Visa Direct Payouts is a service that allows Visa financial institutions and financial institution partners to send push-to-account (P2A) and push-to-card4 (P2C) payouts (i.e. payment transactions) in different markets around the world. The service is intended to support a variety of payout use cases such as money transfers and disbursements. Visa Direct Payouts provides Originating Entities (i.e. The entity connecting to Visa APIs to originate push-to-account or push-to-card payouts. It is either the Acquirer itself or a Service Provider or a Merchant that is sponsored by the Acquirer) with a way to connect to Visa, and push payments directly onto Visa cards or bank accounts.

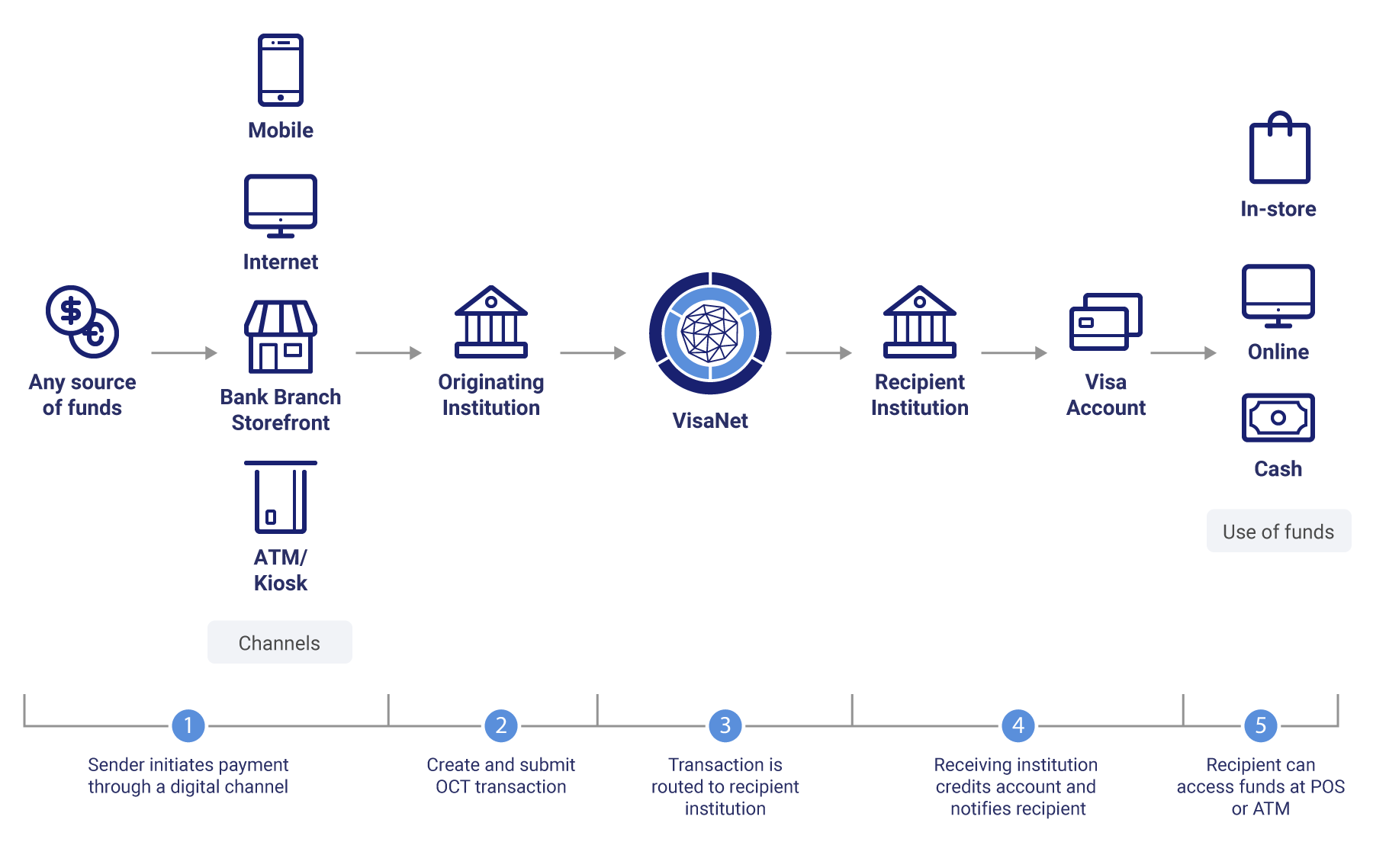

As an Originating Entity, the Visa Direct Payouts provides you with a means to initiate a push payment transaction from within your own web, mobile, ATM, corporate systems, or branch platforms. Push payments enable many consumer and business-facing applications, including person-to-person money transfers as well as corporate, government and merchant disbursements. The best way to get started with Visa Direct Payouts is to understand how it works and the role that the Visa Direct Payout APIs play in enabling Originating Entities to move funds to cards4 and bank accounts

Push-to-Account

Visa Direct Payouts, push-to-account (P2A) service sends payouts to bank accounts via the Visa network using its ACH/RTP fulfilment method. The push-to-account service is available2 for cross border payouts. In order to deliver the push-to-account payout, Visa offers the service through Payouts Service Providers (PSP) who can use their partner banking network to deliver the payout to the Recipient’s bank account using the relevant local funds transfer scheme/network. The scope of the service includes real-time processing of the messages through which the payment instructions can be sent, a global settlement service that facilitates money movement and other related value-added services (e.g., foreign exchange service, notification and cancellation services).

Push-to-Card4

Visa Direct Payouts offers real time1 push payment capabilities to cards, utilizing Visa’s global payment system, one of the world’s largest electronic payments network. Originating Entities can use the Visa network to send money to over three billion eligible Visa card accounts, of which over two billion can be reached in real time1.

Push-to-Account

Visa Direct Payouts provides Originating Entities with a mechanism to push payments directly into bank accounts. This push payment capability is delivered through the use of the Payouts APIs. The parties in a Visa Direct Payouts push-to-account program consist of Visa, an Originating Entity (Acquirer, which may also enable use for its Service Provider and/or Merchant) and its customers (the Senders), a Payouts Service Provider and its Network Partners, a Recipient and its financial institution. The Payout Service Provider, uses its Network Partners’ connection to the local scheme to reach the Recipient’s bank. The Recipient’s bank will receive the transaction(s) under the rules or laws of the local payment scheme.

Push-to-Account Stakeholders

| Sender | The individual or corporate entity that is sending the payment to the Recipient |

|---|---|

Originating Entity |

The entity that is connecting to Visa APIs to originate payouts transaction. Either the Acquirer itself or a Service Provider or a Merchant sponsored by the Acquirer. The Service Provider is an Acquirer-sponsored third-party entity that offers payment or processing services to Merchants, such as a VisaNet processor or Third-Party Agent (including, among others, a Payment Facilitator). |

Acquirer |

The Visa member approved by Visa to originate push-to-account payouts or sponsors the Originating Entity to originate push-to-account OCTs. Acquirers are responsible for all the Visa Direct Payouts programs that they operate or sponsor, including all Service Providers and Merchants. |

Payouts Service Provider (“PSP”) |

The entity that accepts the push-to-account payout instructions and settlement from Visa and uses its proprietary network (‘Network Partners’) to send the payout to the Recipient’s financial institution. Visa Payments Limited (and/or its subsidiaries and other Visa entities) is the Visa subsidiary powering this service and is the Payouts Service Provider |

Network Partner |

The entity contracted by the Payouts Service Provider to process and settle payments to each destination country. |

| Recipient’s Financial Institution | The financial institution that owns the relationship with the Recipient of the payment and provides the bank account to the Recipient. Visa does not have any relationship with this entity related to their client’s non-carded account, unless this is the same entity as the Network Partner |

| Recipient | The individual or corporate entity to whom the payment is being sent. |

Originating Entities can use the same Visa Direct Payouts APIs to push payments directly into Visa card accounts. This push payment capability is delivered through the use of the Original Credit Transaction (OCT), a Visa network transaction that enables eligible Visa cards to receive push payment credits. Originating Entities can use this transaction and the underlying framework of rules and controls to create new consumer and business-facing services. An OCT can be funded through a variety of sources; for example, any network payment account or a bank account. The parties in a Visa Direct Payouts push-to-cards program consist of Visa, an Originating Entity (Acquirer, which may also enable use for its Service Provider and/or Merchant) and its customers (the Senders), a Recipient and its financial institution (Issuer).

The following table outlines examples of consumer and business services that can be built using the Visa Direct Payout APIs and highlights the accounts that can receive payouts. Please contact [email protected] for further information or to request that Visa review and approve other use cases you may envision for Visa Direct payouts.

Visa Direct Payouts APIs enables P2A payouts to a number of bank accounts across the world. Availability varies by region, contact your Visa representative for more information.

| Destination Account Type | Geographic Scope | ||

|---|---|---|---|

| Push Payment Services(P2A) | Bank Account | Domestic | Cross-Border |

| P2P Money Transfer | ✓ | ✓ | |

| Funds Disbursements | ✓ | ✓ | |

Visa Direct Payouts enables push payments to eligible debit and prepaid Visa cards4. Availability varies by region, contact your Visa representative for more information

| Destination Card Types | Geographic Scope | ||||

|---|---|---|---|---|---|

| Push Payment Services (P2C)4 | Visa Credit | Visa Debit | Visa Prepaid | Domestic | Cross-Border |

| P2P Money Transfer |

✓ | ✓ | ✓ | ✓ | ✓ |

| Funds Disbursements |

✓ | ✓ | ✓ | ✓ | ✓ |

Visa Direct Payouts can help your business develop fast, convenient, innovative and secure payment experiences. Use Visa’s familiar global network and distribution systems to enable digital services using Visa Direct Payouts capability. Some of the opportunities include:

| Person-to-Person Payments | Funds Disbursements |

|---|---|

Visa Direct Payout capabilities open up more convenient payment experiences for many different use cases, including:

|

Visa Direct Payouts offers fast and efficient fund disbursement options for a variety of different applications including:

|

Send Payout API

The Send Payout API allows the Originating Entities to send payouts to a card or a bank account. Visa will then route the payment request based on the payment method. If the payment method is to a Visa Card4, then it will be routed to an Issuer. If the Payment method is to a Bank Account then it will be routed to a Payment Service Provider. The PSP will send the payment instruction to a Network partner bank. The Network partner bank will send the credit directly to the Recipient Bank who will credit the recipient’s account.

Validation API

Designed to reduce payout errors, the Validation API allows Originating Entities to validate push-to-account transactions PRIOR to the payout being sent via the Send Payout API for clearing and settlement. The Validation API performs schema (format, mandatory fields, etc.) and route specific (based on Network Partner requirements) checks and exposes validation errors identifying where the Originating Entity should make corrections prior to payout.

Query API

The Query API allows Originating Entities to query in real-time the processing status of Visa Direct Payout transactions. Query API checks the latest state of a push-to-card or push-to-account transactions and returns the results; transaction successfully or erroneously received and processed by Visa and/or the financial institutions. Query API can also be invoked when there is no response returned from Visa for the Send Payout API

Cancel API

Originating Entity may request to cancel a transaction in scenarios where the Sender sent to an incorrect recipient or the wrong amount in the payout instruction or sent a duplicate payout in error to stop a payment submitted to Visa for processing. The PSP can accept the cancellation request if the payment has not been sent to Network Partner. If the PSP has accepted the cancel request, then it will initiate a Notification/Return transaction to the Originating Entity. Note: This API is allowed only for transactions sent to a bank account.

Status Notification API

The Originating Entity will be notified of the initial transaction status of a push-to-account payout transaction as well as of any status changes at each key step, along with the updated expected posting date. Note: This call back API will be sent to Originating Entity only for transactions sent to a bank account.

Return Notification API

Payouts sent to a bank account through a PSP may get returned back for multiple reasons, for example, if the bank account details provided are not accurate, or the account details are accurate but the account is not active or the Originating Entity has requested to cancel the payout if it is funded. In such cases, the PSP will inform Visa that the payout has been returned, and Visa will send the return notification request to the Originating Entity. Note: This call back API will be sent to Originating Entity only for transactions sent to a bank account.

Debit Credit Advice API

This API conveys details of the debits/credit entries posted to an Originating Entity’s settlement account with Visa for a given processing day. Please contact your Visa Representative to get access and learn more about this API. Note:This API is only applicable to Originating Entities availing Visa Direct’s “Accelerated Payment Delivery” service.

As part of continuing security improvements, Visa enabled Message Level Encryption (MLE) for Visa Direct APIs. Clients using Visa Direct APIs are required to support MLE in both certification and production environment.

For existing clients already using Visa Direct APIs, please refer to "New Encryption Requirements for Visa Direct APIs” in the Visa Business News, dated 17 October 2019 for adoption timelines.

Refer to the Message Level Encryption guide at the Visa Developer Center website for instructions on using MLE.

The following table lists the regional availability for Visa Direct Payouts. To view availability of all products, refer to the Availability Matrix.

| API | North America | Asia-Pacific | Europe | CEMEA | LAC |

|---|---|---|---|---|---|

|

Visa Direct Payouts |

This section provides the clients with an overview of the implementation considerations associated with using the Payout APIs.

Forms, Licenses, and Registration

The following table outlines the forms, licenses, and registration activities for Originating Entities implementing Visa Direct Payouts APIs. Client must complete any required form to participate in the Visa Direct Payouts program.

Visa Account Representative should be contacted for information on obtaining any necessary forms and/or licenses.

Form |

Requirements |

|---|---|

Program Information Form (PIF) |

Mandatory All Acquirers must submit this online form and receive approval prior to launching a Visa Direct Payouts program. |

Client Information Questionnaire (CIQ) |

Mandatory A CIQ will need to be completed by the Visa Direct Acquirer for configuration and installation of the Acquiring BIN. This is needed before the client can start testing in the VCMS (Certification) environment OR move into Production. |

Visa Direct Payout API - Client Onboarding Form |

Mandatory This form is used to register which Visa Direct APIs the Acquirer, service provider or merchants will use to provide the Visa Direct Payouts program. This is required when the client is ready to be certified for VDP. This process is automated on the Visa Developer Portal. |

Visa Direct Payout API Server Certificate |

Mandatory Client uses Visa Direct Payout API will have to provide server certificate signed by an authorized Certificate Authority (CA). |

Sandbox Testing

Once API development has been completed, clients can proceed with integration testing in the sandbox environment. The objective of Sandbox testing is to ensure the Originating Entity can properly send and receive the API messages associated to the Visa Direct Payout APIs. Test data will be provided to facilitate this testing phase. VCMS certification testing will only be arranged after the Sandbox testing is successfully completed

API name |

HTTP Method |

Accept |

Hosted by |

Description |

Validation |

POST |

application/json |

Visa |

https://sandbox.api.visa.com/visapayouts/v1/payouts/validate |

Send Payout |

POST |

application/json |

Visa |

|

Query |

GET |

application/json |

Visa |

https://sandbox.api.visa.com/visapayouts/v2/payouts/{payoutId} |

Query with parameters |

GET |

application/json |

Visa |

https://sandbox.api.visa.com/visapayouts/v2/payouts?bankId=&originatorId=&RRN= |

Cancel |

DELETE |

application/json |

Visa |

https://sandbox.api.visa.com/visapayouts/v2/payouts/{payoutId} |

Status Notification |

POST |

application/json |

Client |

<client url>/v2/payouts/notification |

Return Notification |

POST |

application/json |

Client |

<client url>/v2/payouts/return |

VisaNet Certification Management (VCMS) Testing

Once basic Payout API Sandbox integration testing has been completed successfully, clients are to perform end-to-end testing in the VisaNet Certification Management Testing (VCMS) environment before going live. This is an attended certification testing phase administered by Visa’s Global Client Testing (GCT) team. The testing environment allows the clients to test all components in the transaction lifecycle all the way through settlement and exception management

API name |

HTTP Method |

Accept |

Hosted by |

Description |

Validation |

POST |

application/json |

Visa |

|

Send Payout |

POST |

application/json |

Visa |

|

Query |

GET |

application/json |

Visa |

|

Query with parameters |

GET |

application/json |

Visa |

https://cert.api.visa.com/visapayouts/v2/payouts?bankId=&originatorId=&RRN= |

Cancel |

DELETE |

application/json |

Visa |

|

Return Notification |

POST |

application/json |

Client |

<client url>/v2/payouts/return |

Status Notification |

POST |

application/json |

Client |

<client url>/v2/payouts/notification |

This section briefly describes the onboarding process with Payout APIs, and the mechanism used by Visa to ensure that the transactions are processed securely.

Complete Client Onboarding Form

Clients are required to complete the Client Onboarding Form, providing information about the client and the setup required to be configured. Separate forms are required to be completed for onboarding to Sandbox, VCMS and Production.

The following table contains some of the key information that have to be provided to complete the setup:

Onboarding Form: Key Information

BID |

The Originating Acquirer's Business Identifier |

|---|---|

ACQUIRING BIN |

The Originating Acquirer's BIN |

MLE |

Message Level Encryption flag, should be true for Payouts projects |

ALLOWED APIS |

List of APIs that Originating Enteties can subscribe to:

Note: There are several other available APIs that can be used by clients to build the complete functionality (e.g., FX API, Account Lookup API (cards only), Account Verification API (cards only), etc. Clients should work with their Visa representative to identify all relevant APIs and include them in this onboarding form. |

Information to Clients

Visa URL |

URLs to post messages to Visa API endpoint |

|---|---|

Key ID |

A unique ID which is used to determine the RSA keys needed to encrypt/ decrypt data. |

RSA key (encryption/ decryption key) |

Private/public key to be used encrypt/decrypt request and response. |

Setup Mutual SSL Authentication

Payout API secures its connection with client using mutual SSL authentication. This is a process which both the server and client have to authenticate each other, to ensure each other’s identity.

To establish the SSL connection, the following are required:

Note: Refer to Authentication and Encryption for more details

Managing Security of Data Elements

There is sensitive information in the payout request (e.g. recipient bank or card details). The request has to be encrypted by the client using standard JWE before sending to Visa endpoints, while the response needs to be decrypted. The client should use the Key ID and RSA keys to encrypt/decrypt request/response

Note: Refer to Message Level Encryption for more details

Visa Direct Payouts Regional Mailboxes

To reach the various regional product offices please use these email addresses:

Please contact your Visa representative to obtain a copy of below guides

Title |

Description |

Visa Direct Payouts - Push to Account Program Guide |

This program guide provides an overview of the Visa Direct Payouts service for “push to account” payouts, including operating rules, participation framework and implementation guidelines for Originators to implement this functionality. |

Visa Direct Payouts - Endpoint Guide |

This guide provides the country specific details (e.g. cutoff times, limits, required data elements etc.) for all recipient markets where Visa supports payouts to bank accounts through a partner bank network. |

Visa Direct Original Credit Transaction Implementation Guide |

This program guide provides an overview of the Visa Direct Payouts service for “push to card” payouts, including operating rules, participation framework and implementation guidelines for Originators to implement this functionality. |

Foreign Exchange Rates

Get Visa's latest Foreign Exchange rates instantly.

Payment Account Attributes Inquiry

Find key attributes of a specific payment account.

Payment Account Validation

Access multiple methods of ensuring that a payment account is valid.

Disclaimers

¹Actual fund availability varies by receiving financial institution, receiving account type, region, and whether transaction is domestic or cross-border.

2Availability varies by market. Please refer to your Visa representative for more information on availability.

3Use cases are for illustrative purposes only. Program providers are responsible for their programs and compliance with any applicable laws and regulations.

4Availability for Push to Card Payouts is an upcoming capability, please contact your Visa Representatives for more information on availability