Payment Account Validation

Access multiple methods of ensuring that a payment account is valid.

available for use by

Issuer Banks

Merchants

Independent Developers

Regional Availability

View Details- N. America

- Asia-Pacific

- Europe

- CEMEA

- LAC

Fees & Pricing

Contact Visa for pricing to use in Production. Product terms located at end of the page.

Determine if a particular Visa account is valid and in good standing

There are many situations in which you may need to know if a Visa account provided by your customer is valid before making services available to that customer in your project. Examples include validating a sender and/or recipient account before initiating a money transfer between them or validating an account before loading it into a digital wallet or card-on-file repository.

The Payment Account Validation API offers several methods that you can use to determine if a particular Visa account is valid and in good standing. Before using the API, it is important to understand what the available methods are and how they work. The API currently has four methods of account validation: Account Verification, the Address Verification Service (AVS), Card Verification Value (CVV2) Validation, and Account Name Inquiry (ANI).

Key Features

Validate a payment account before processing a transaction.

Identify stolen, expired, or frozen payment accounts.

Increase probability of a successful transaction.

Why Use It?

Seamless Transaction Flow

Applications can check if a card is stolen, expired, or frozen before initiating a transaction.

Early Error Detection

Applications can prompt users to correct incorrectly entered or invalid account number, address, or CVV2 information.

How Does It Work?

The Payment Account Validation API accepts a primary account number (PAN) as input and performs an Account Verification. You can optionally elect to have Account Name Inquiry (ANI), Address Verification (AVS) and/or CVV2 Validation done at the same time. The API returns the validation results for each option in the API response.

APIs Included

Payment Account Validation

The Payment Account Validation API allows applications to run validations on a payment account before processing a transaction, ensuring greater probability of success and allowing for a more seamless transaction flow.

Related Content

Create the Airport Companion Mobile App

DragonPass, the world's first all-in-one digital airport platform, allows eligible Visa cardholders to easily check for lounge access and other travel benefits on its airport companion app via the Payment Account Validation and Payment Account Attributes Inquiry APIs.

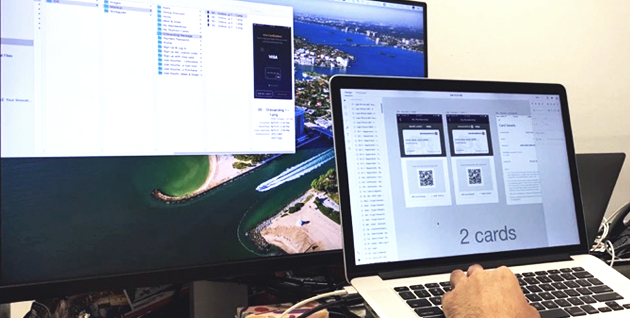

Make Digital Payments by Scanning a QR Code at Point of Sale

Fidelity Bank Plc uses Payment Account Validation to let customers make digital payments by scanning a QR code at point of sale and validate payment in their online app.

Combine APIs for Even More Delightful Experiences

See what other APIs work well with Payment Account Validation so that you can help your customers get the best experience possible.

How Interswitch Uses Payment Account Validation

Interswitch uses Foreign Exchange Rates, Payment Account Attributes Inquiry, Payment Account Validation and Visa Direct to enable digital payments in the mobile apps they develop for Nigerian banks.