Visa Transaction Controls

Empower cardholders to control how, when and where their cards are used.

available for use by

Issuer Banks

Issuer Banks for Small Business

Regional Availability

View Details- N. America

- Asia-Pacific

- Europe

- CEMEA

- LAC

fees & Terms

Product terms located at end of the page.

Transform your mobile app into a financial command and control center

VTC control-types let cardholders place their own rules on a payment card's use and when to be notified of different financial events.

Independent alert and decline settings can be tailored to different transaction and merchant types (e.g. ATM, Ecom, Gasoline, Gambling...) or can be applied to all payment account activity.

Key Features

At the touch of a button, cardholders can disable or enable the use of their card.

Cardholders can closely monitor purchase transactions on their accounts with alerts.

Scalable and flexible platform to conform to your business needs and timelines.

Why Use It?

Relevance

- Engage cardholders with digital innovations that improve their financial well-being.

- Security and visability tailored to your cardholder's needs.

Risk and Fraud

- Alerts can reduce subsequent card fraud up to 36%.*

Operational Savings

- Lower Call Center volume due to temporary misplaced cards.

- Reduce card costs and shipping fees due to “found” plastics.

- Decrease Chargeback volume and processing costs.

How Does It Work?

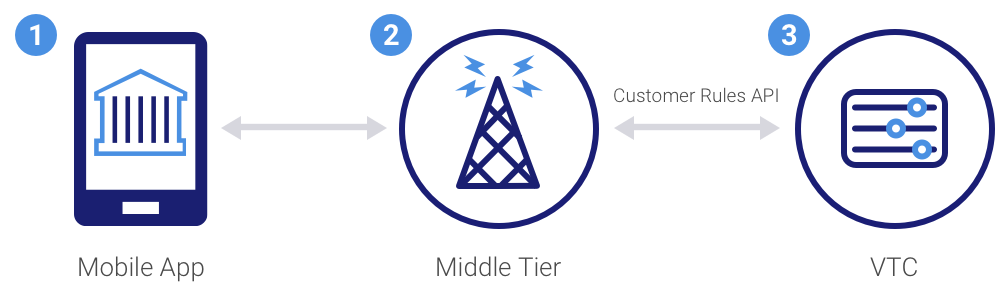

Customer Enrollment Flow

- The customer selects their card and configures the controls the issuer has made available.

- A secure communication channel is established between the issuer’s mobile gateway and the Customer Rules API on the Visa Developer Platform. The PAN is encrypted in transmission.

- VTC verifies the account number is within the issuer’s prescribed BIN range and the application is authorized by the issuer. VTC then checks if a “document” already exists for this combination of account number and appID. If so, it returns the existing documentID; otherwise, VTC will create a new control document

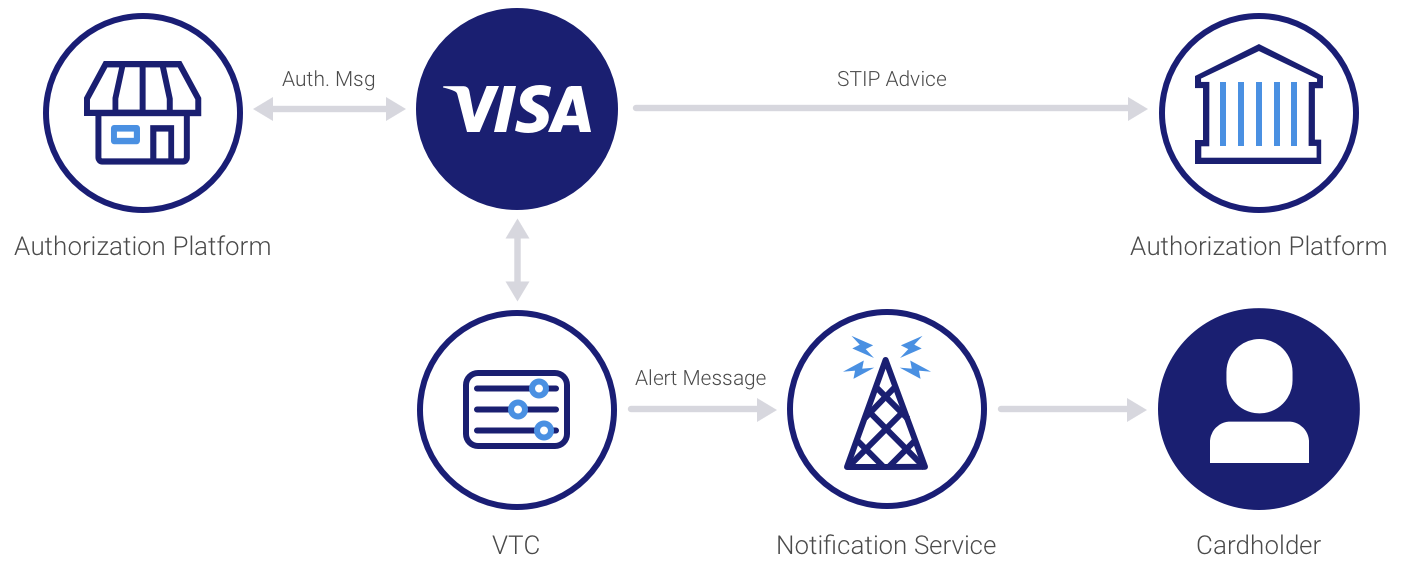

Visa On-Behalf-Of Service Flow

- Merchant submits an authorization request (0100).

- Visa sees the account participates in VTC (via whitelist). Sends the authorization data to VTC for a decision. If the transaction violates a VTC setting, then it will be declined in STIP. NOTE: VTC rules are applied after all other Visa risk and processing rules are applied.

- Visa sends a decline response back to the merchant; and,

- Visa sends an Advice msg (120) to the issuer with new STIP Reason Code “9037” identifying the transaction as declined due to VTC settings. The issuer processor will have to update their authorization platform to accept this new value in an existing field.

- If the cardholder’s VTC setting indicates an alert should be triggered; then VTC will send the notification information to the issuer’s Notification Service for final delivery to the cardholder.

- The Notification Service will use the VTC information to identify the cardholder and to send the cardholder notification based on the customer’s communication preferences (SMS, email or Push-Notification).

APIs Included

Customer Rules API

The Customer Rules API is used to register, retrieve, modify and delete an account’s card control settings.

Alert History and Customer Profiles API

The Alert History and Customer Profiles API is used to retrieve an account’s VTC notification history. For issuers who participate in the VTC Alert Delivery Service this API is also used to create and manage a cardholder’s Customer Profile.

Authorization API

The Authorization Decision API enables an authorization processor to request authorization decisions on non-Visa transactions for participating accounts.

Program Administration API

The Transaction Controls Program Administration API enables Issuers to change program configurations for their sponsorID.

Enrollment Callback API

The Enrollment Callback API is not applicable to most development programs. It is used in conjunction with the Authorization API when solving for non-Visa transactions. It notifies the issuer’s authorization platform(s) of active VTC accounts so it can begin sending transaction data to VTC for a decision recommendation.

Notification Delivery Callback API

The Notification Delivery Callback API sends VTC alert information to an issuer’s notification service provider to create the customer-facing message they then deliver via email, SMS or Push notification. It includes data on the cardholder, merchant, purchase amount, date/time, location and the VTC setting that triggered an alert and/or decline event. It is the service provider’s responsibility to manage cardholder contact information, alert messages and notification delivery.

Related Content

Turn Your Card On or Off

At the touch of a button, cardholders can temporarily disable or enable the use of their card.

Manage Overseas Spend

Visa Transaction Controls allows cardholders the option to block international transactions when they are not traveling and / or allow purchases in select countries.

How Michigan State Uses Visa APIs

Michigan State University Federal Credit Union (MSUFCU) uses Mobile Location Confirmation and Visa Transaction Controls to provide its members with added fraud protection and the ability to lock and unlock their Visa cards through the MSUFCU mobile app.

How NAB Uses Visa APIs

National Australia Bank (NAB) provides a convenient, educational mobile app experience for travelers using Visa Transaction Controls, Travel Notification Services and Foreign Exchange Rates.

How Hanseatic Bank Uses VTC

Hanseatic Bank uses Visa Transaction Controls to offer new features that enhance the capabilities of their mobile banking app, including card blocking, transaction alerts and real-time balance information.