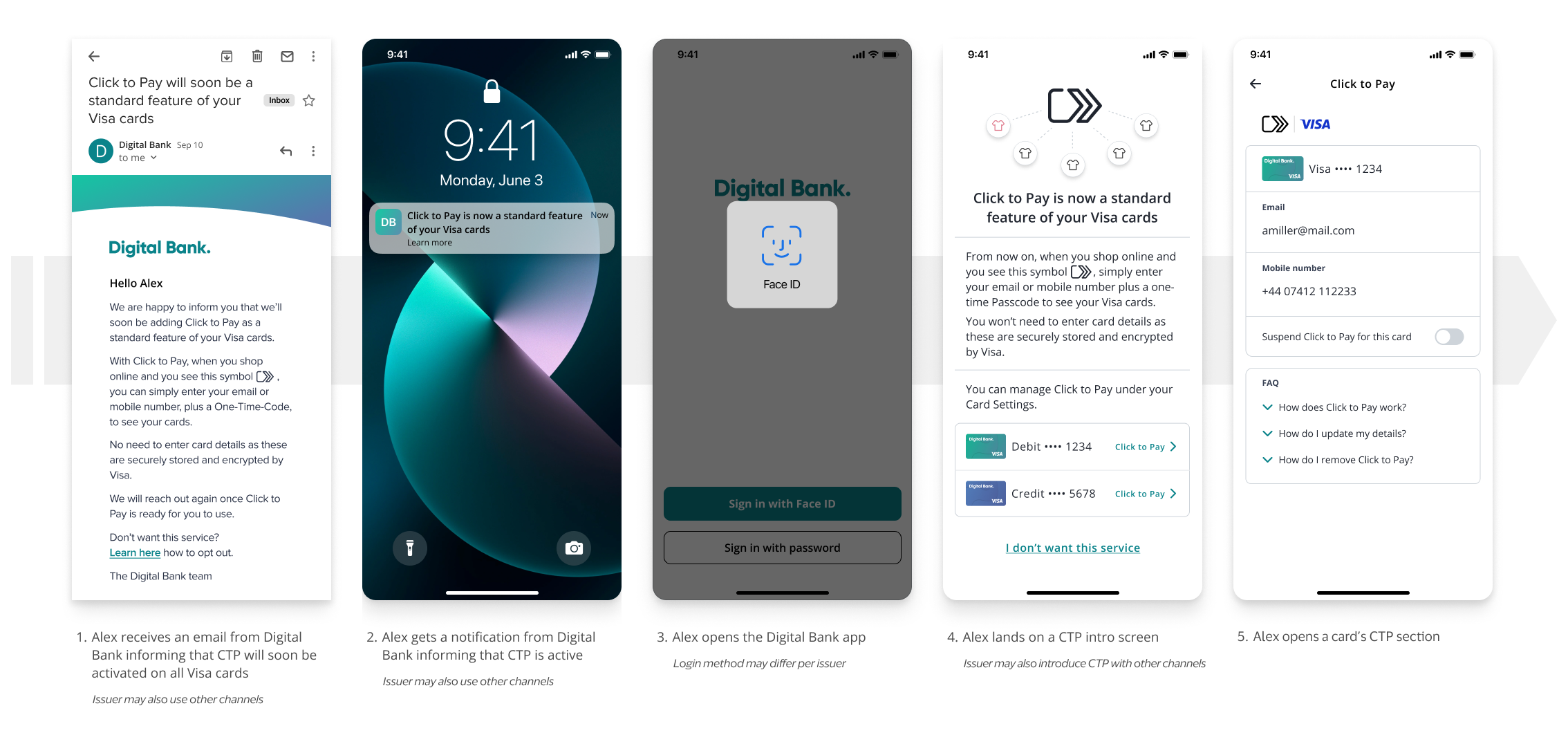

Fig.1. Illustrative UX for a new consumer opening an account with a Digital Bank.

Fig.2. Illustrative UX for an existing consumer opening another account with a Digital Bank.

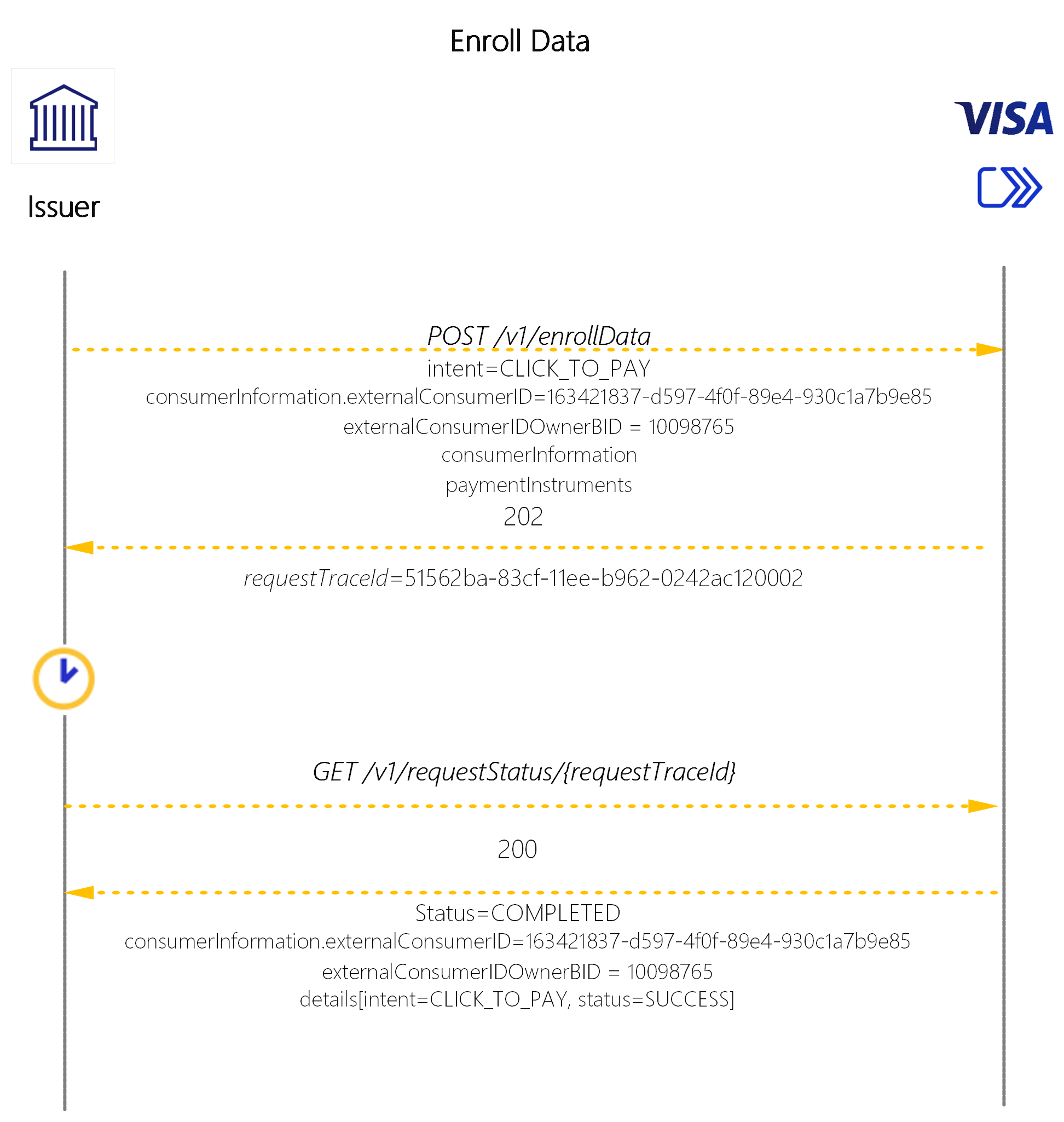

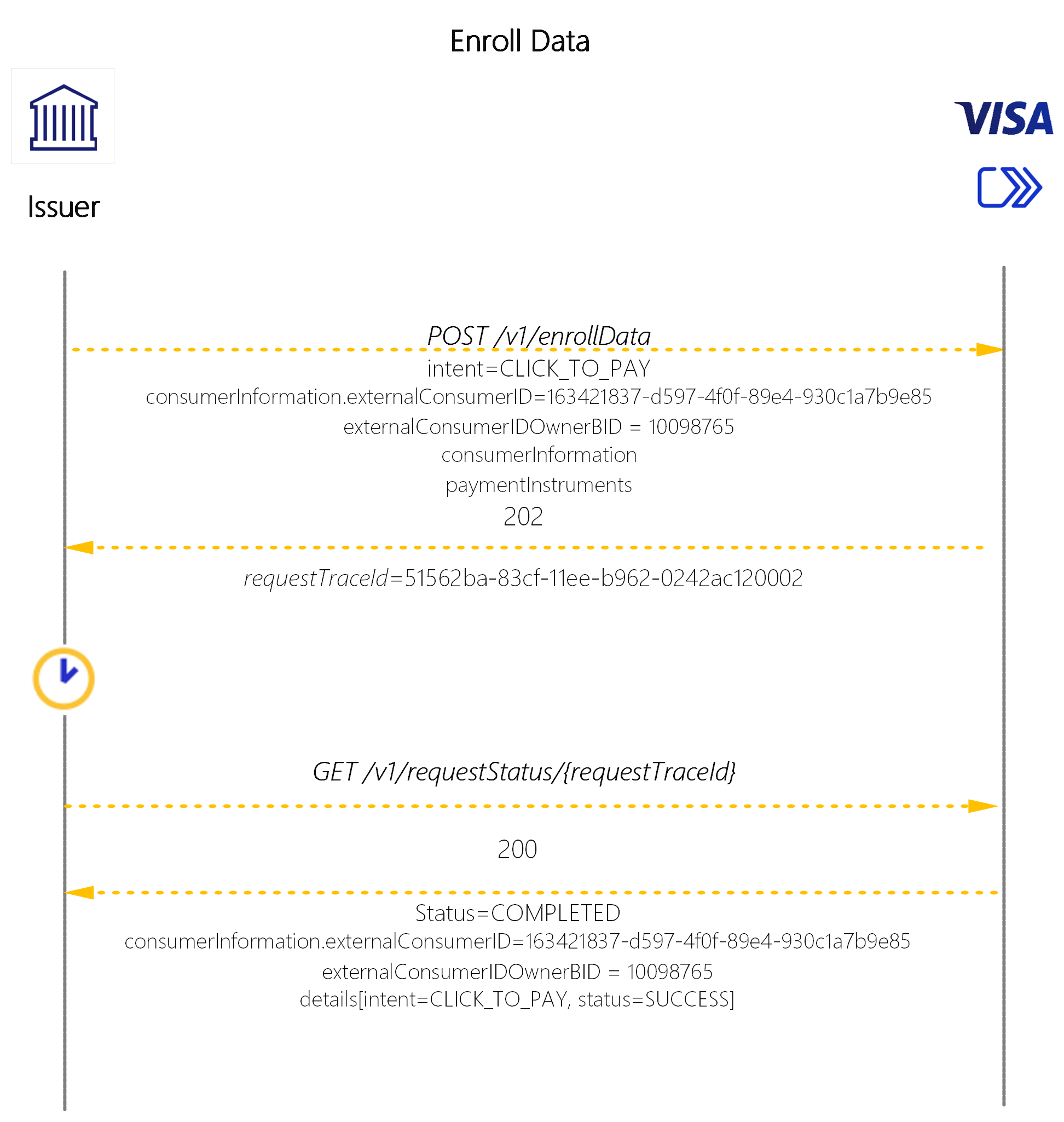

The Click to Pay activation use cases in Fig. 1&2 are achieved by using Visa ID & Credential’s Enroll Data API.

Fig.3. Illustrative UX for a consumer, who already has card/s in Click to Pay with the same Digital Bank, applying for a new card.

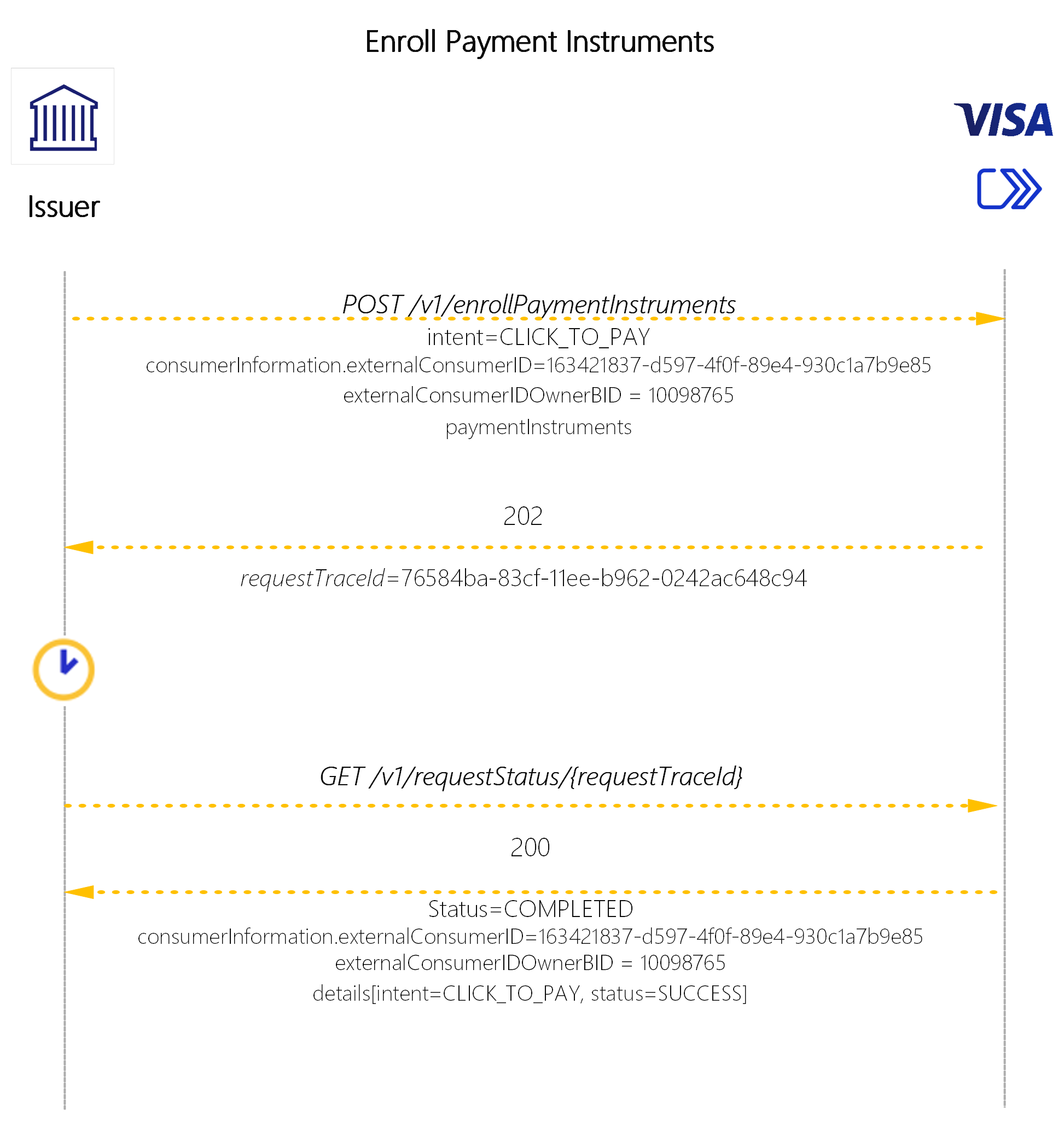

The Click to Pay activation use case in Fig.3 is achieved by using Visa ID & Credential’s Enroll Payment Instruments API.

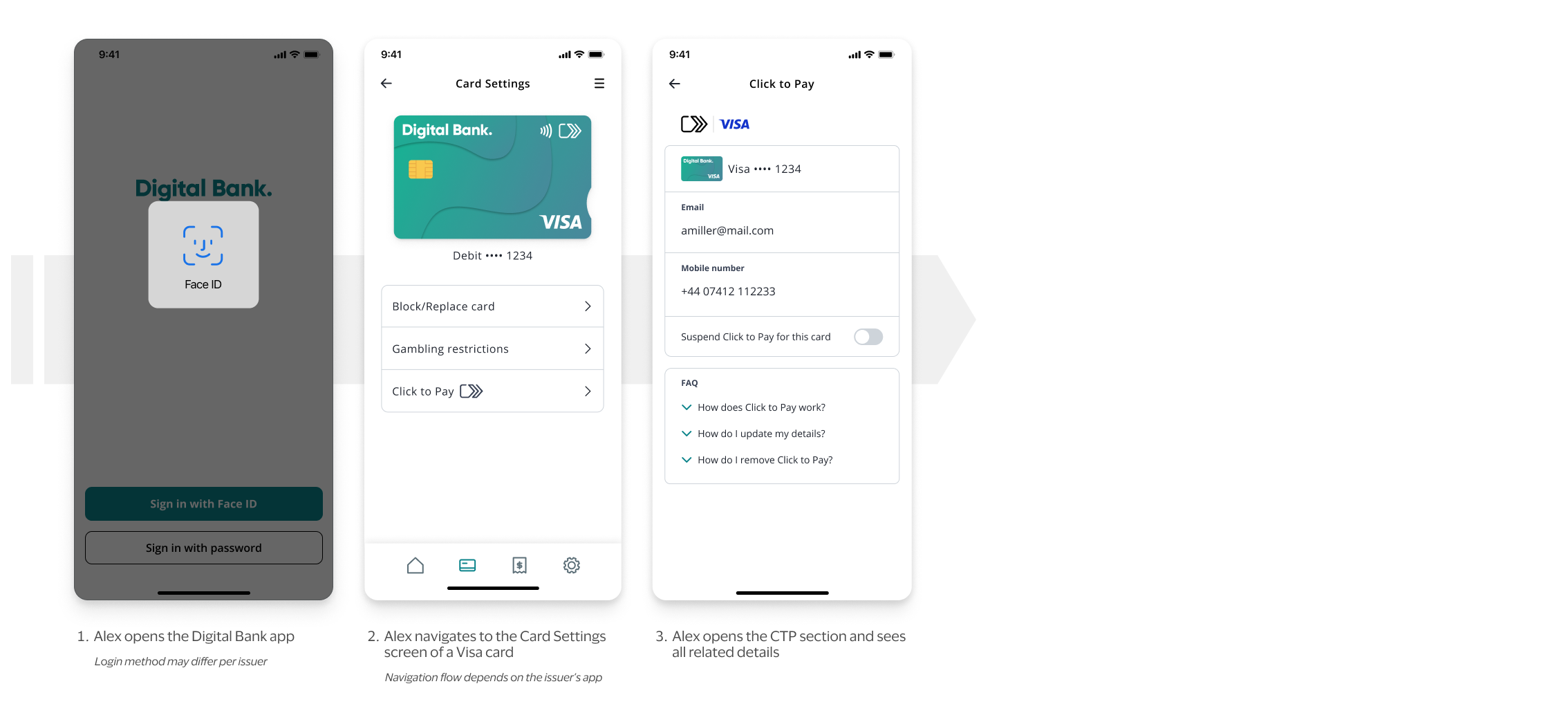

Fig.4. Illustrative UX for a consumer, who has card/s in Click to Pay, reviewing the details of their cards in Click to Pay.

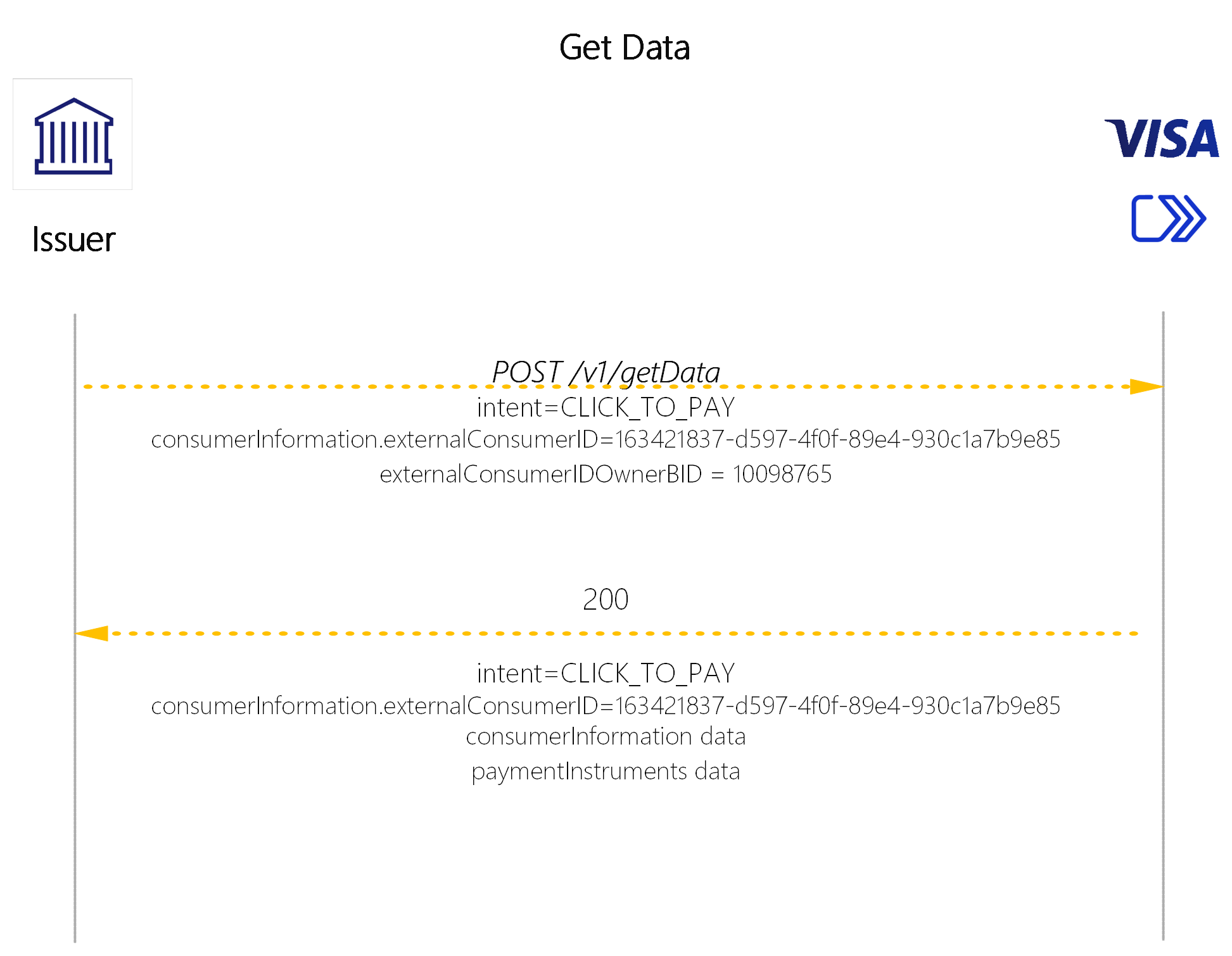

The Click to Pay information access use case in Fig.4 is achieved by using Visa ID & Credential’s Get Data API.

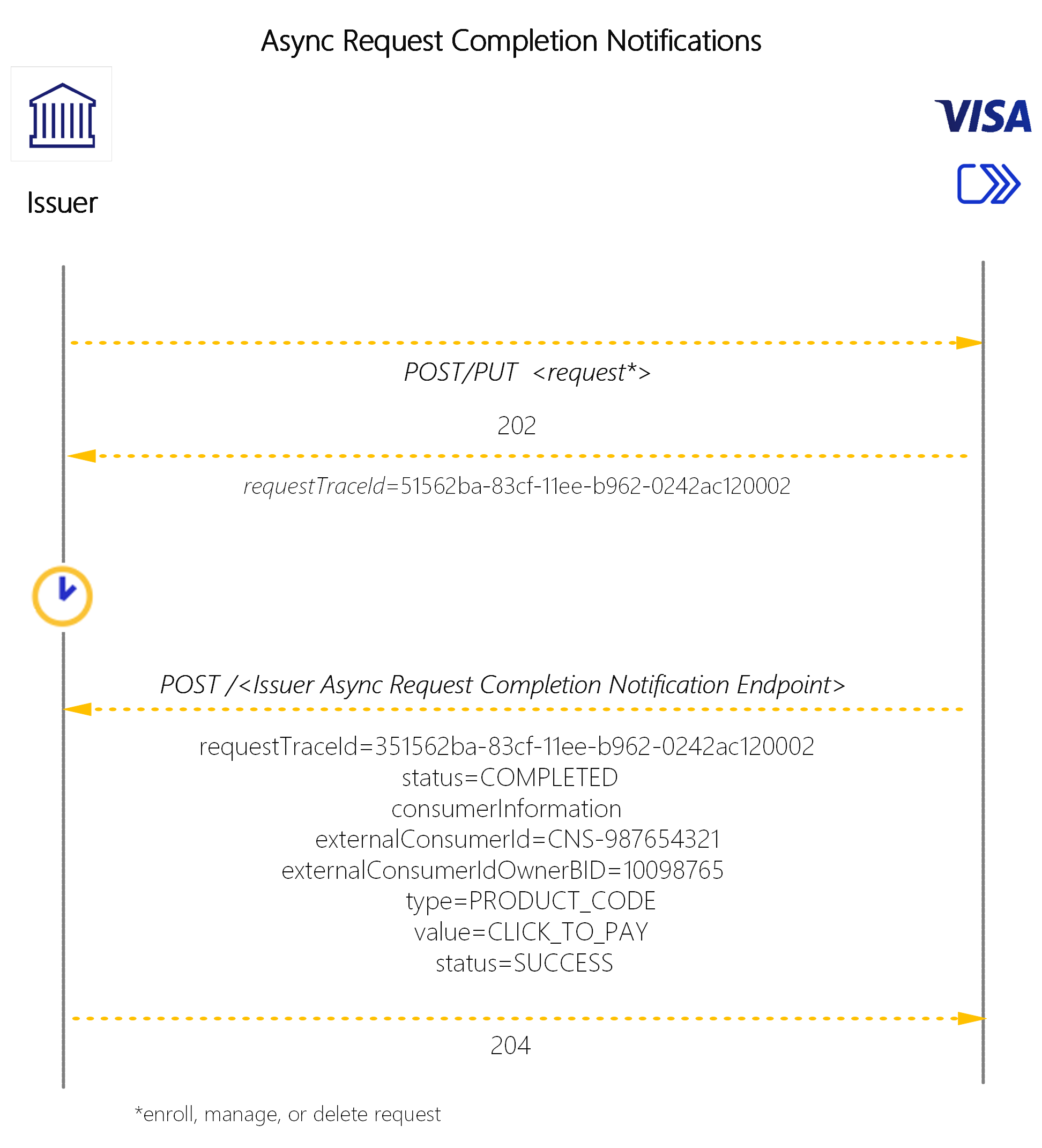

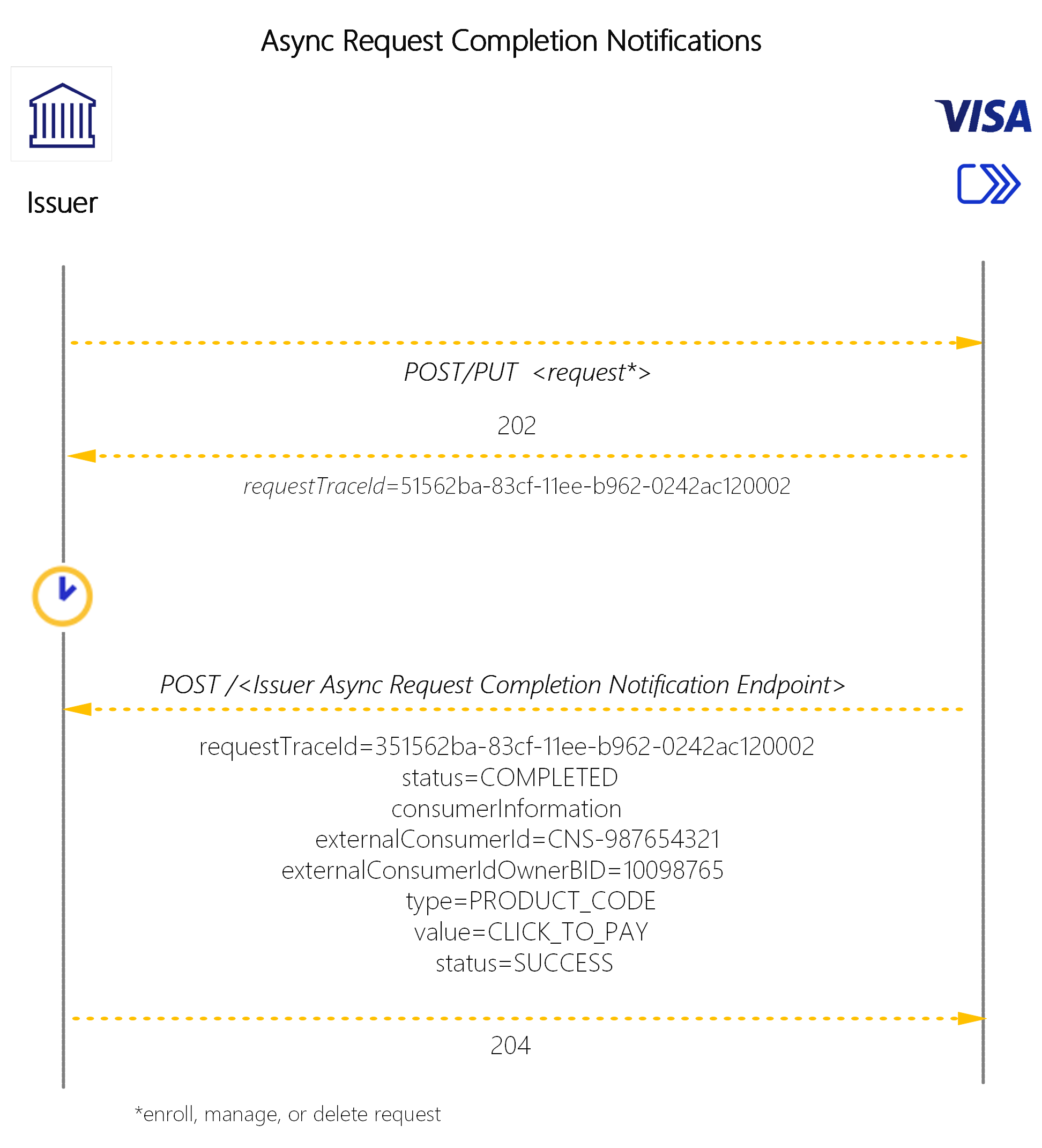

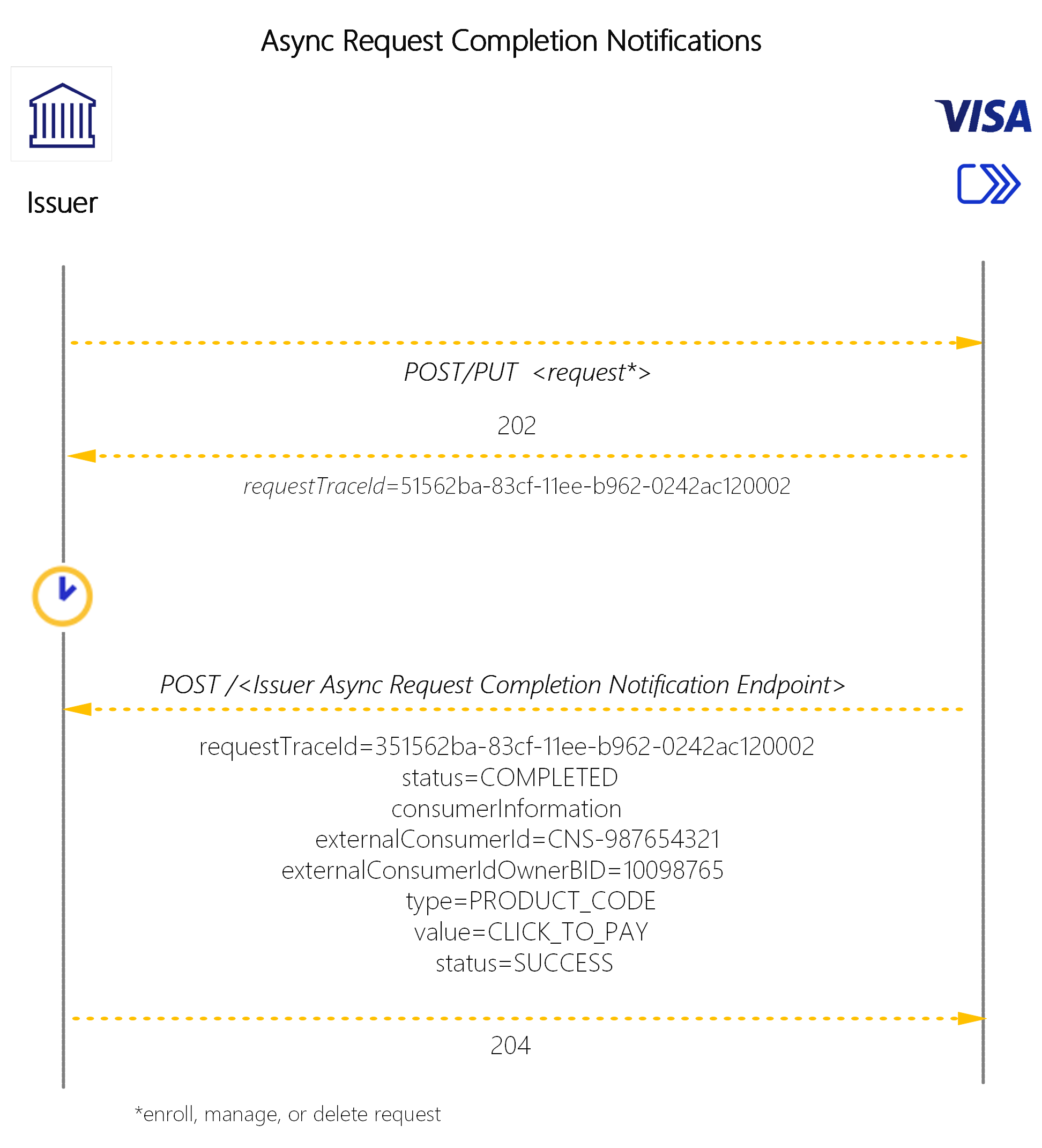

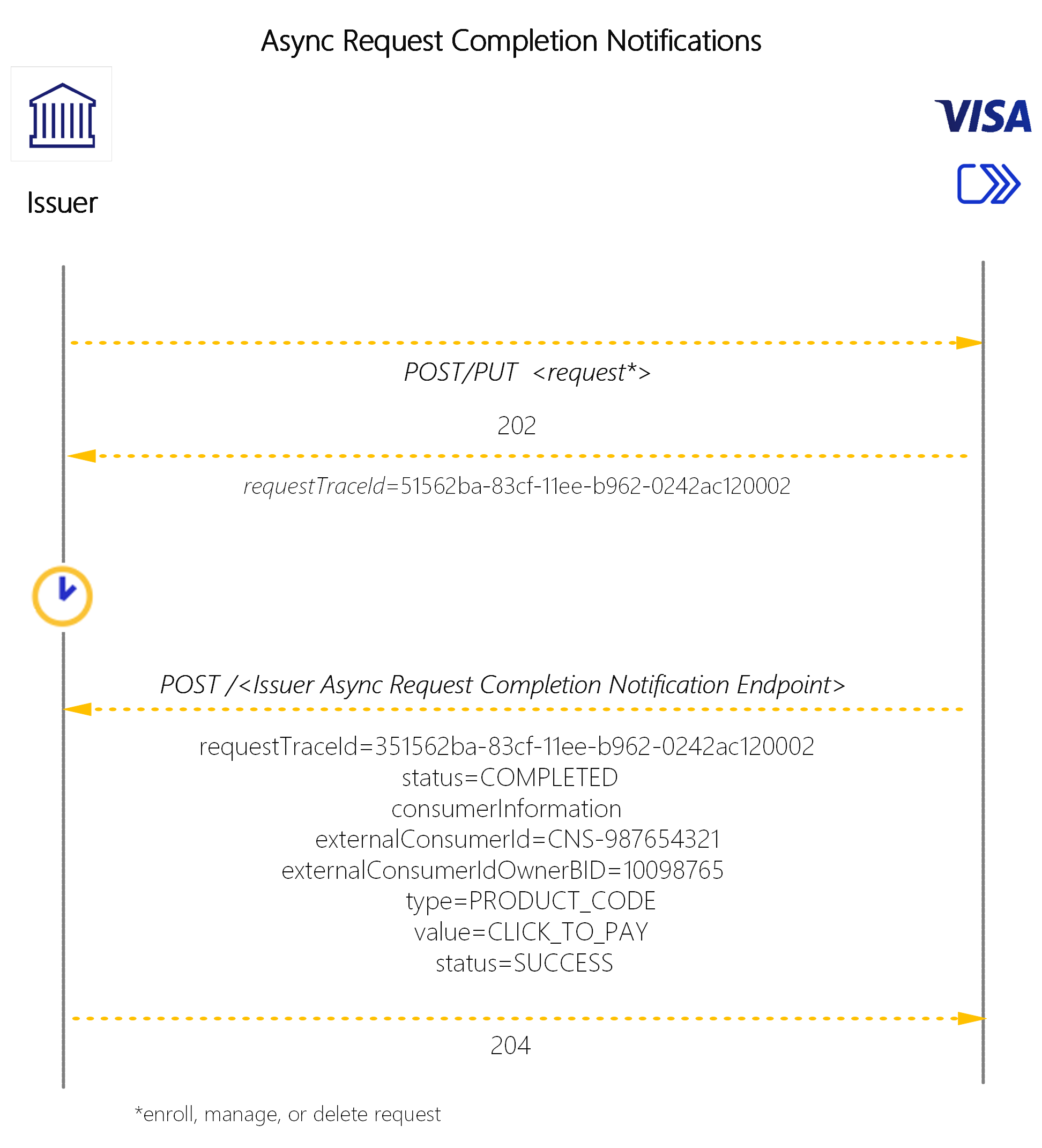

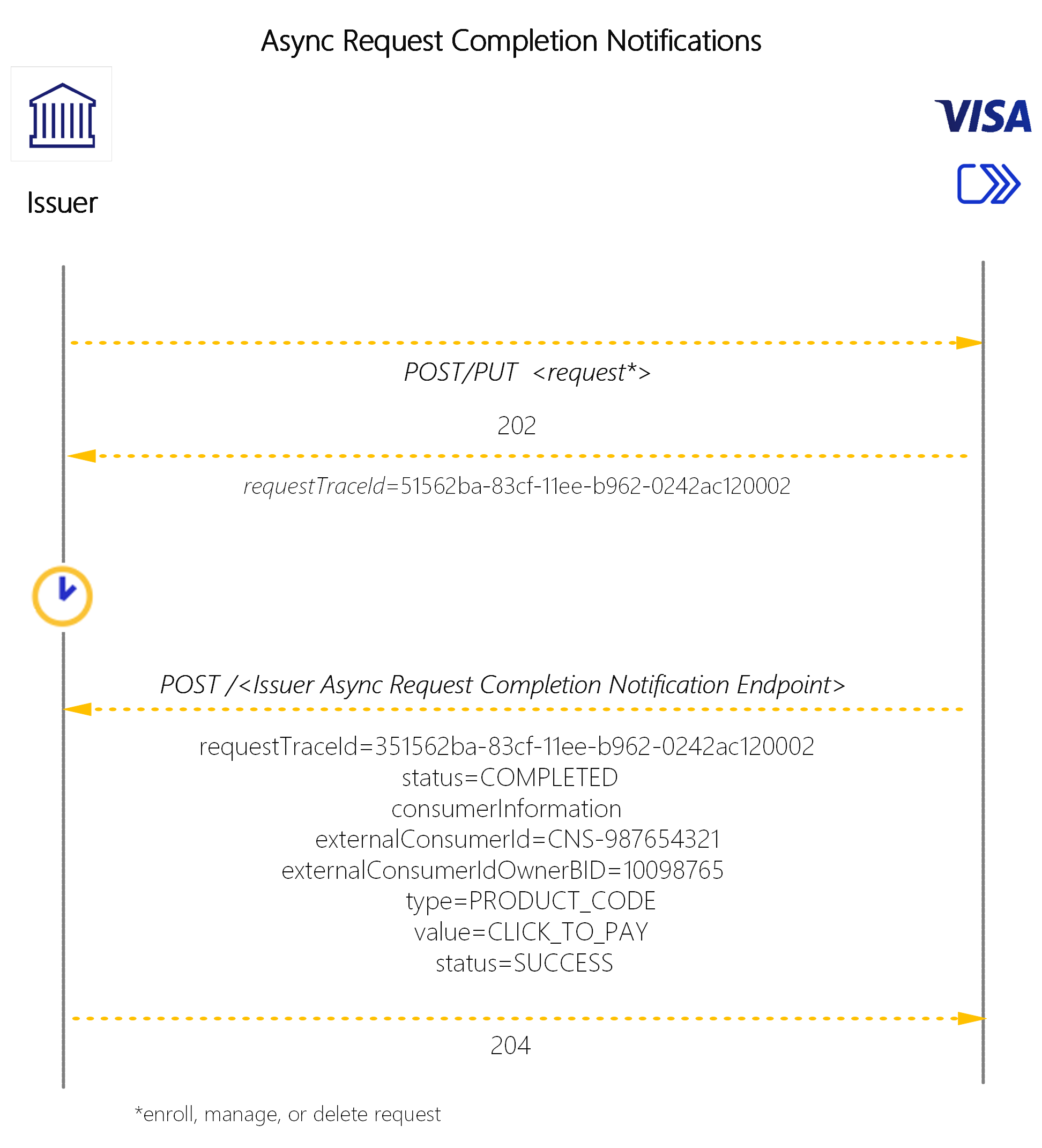

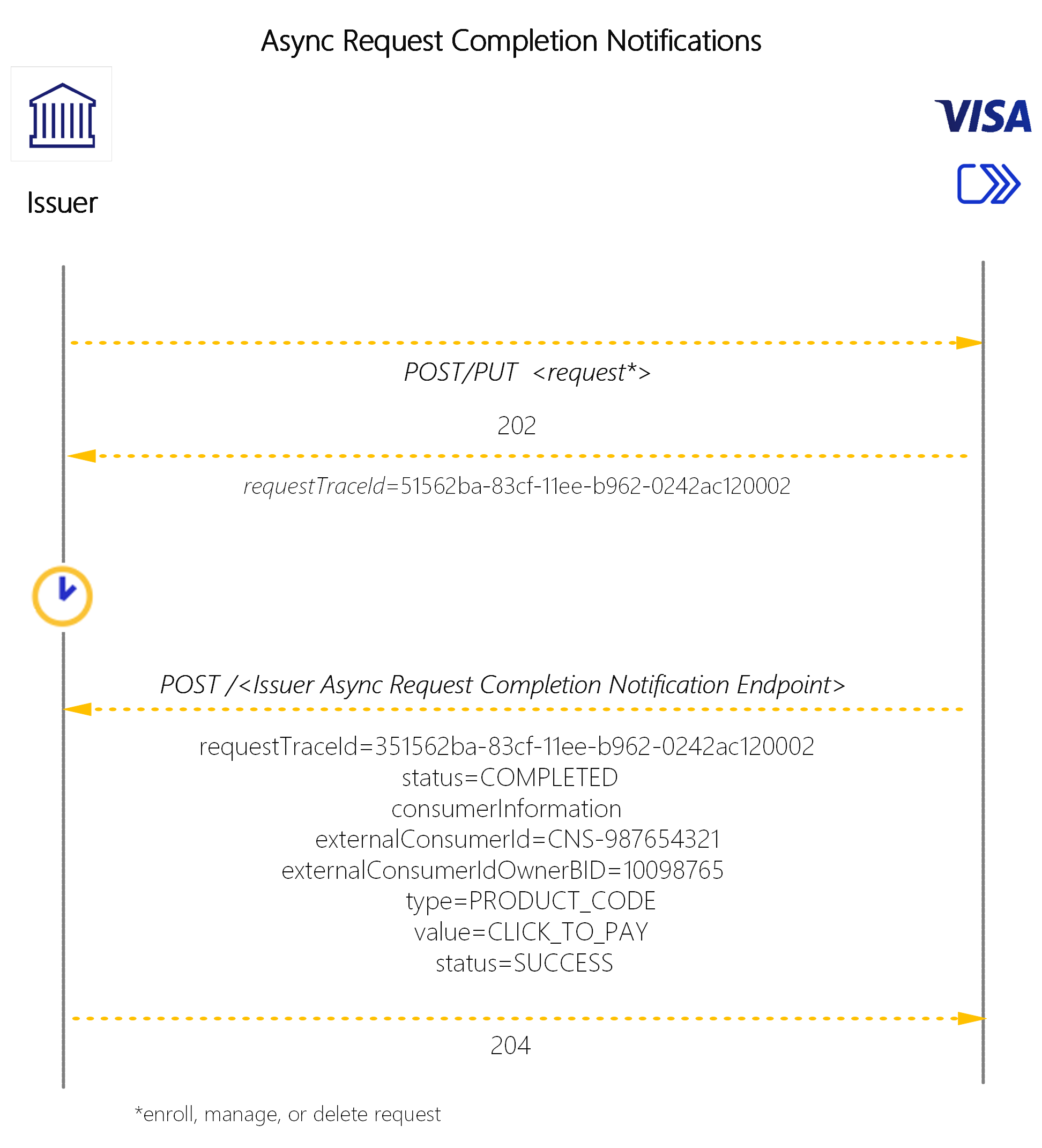

Note: only selected parameters are called out here for brevity

Fig.5. Illustrative UX on how a consumer would find instructions on changing personal information in Click to Pay.

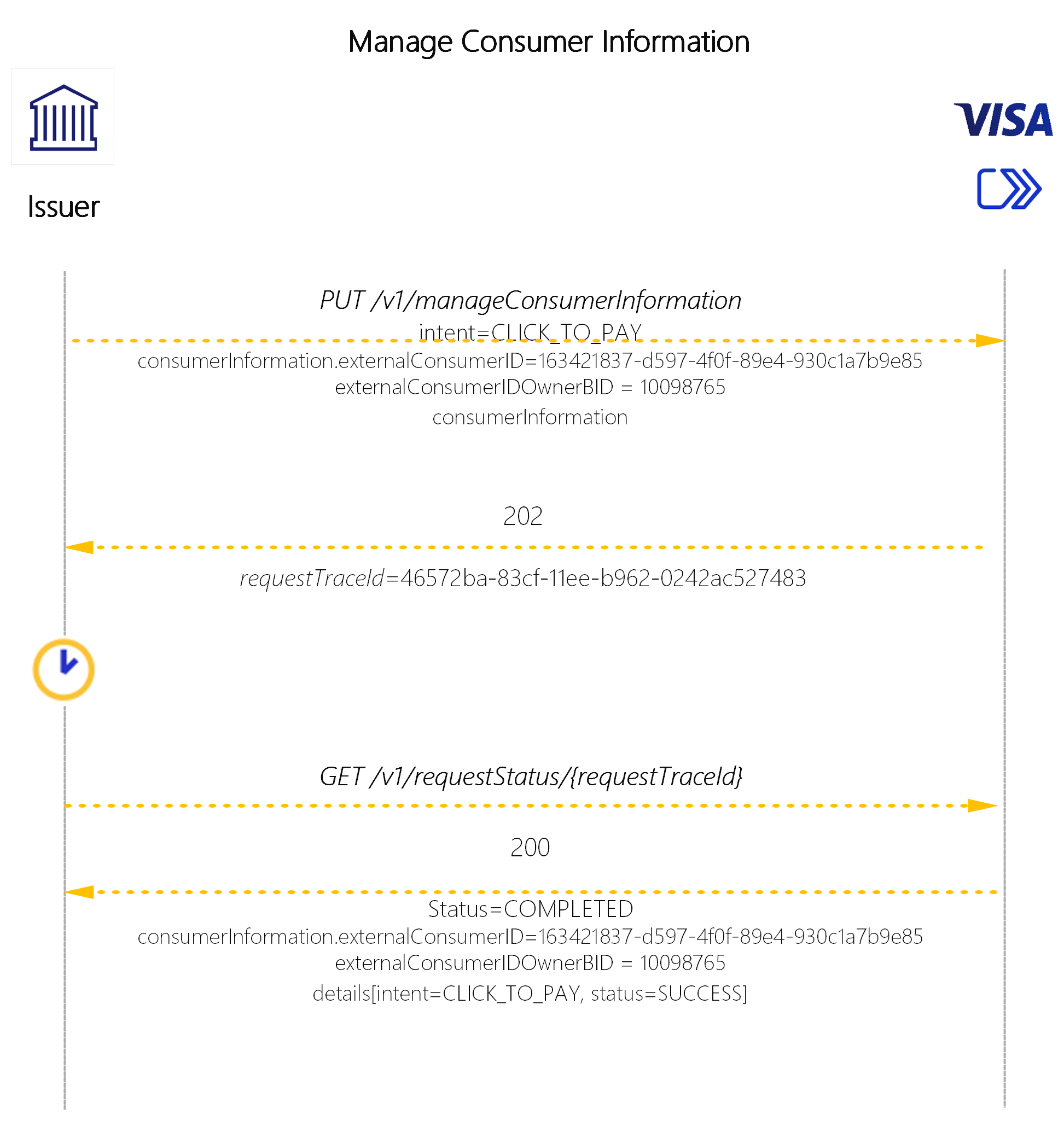

The Click to Pay email and/or mobile update use case in Fig.5 is achieved by using Visa ID & Credential’s Manage Consumer Information API.

Note: only selected parameters are called out here for brevity

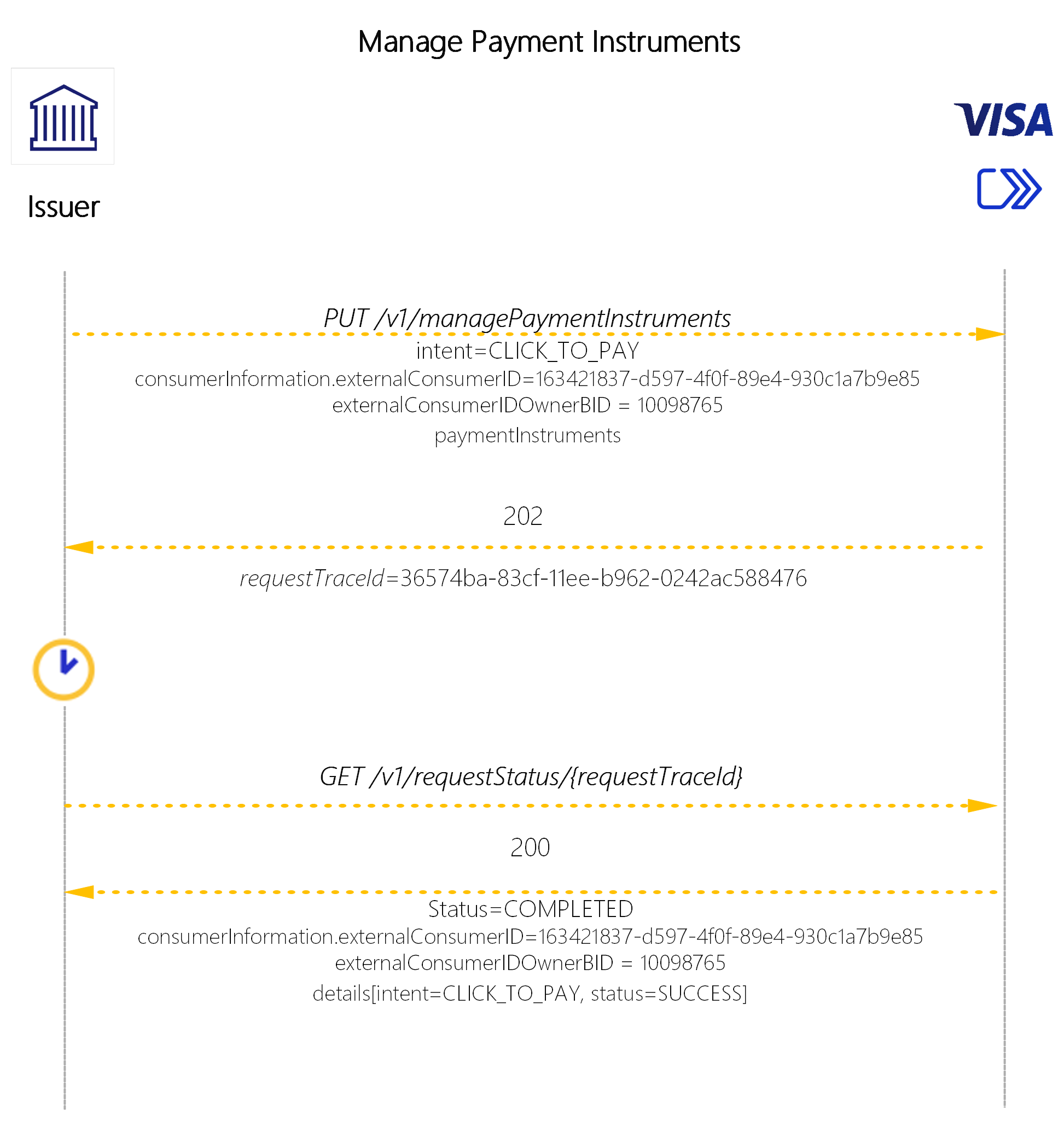

Note: only selected parameters are called out here for brevity

Fig.6. Illustrative UX on how a consumer would find instructions on opting out from Click to Pay for one of his cards.

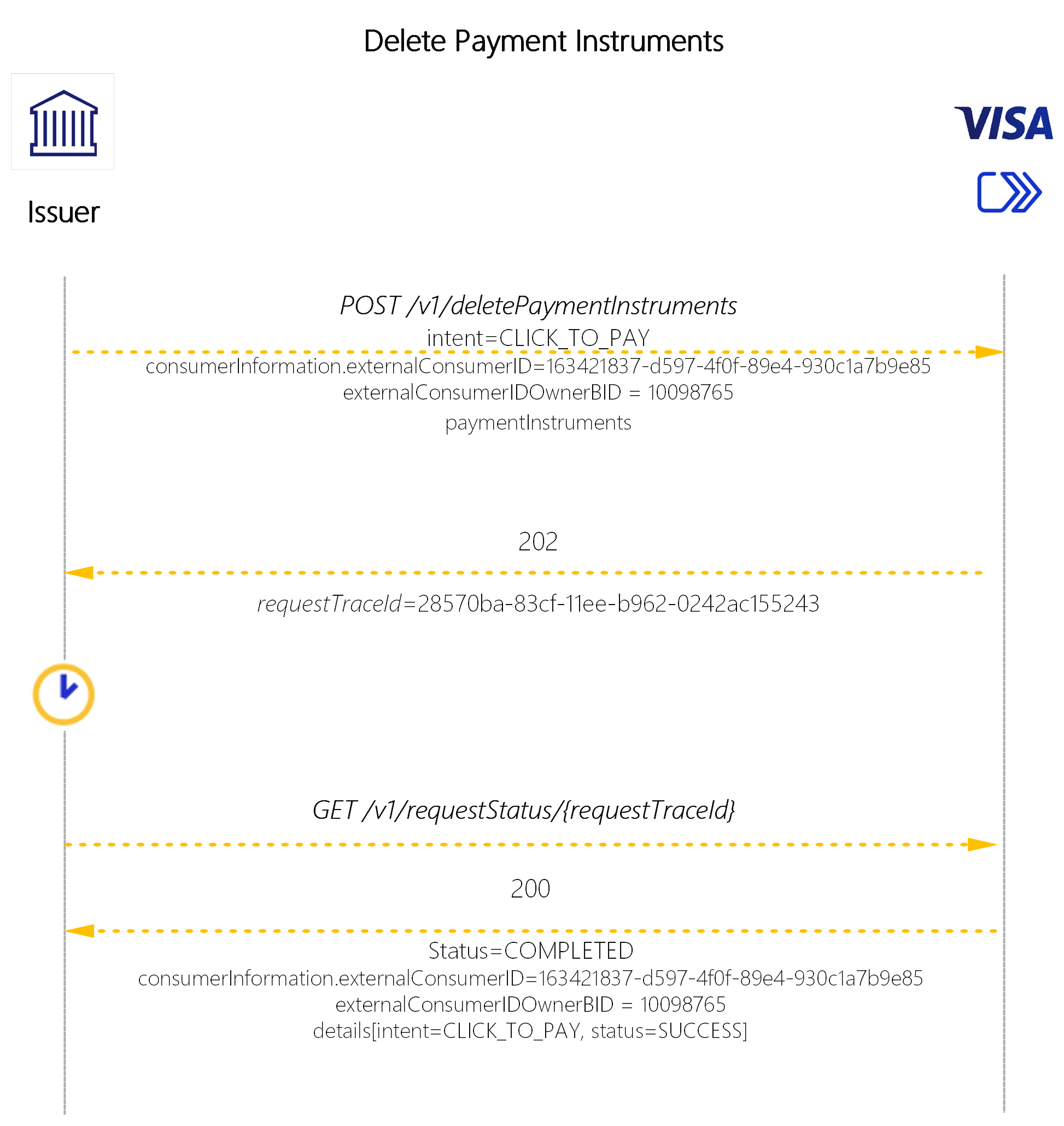

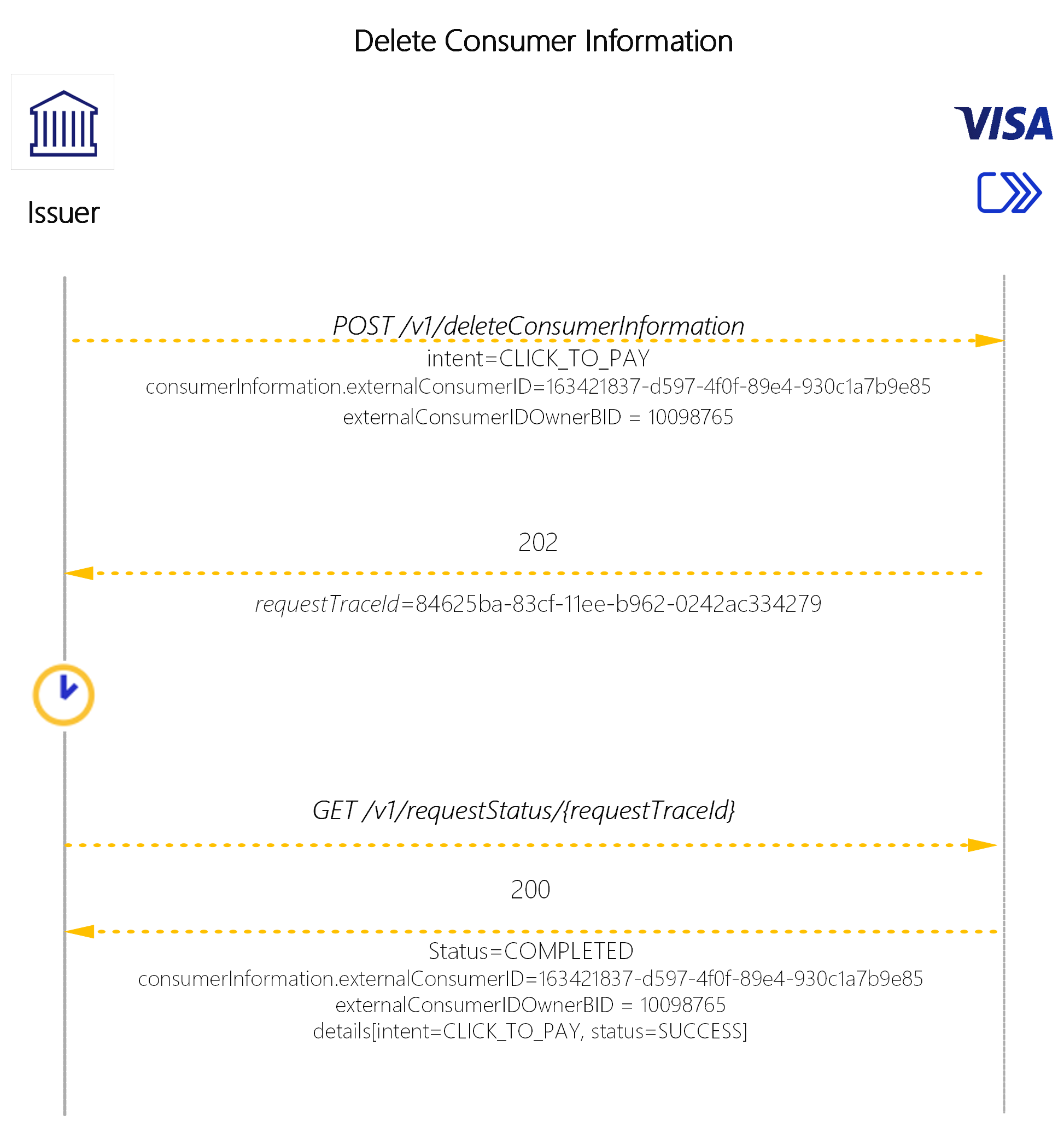

The Click to Pay opt out use case for a single card in Fig.6 is achieved by using Visa ID & Credential’s Delete Payment Instruments API.

Note: only selected parameters are called out here for brevity

Note: only selected parameters are called out here for brevity

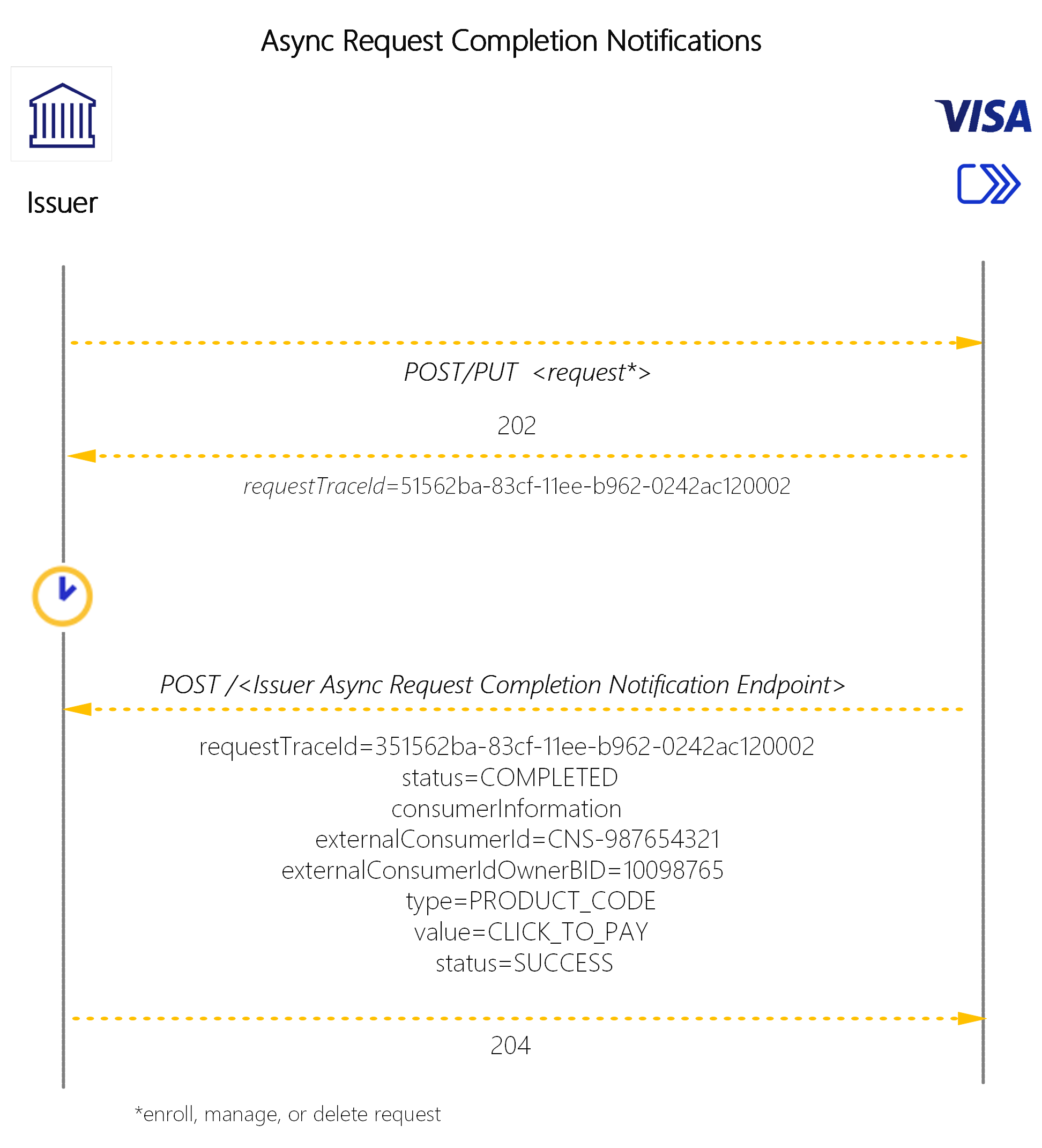

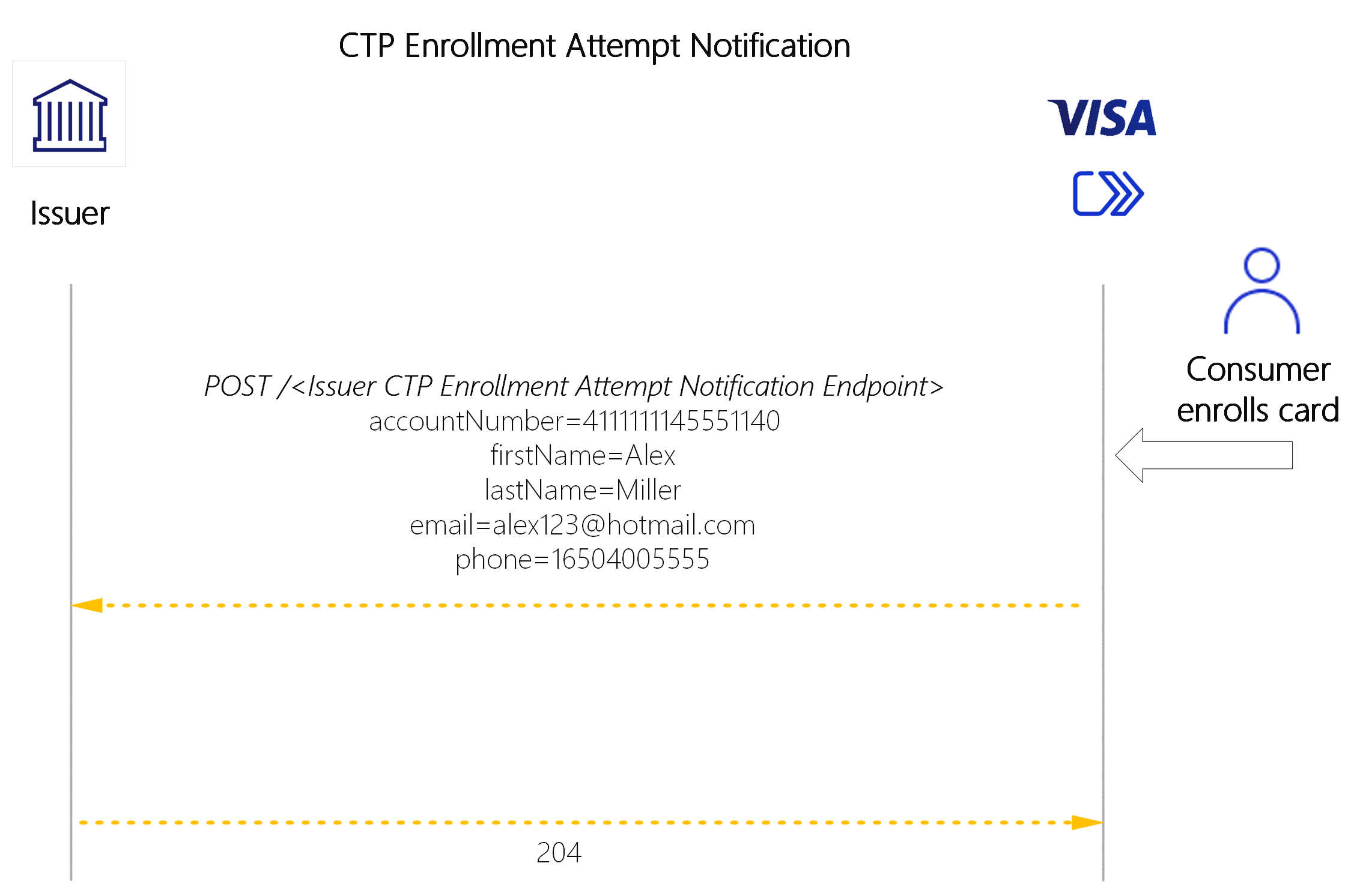

The Click to Pay activation use case is achieved by first recieving a Click to Pay Enrollment Attempt Notification from Visa, then calling Visa ID and Credential's Enroll Data API.

Disclaimer: This page is provided on an “as is, where is” basis, “with all faults” known and unknown. This page could include technical inaccuracies or typographical errors. Changes are periodically added to the information herein: these changes will be incorporated in new editions of the document. VISA may make improvements and/or changes in the product(s) and/or the program(s) described in this document at any time. Where potential future functionality is highlighted, visa does not provide any warranty on whether such functionality will be available or if it will be delivered in any particular time. To the maximum extent permitted by applicable law, visa explicitly disclaims all warranties, express or implied, regarding the information contained herein, including any implied warranty of merchantability, fitness for a particular purpose, and non-infringement.

If you have technical questions or questions regarding a Visa service or questions about this document, please contact your Visa representative.