VCES is a card number verification product designed to promote targeted distribution of Visa card benefits. The service enables Visa clients, merchants, partners, and third-party developers to use a 16-digit card account number to check eligibility and benefit access rights available for the associated Visa cardholder

The below provides the steps involved in gaining access to VCES APIs:

- Onboarding is done to capture basic details about the partner, including the API(s) desired for consumption. This is done in collaboration with your Visa representative, VCES Product Office, and Developer team. VCES has 3 environments: Sandbox (SBX), Certifiation (CTE), and Production (PROD).

- A program, referred to as a Vendor Unique ID (VUID), is created and a set of eligibility criteria is assigned in each environment. More details on eligibility criteria are available in the Getting Started section.

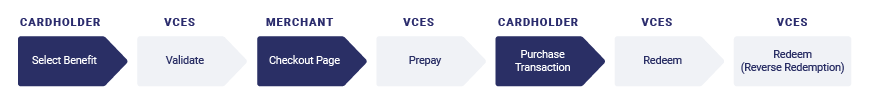

A partner who has access to the PAN data (PCI DSS Complaint) as part of their use case, would use the Visa Card Eligibility API and follow the below steps:

- The partner calls the Validate operation to check if the cardholder has access to the benefit, offer, or promotion.

- If eligible for the program, a success response is returned.

- If ineligible, an ineligible response is returned.

- If configured, an Alias ID is returned in the response so that a PAN does not have to be passed in future calls.

- If eligible, the cardholder is directed, by the partner, to the benefit, offer, or promotion details. The cardholder goes through the purchase flow and enters their card details in the partner checkout page.

- The partner could call the PrePay operation to check if the card entered by the cardholder is the same one which was used initially to check the access privilege.

- Based on the success of this call, the partner would submit the card information to their payment provider.

- After the payment has been processed successfully, the final Redeem operation could be made to notify VCES the cardholder completed the purchase. The Redeem operation is the final step after the completion of all business processes on the partner’s side.

- If needed, the Redeem operation can be invoked to cancel a redemption by decrementing the redemption counter using a Reverse Redemption call. The program must be enabled to allow these transaction types.

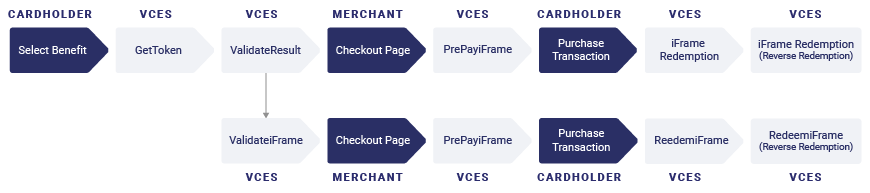

A partner who does not have access to PAN data as part of their use case or does not want to handle PAN data would use the Visa Card Eligibility iFrame API and follow the below steps:

- The partner calls the GetToken operation to obtain a token, which is valid for 600 seconds.

- The token obtained in the prior step would be sent as a parameter to load the VCES iFrame. The partner can customize the look-tone-feel of the iFrame through CSS hosted on their side. The externally hosted CSS file line would need to be provided as part of onboarding.

- The cardholder enters their full 16-digit PAN on the iFrame and submits the iFrame.

- The partner calls the ValidateResult operation to check the eligibility status of the card. The response of this operation lets the partner know whether the card is eligible for the offer or benefit.

- VCES validates the card based on the eligibility criteria setup for the program and redirects to a pre-defined URL configured by the partner. This pre-defined redirect URL is provided as part of onboarding process.

- If eligible for the program, a success response is returned.

- If ineligible, an ineligible response is returned.

- If configured, an Alias ID is returned in the response to use additional endpoints during subsequent flows.

- If eligible, the cardholder is shown the benefit, offer, or promotion details. The cardholder goes through the purchase flow and enters their card details in the partner checkout page.

- The partner could call the PrePayiFrame operation to check if the card entered by the cardholder is the same one which was used initially to check the access privilege. This requires an Alias ID to be passed in the PrePayiFrame call. Based on the success of this call, the partner would submit the card information to their payment provider.

- After the payment has been processed successfully, the final iFrameRedemption operation call would be made to notify VCES the cardholder completed the purchase. This operation is the final step after the completion of all business processes on the partner’s side.

- If needed, the iFrameRedemption operation can be invoked to cancel a redemption by decrementing the redemption counter using a Reverse Redemption call. The program must be enabled to allow these transaction types.

- The ValidateiFrame operation is invoked when revalidating a PAN previously submitted using the ValidateResult operation using an Alias ID. A partner can check the eligibility of a PAN without having the cardholder re-enter their card number in the iFrame.

- The RedeemiFrame operation is invoked when redeeming a ValidateiFrame transaction. A partner can redeem a transaction without having the cardholder re-enter their card number in the iFrame.

- If needed, the RedeemiFrame operation can be invoked to cancel a redemption by decrementing the redemption counter using a Reverse Redemption call. The program must be enabled to allow these transaction types.