Visa Payment Passkey

A modern authentication solution

available for use by

Issuer Banks

Merchants

Regional Availability

View Details- N. America

- Asia-Pacific

- Europe

- CEMEA

- LAC

FEES & TERMS

Free to use in Sandbox. Contact Visa for pricing and commercial details to use in Production

Enable strong, device-based authentication across Visa card-not-present acceptance solutions with one single device registration

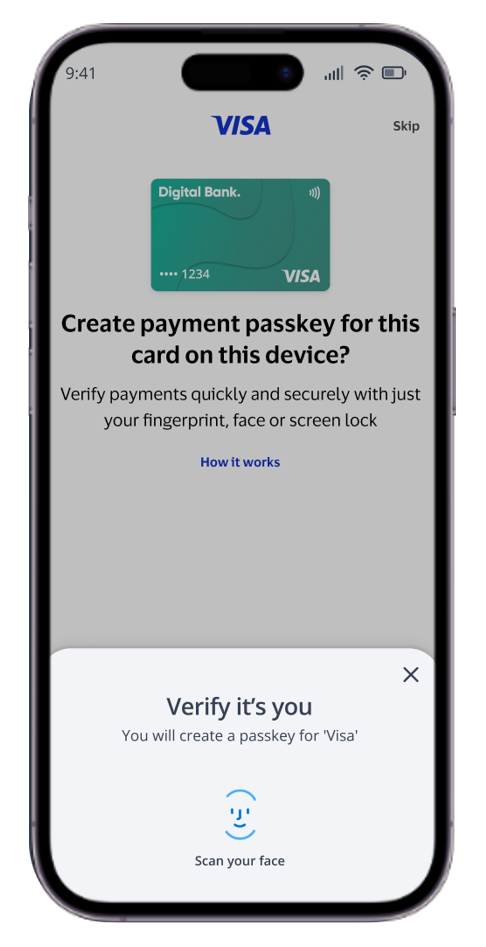

Visa Payment Passkey (VPP) helps provide strong, device-based authentication for online payments, reducing fraud and improving user experience. It supports various payment methods, including card-on-file tokens, manual PAN entry, and digital wallets, ensuring seamless and secure transactions.

It is an authentication solution for ecommerce built on FIDO (Fast Identity Online), an open industry standard developed to help reduce the use of passwords and OTPs, which are susceptible to fraud. This service will provide Visa cardholders with a consistent, secure, and low-friction ecommerce payment experience using device-based authentication while also integrating with other Visa card-not-present acceptance solutions, like Visa Token Service (VTS). It links a Visa card with a consumer device, allowing the Visa cardholder to use their device's unlock features to verify payments, which eliminates the need for passwords or one-time passcodes, providing a seamless and secure payment experience.

Key Features

Passwordless authentication

Uses FIDO-based authentication, allowing consumers to authenticate payments using biometrics or other secure methods without relying on passwords or OTPs

Integration with Visa products

VPP is integrated into various Visa acceptance products and services, such as VTS, 3DS, and others.

Frictionless user experience

Provides a consistent and frictionless user experience across different payment methods, including card-on-file tokens, manual PAN entry, and digital wallets, which may help reduce purchase abandonment.

Enhanced security

Helps reduce fraud by providing device-based authentication, ensuring secure transactions for both consumers and merchants.

Key Benefits

Merchants & Payment Service Providers

- Can help increase conversion rates of ecommerce transactions by streamlining the checkout process through fast and easy passwordless authentication, effectively reducing friction and improving overall customer experience.

- Enhances security by offering cryptographic proof of authentication, making it resistant to phishing and preserving the cardholder’s privacy as biometric data never leaves the cardholder’s personal device.

- Offers seamless API integration and is natively supported by all major operating systems and most browsers, while also complying with payment regulations, such as PSD2 in Europe.

Issuers

- Visa Payment Passkey drives improved experience with minimal friction during payment authentication, helping issuers achieve top of wallet usage.

- Creation of the payment passkey can be initiated within the issuer’s domain via a seamless exposure of the Visa Payment Passkey enrollment flow within the issuer’s website or mobile application.

- Cardholders can manage their passkeys, including deleting and renaming passkeys, all within the issuer domain to help maintain a strong cardholder relationship. This approach helps issuers strengthen cardholder relationships through direct communication, personalized support, and seamless integration with other banking services, fostering trust and engagement. Additionally, cardholders benefit from a familiar interface that empowers them with self-service capabilities for managing their passkeys, enhancing satisfaction and loyalty.

API Suite

Merchants and Payment Service Providers (PSPs)

Merchants and Payment Service Providers can implement VPP APIs to enable cardholders to create and authenticate with their Visa Payment Passkey.

Issuers

Issuers can implement a suite of VPP APIs through Visa ID & Credential that will enable creation and lifecycle management activities of Visa Payment Passkey within the Issuer domain.