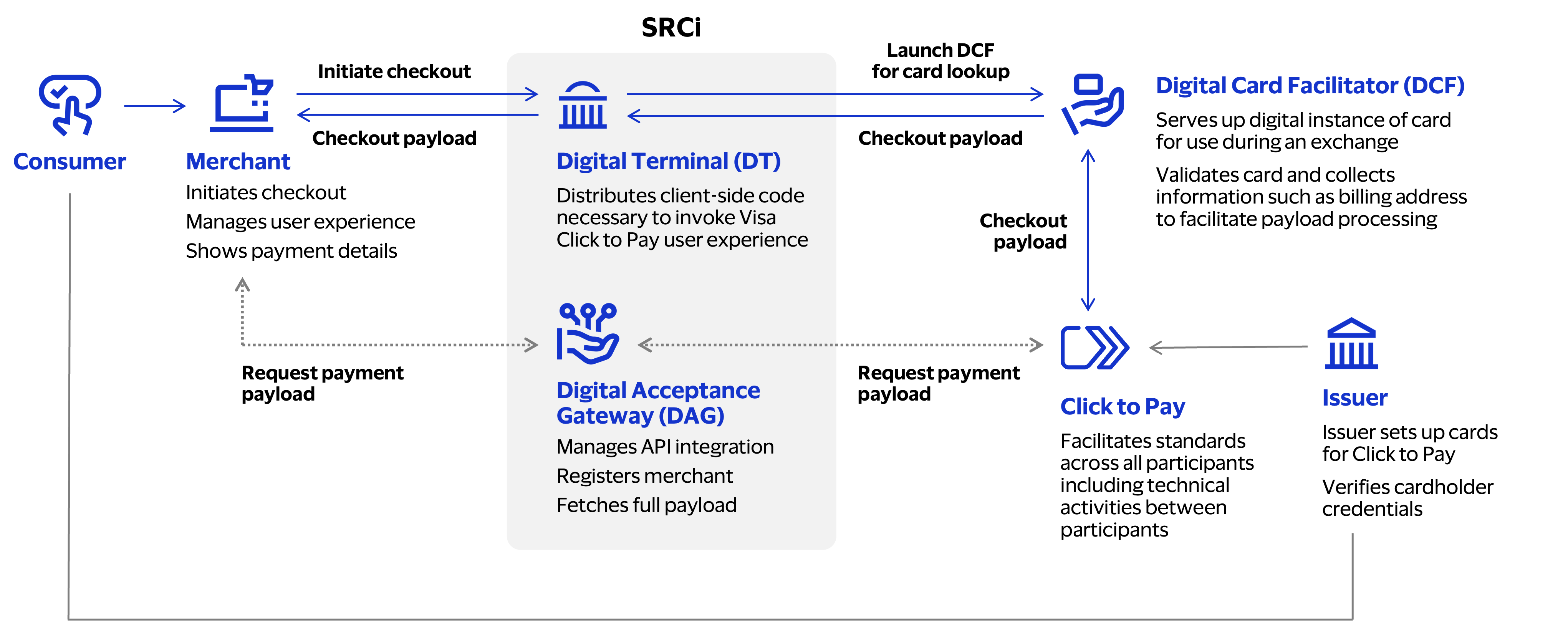

Similar to the brick-and-mortar environment in which a POS terminal provides merchants with card acceptance capability, the Digital Terminal provides e-commerce merchants with a secure method to initialize the Visa Click to Pay checkout experience and accept card payments. Visa Click to Pay is designed to:

As a merchant or payment service provider, you can implement Visa Click to Pay or Unified Click to Pay solutions.

As an issuer, you can enroll cardholders into Click to Pay and offer them a seamless and convenient shopping experience across participating merchants. You can also ask your VisaNetProcessor, Visa Scheme Processor (Europe region) or Third-Party Agent to enroll and perform lifecycle management on your behalf.

Note: In Merchant Orchestrated Checkout experience, role of Digital Card Facilitator is performed by Digital Terminal.

Visa Token Service (VTS) is based on the protocol described in the EMV® Payment Tokenization Specification Technical Framework. Visa Token Service enables contactless (tap to pay) and in-app payments on third party or issuer applications on mobile devices and wearables as well as remote payments through e-commerce enablers and merchant card-on-file solutions.

These are some of the key terms used throughout this implementation guide. For a more complete list, please view the Glossary.

Acquirers and acquirer processors that process Visa transactions.

Issuers and Issuer processors that process transactions for Visa cards. An issuer can use a VisaNet Processor, Visa Scheme Processor (Europe Region) or Third-Party Agent to perform some activities on their behalf.

Merchants that accept Visa cards.

A method of performing a payment or secure purchase of goods or services during a remote payment experience that involves a DPA checkout and a consumer device, as defined by the EMV® Secure Remote Commerce Technical Framework and the EMV® Secure Remote Commerce Specification.

Role defined in the EMV® Secure Remote Commerce Technical Framework for ecosystem participant that connects with all SRC systems on behalf of merchant. VDCP has two roles to denote an SRCI: Digital Terminal and Digital Acceptance Gateway.

The program role responsible for providing payment card acceptance capability for Visa payment credentials to one or more DPAs. Responsible for initiating the Click to Pay checkout experience.

An entity, not defined as a VisaNet Processor or Visa Scheme Processor, that provides payment-related services, directly or indirectly, to a Member and/or its Merchants or Sponsored Merchants or their agents.

A Member, or Visa-approved non-Member, that is directly connected to VisaNet and that provides Authorization, Clearing, or Settlement services to Merchants and/or Members. In the Europe Region: See also Visa Scheme Processor.

A Member or a third party that provides Authorization, Clearing, Settlement, or payment-related processing services for Merchants or Members.

| North America | Asia-Pacific | Europe | CEMEA | LAC | Notes |

|---|---|---|---|---|---|

|

North America : Available in Canada |