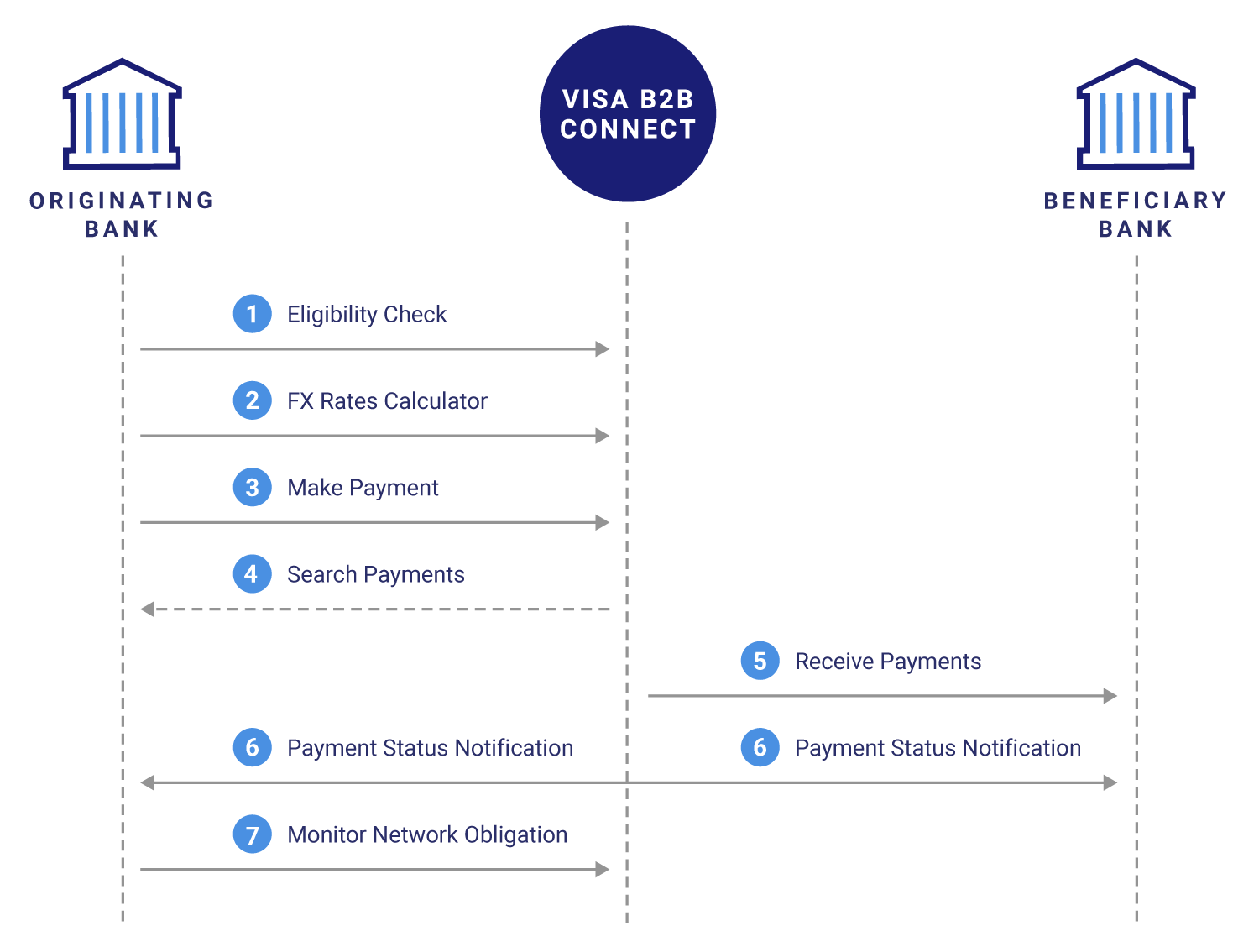

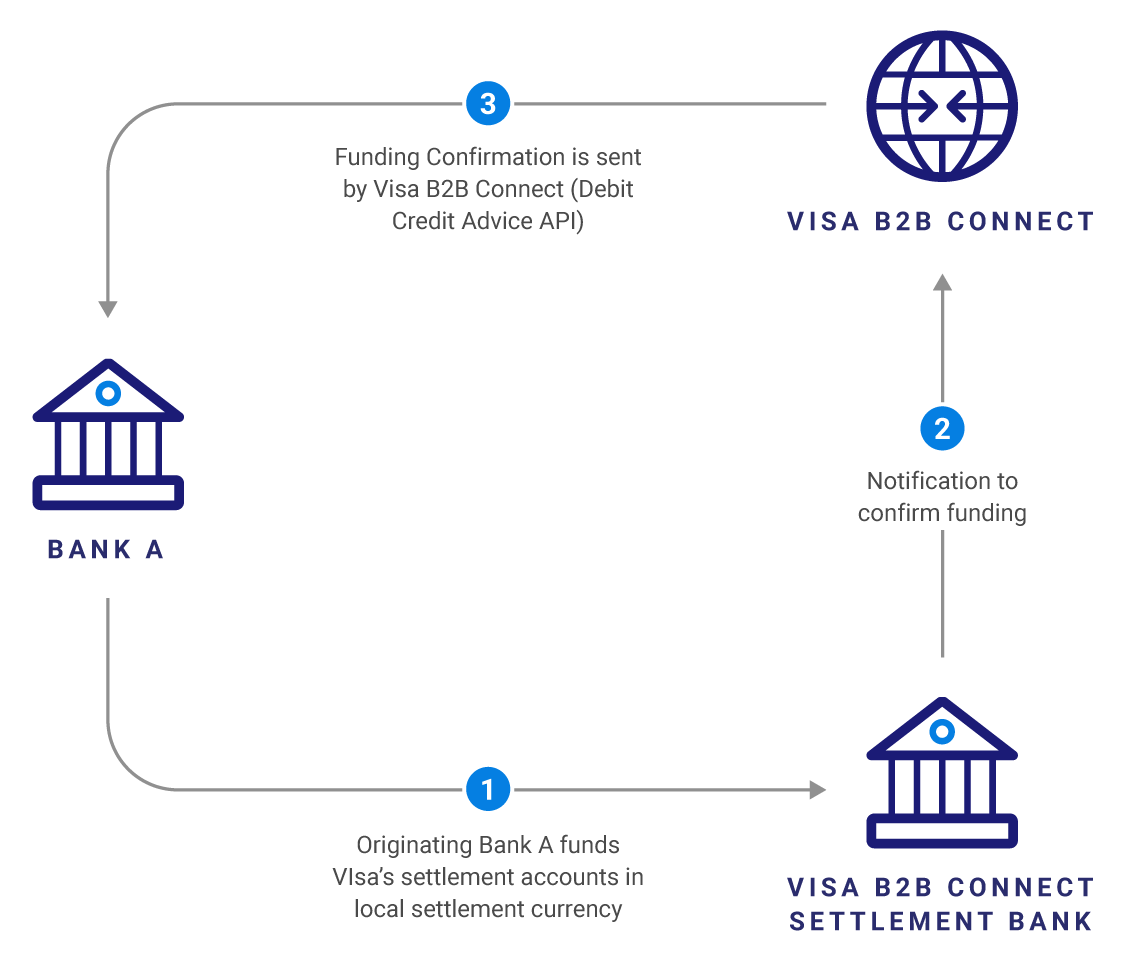

The following image illustrates the API process flow between the Originating Bank, Visa B2B Connect, and the Beneficiary Bank.

You can find the technical specifiations for each operation on the API Reference Tab.

For further information on the end-to-end process around engaging with our APIs and building a new project vist the Working with Visa APIs page.

The Validate Payment Eligibility API allows the originating bank to pre-validate some payment details before sending the payment to Visa B2B Connect. This API also validates that the Commerical Customer Beneficiary can be paid through the Visa B2B Connect network and sends a positive or negative response back. This API minimizes the potential for exception scenarios in the Make Payment message process.

This API has been enhanced to ensure that payment instructions adhere to the plreliminary rules as specified by Visa Compliance for Out-of-Network payments. These checks include Beneficiary Bank Status Eligibility and Creditor Country. Debtor Country Code has been added for future use.

The FX Rate Calculator API allows the originating bank to validate the source currency provided in the message and sends the daily foreign exchange rate back for provided currency pairs.

The FX Rate calculator method required that the originating bank provide both the source and the target currency ISO codes in the requiest but can be used with or without providing an effective date. When an effective date is provided, the FX Rate Calculator method response will contain the Visa B2B Connect foreign exchange rate for the requested processing day. Historical rates can also be returned by providing a past date as the effective date.

When using FX Rate Calculator, the source currency is intended to be the currency of the originator of the payment. The target currency will be the currency of the payment recipient.

The Make a Payment API allows the originating bank to provide payment instructions to the Visa B2B Connect service for further payment to the beneficiary bank. It also provides the originating bank a response to the make payment message.

This API has been enhanced to support Out-of-Network payments with the addition of creditor fields relevant for out-of-network payments. Additional fields for debtor and FX Trade Reference number have been added for future use.

The Search Payments API allows the originating bank to retrueve payment information by specifying the Visa-issued Business ID of the bank. Optionally, fromDate and toDate variables can be provided to get the list of payments made between two dates. Payments can also be searched using the Payment ID assigned by Visa or an End-to-End ID supplied by the originating bank when first initiating the payment.

The Receive Payment API is a callback API that will notify a beneficiary bank about a payment for its corporate customer. This will allow the beneficiary bank to have real-time visibility into their inbound payments.

In order to access this feature, beneficiary banks will need to host their own endpoint behind their API gateway.

To download the Receive Payment API please refer to the following table

| API | VERSION | DATE |

|---|---|---|

| Receive Payment API | 1.0 | May 2020 |

| Receive Payment API | 2.0 | July 2020 |

| Receive Payment API | 3.0 | September 2020 |

| Receive Payment API | 3.1 | April 2021 |

The Payment Status Notification API is a callback API that allows either the originating bank or the beneficiary bank to monitor for any changes in the payment status for either outbound or inbound payments. This will allow the beneficiary bank to have real-time visibility into changes in payment statuses.

For example, it can provide a confirmation of funds movement or even notify a Commerical Customer of a recalled or reject payment.

The complete list of available statuses are included below:

In order to access this feature, beneficiary banks will need to host their own endpoint behind their API gateway.

To download the Payment Status Notification API, please refer to the following table

| API | VERSION | DATE |

|---|---|---|

| Payment Status Notification API | 1.0 | March 2020 |

| Payment Status Notification API | 2.0 | July 2020 |

| Payment Status Notification API | 3.0 | September 2020 |

The Get Net Position API allows an originating bank to view their current net settlement position in each of the settlement currencies registered with Visa. This will reflect in their settlement obligation to the network and vice versa.

You can get the originating bank net position (Total Incoming Payments minus the Total Outgoing Payments) for all settlement currencies. Originating Banks can also filter by a settlement currency.

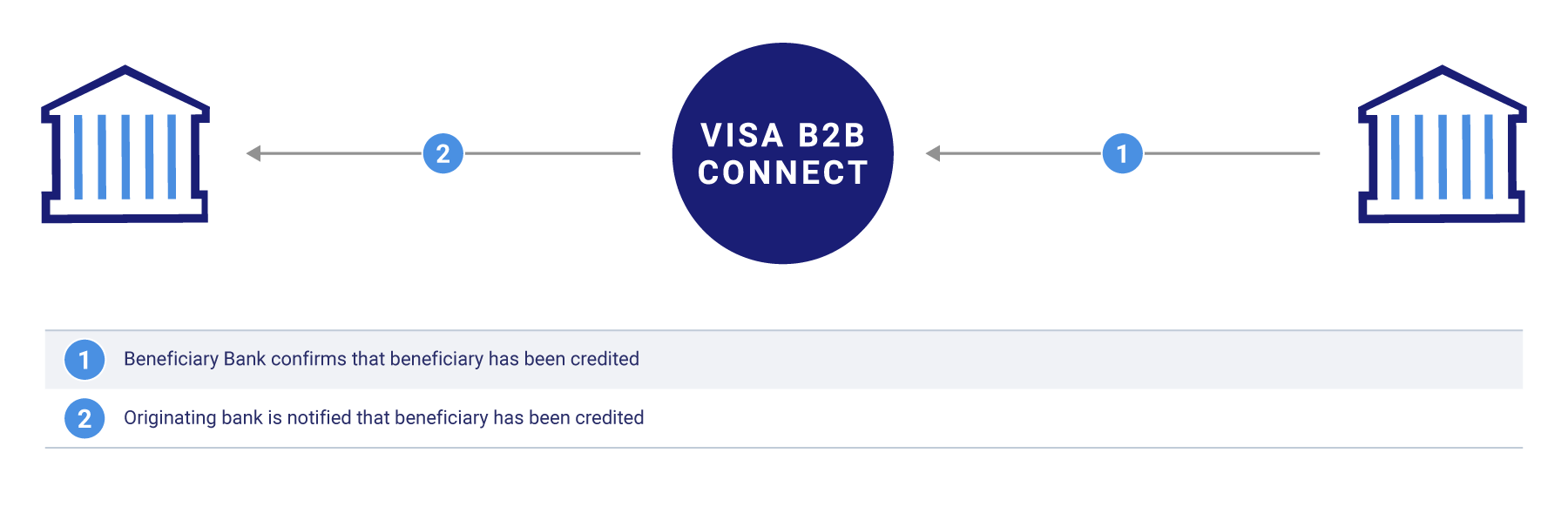

Update Payment Status API allows the beneficiary bank to confirm that the beneficiary commerical customer has been credited. Originating Bank will also be notified aboutthe creditor to beneficiary commerical customer.

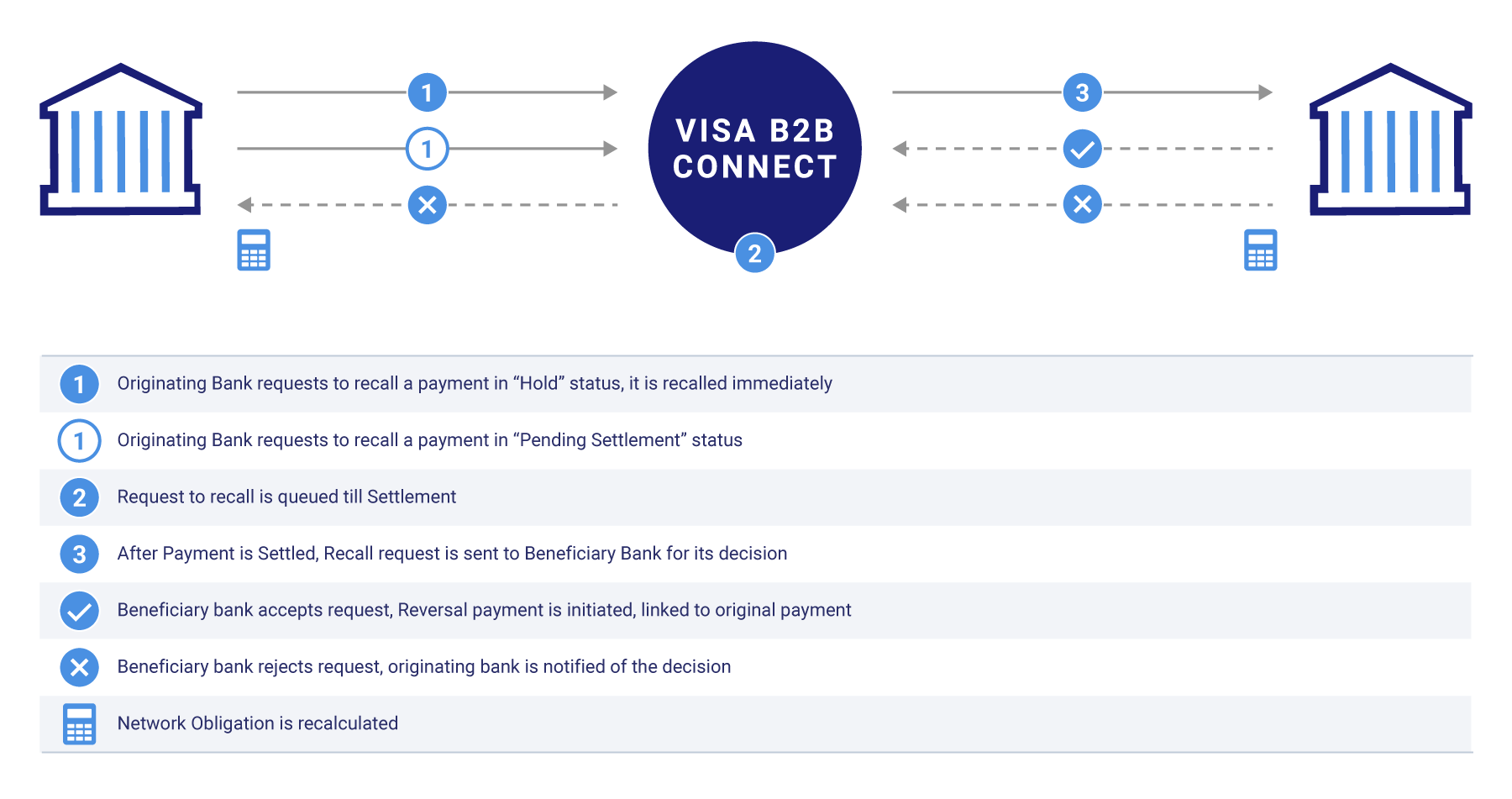

The Update Payment Status API allows the originating bank to request for a recall of a payment it originated with Recall Reason Code. This API will aslo allow the beneficiary bank to accept to reject the recall request. Originating Bank will also be notified about Beneficiary Bank's action.

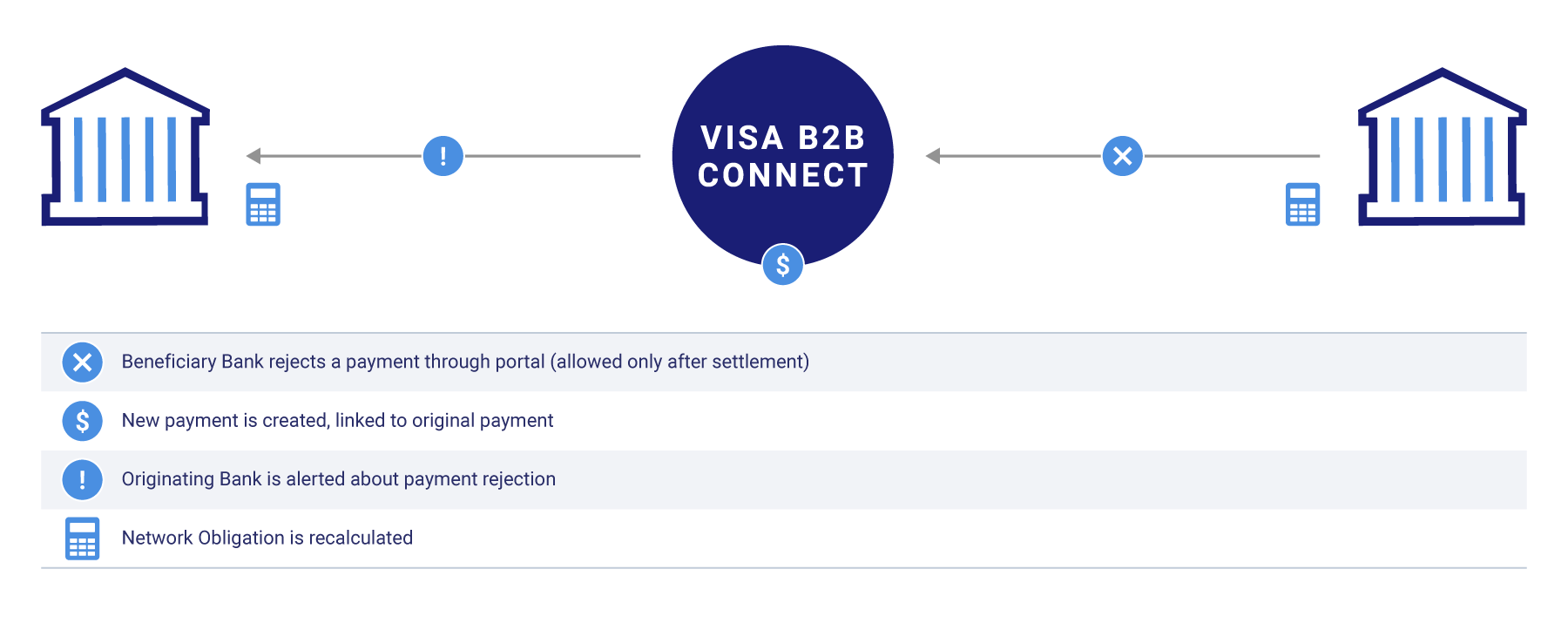

The Update Payment Status API allows the beneficiary bank to reject an incoming payment with Reason Code. Originating Bank will also be notifed about Beneficiary Bank's action

The Debit Credit Advice API is a callback API that allows participant banks to receive a credit advice when funding Visa. This API can help bans reconcile their funding activity intra-day instead of waiting for end of day for reconciliatio

In order to access this feature, beneficiary banks will need to host their own endpoint behind their API gateway.

To download the Debit Credit Advice API, please refer to the following table

| API | VERISON | DATE |

|---|---|---|

| Debit Credit Advice API | 1.0 | August 2020 |

Participants banks who have or want API-only inegerations with B2B Connect can have their statements delivered either over a file connection, push API, or webhook. If you choose to have your statements over API or webhook please note that there will be no changes to statement generation timing or changes to the file mapping.

In order to access this feature, participant banks will need to host their own endpoint behind their API gateway.

To download the Statement Delivery API, please refer to the following table:

| API | VERSION | DATE |

|---|---|---|

| Statement Delivery API | 1.0 | April 2022 |